The Western narrative is clear: China is deliberately using subsidies to create massive oversupplies of everything from solar panels and wind turbines to semiconductors, batteries and electric vehicles that can then be dumped onto world markets, undermining foreign competitors and creating long-term dominance for China’s state-owned enterprises.

The narrative is enticing, plausible and wrong. And it is being ruthlessly exploited to justify protectionism on a scale unprecedented since the 1930 Smoot-Hawley Act, which eventually imposed mountainous tariffs on more than 20,000 imported goods.

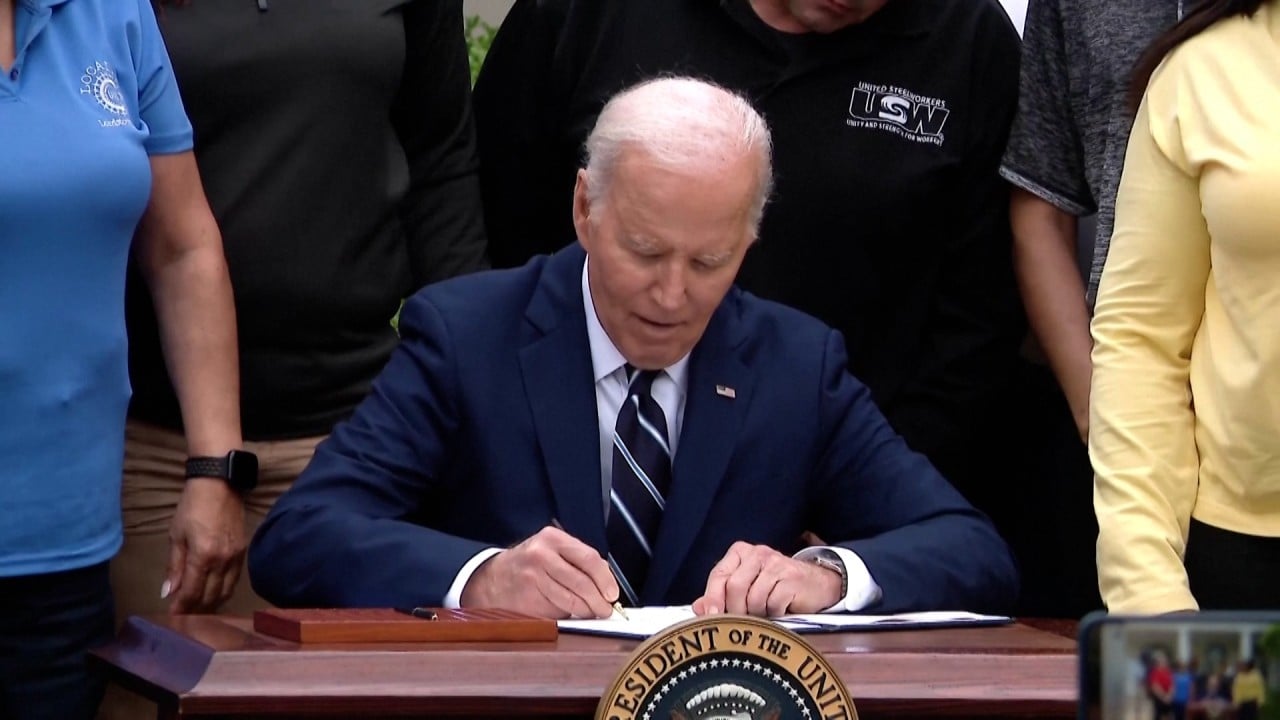

To be concerned about oversupplies in the global market is not unreasonable. Nor is it unreasonable to be concerned about the risks of becoming heavily reliant on a small number of suppliers in any strategic areas of an economy. But to misunderstand China’s strategic motivations is to misdiagnose the problem and prescribe the wrong solutions. Smoot-Hawley made matters worse, and Biden’s newly conceived blizzard of tariffs is likely to do the same.

China’s ambitions to recover its “proper” place in the world were always going to be problematic for those in the West who have benefited from their economic dominance.

With almost 18 per cent of the world’s population, around 19 per cent of global gross domestic product when adjusted for price differences, 14 per cent of world merchandise trade and more than 28 per cent of the world’s manufacturing output, simple arithmetic suggests to Beijing that it is not unreasonable to aspire to be among the top competitors in the most strategic sectors. How to get there without ruffling too many feathers is a challenge, nevertheless.

China’s core recovery problem is its own awesome size. Coordinating policies across 27 provinces and autonomous regions, five of which are more populous than Germany, has always been a daunting challenge. Few outside China appear to properly recognise the implications.

Chinese leaders have a chronic angst about rolling out sweeping reforms that carry the risk of devastating mistakes. It is better, therefore, to seed lots of small-scale experiments and allow competitive forces to lift the successful ones, and the problematic ones to wilt away with limited damage.

Beijing has repeatedly encouraged this competitive model to spur competition in strategically important areas of the economy: provide large-scale subsidies to large numbers of initial competitors, then progressively reduce support to weed out the least competitive.

The result is fierce domestic competition, energetic innovation and enough survivors to maintain strong competition after subsidies are withdrawn. The result is also often oversupply – not driven by an urge to capture overseas markets, but to ensure domestic innovation and self-reliance.

A second oversupply challenge is that even small shifts in output can result in massive changes as a global exporting force. To encourage food security, China has invested massively in agricultural reforms that mean it is today the world’s largest rice producer – around 208 million tonnes per year.

However, because domestic demand gobbles up almost all of this, just 2.2 million tonnes is exported. India is the world’s second-largest rice producer at around 196 million tonnes, but it exports 16.5 million tonnes. A five per cent rise or fall in Chinese rice production would have massive impacts on rice prices in global export markets.

So too with steel. China is the world’s largest producer – making about 1.02 billion tonnes in 2023. Last year, China consumed most of its steel, exporting only around 90 million tonnes – but that still made it the world’s biggest exporter.

In hit-or-miss efforts to satisfy domestic demand, minor fluctuations in production in such a large manufacturing economy have massive effects on global markets. What to one leader is a structural and predatory oversupply can, for another, be a modest domestic fluctuation in supply and demand.

When an oversupply challenge arose from Japan in the 1980s, the main release valve was to set export limits, but allow Japanese companies to invest and produce in the US. Sadly, no such valve is likely to be allowed this time. The US seems set on blocking Chinese efforts to build production within the US economy. For China, different solutions must be found – though it remains possible that the European Union will be more open to allowing Chinese companies to establish footholds in Europe.

What is not helpful is a refusal to acknowledge that China is an economic force that will not go away. As economist Jurgen Matthes recently observed, in 1995, China accounted for just 5 per cent of global manufactured value-added. In 2020, its share had risen past 35 per cent. In the same time frame, the next nine global manufacturing powerhouses have seen their share fall from about two-thirds to one-third.

China has also become the dominant force in an unprecedented number of sectors. In an analysis of 5,000 products, Matthes discovered that China accounts for more than 50 per cent of global output in 600 of these 5,000. Based on those metrics, the US and Japan dominate in about 100, and the entire EU in around 300. This suggests the bigger problem is not oversupply, but the risks linked with concentration around a small and dominant cluster of companies.

Even small shifts up or down in their production are going to have big impacts worldwide. Throwing up tariff walls and putting heads in the sand does not count as a solution. We need to remember the lessons from Smoot-Hawley.

David Dodwell is CEO of the trade policy and international relations consultancy Strategic Access, focused on developments and challenges facing the Asia-Pacific