The United States must employ “all the tools at our disposal” to outcompete China, Deputy Secretary of State for Management and Resources Rich Verma said on Monday as the Biden administration unveiled its budget request for the 2025 financial year.

The request includes US$4 billion over five years in mandatory funding for this purpose, including US$2 billion to create a new international infrastructure fund that provides a credible, reliable alternative to Chinese infrastructure funding, Verma said.

US President Joe Biden sketched his policy vision for a potential second four-year term on Monday, unveiling a US$7.3 trillion election-year budget aimed at convincing sceptical Americans that he can run the economy better than Donald Trump.

Biden wants to raise taxes by trillions on corporations and high earners, his budget wish list showed, to help cut the deficit and pay for new programmes helping those who make less cope with high housing and childcare costs. Congress is unlikely to adopt the measures as proposed.

Biden’s budget for the 2025 financial year, which starts in October, would raise tax receipts by US$4.951 trillion over 10 years, including more than US$2.7 trillion in tax hikes on businesses and nearly US$2 trillion on wealthy individuals and estates, the US Treasury said on Monday.

The budget plan also calls for an additional US$104.3 billion in mandatory funding for the Internal Revenue Service on top of US$80 billion won by the tax agency in 2022, the Treasury said in its “Green Book” estimates of the budget’s revenue effects.

This additional funding would add US$341 billion in new revenues over the 10-year period compared with current funding, the Treasury said.

The Treasury estimated that reforms to international business taxation, driven by implementation of a 2021 global 15 per cent minimum tax deal by 137 countries, would add US$632.2 billion to US receipts over 10 years. But even with the addition of a higher US overseas minimum tax of 21 per cent, this is well below last year’s estimate of about US$1.16 trillion.

A US Treasury official told reporters the reduction was due to revised assumptions that fewer countries would adopt the minimum tax apart from Britain, Japan, the European Union, Mauritius and Vietnam.

The reduction was made up elsewhere, including through an increase in the domestic large-company minimum tax to 21 per cent from 15 per cent, which the Treasury estimates would raise US$137.4 billion over 10 years. It estimates that a new proposed ban on companies’ ability to deduct non-CEO and CFO employee compensation above US$1 million would raise US$271.9 billion over 10 years.

Elimination of tax breaks for fossil fuel energy companies would raise US$45.1 billion in new revenues over the decade through 2034, while raising the overall corporate tax rate to 28 per cent from 21 per cent would raise US$1.35 trillion, Treasury estimated.

First over-the-counter birth control pill in US begins shipping to shops

First over-the-counter birth control pill in US begins shipping to shops

The Treasury estimated that provisions to raise taxes on wealthy individuals, new rules for estate transfers, and limiting high-income individuals’ use of tax-advantaged retirement accounts would raise US$1.96 trillion.

That total includes Biden’s “billionaire tax,” which would impose a 25 per cent minimum tax on individuals with wealth of over US$100 million. The Treasury estimated it would raise US$502 billion over the decade.

The Treasury again proposed more funding for the IRS to conduct more audits of wealthy individuals and complex business partnerships. The Treasury has recently increased its internal estimates of the revenues that could be collected from the IRS modernisation efforts.

The budget also includes a number of new proposals to help Americans cope with the high cost of housing, including a US$10,000 tax credit over two years to help offset high interest costs for first-time homebuyers and a one-time US$10,000 credit for sellers of “starter homes” to increase market inventory.

Together these would cost US$47.3 billion over the 10-year period, the Treasury said.

The budget’s overall tax proposals to help moderate-income families, including the housing credits and expanded tax credits for children and health insurance premiums, would cost US$764.9 billion over 10 years, the Treasury said.

Netanyahu rejects Biden criticism, says majority of Israelis back him

Netanyahu rejects Biden criticism, says majority of Israelis back him

Republican House of Representatives Speaker Mike Johnson quickly rejected the proposal, saying it reflected an “insatiable appetite for reckless spending” and a “disregard for fiscal responsibility”.

The budget was released days after the Democratic president’s fiery State of the Union address, where he assailed the values of Trump, his expected Republican opponent in November’s election.

Biden’s campaign has struggled to shake voters’ concerns about high prices and the US economy’s direction.

Forty per cent of Americans think Trump would handle the economy best, compared with 31 per cent who picked Biden and 28 per cent who either did not know or refused to answer, according to a January Reuters/Ipsos poll. Biden travels to the competitive election state of New Hampshire on Monday.

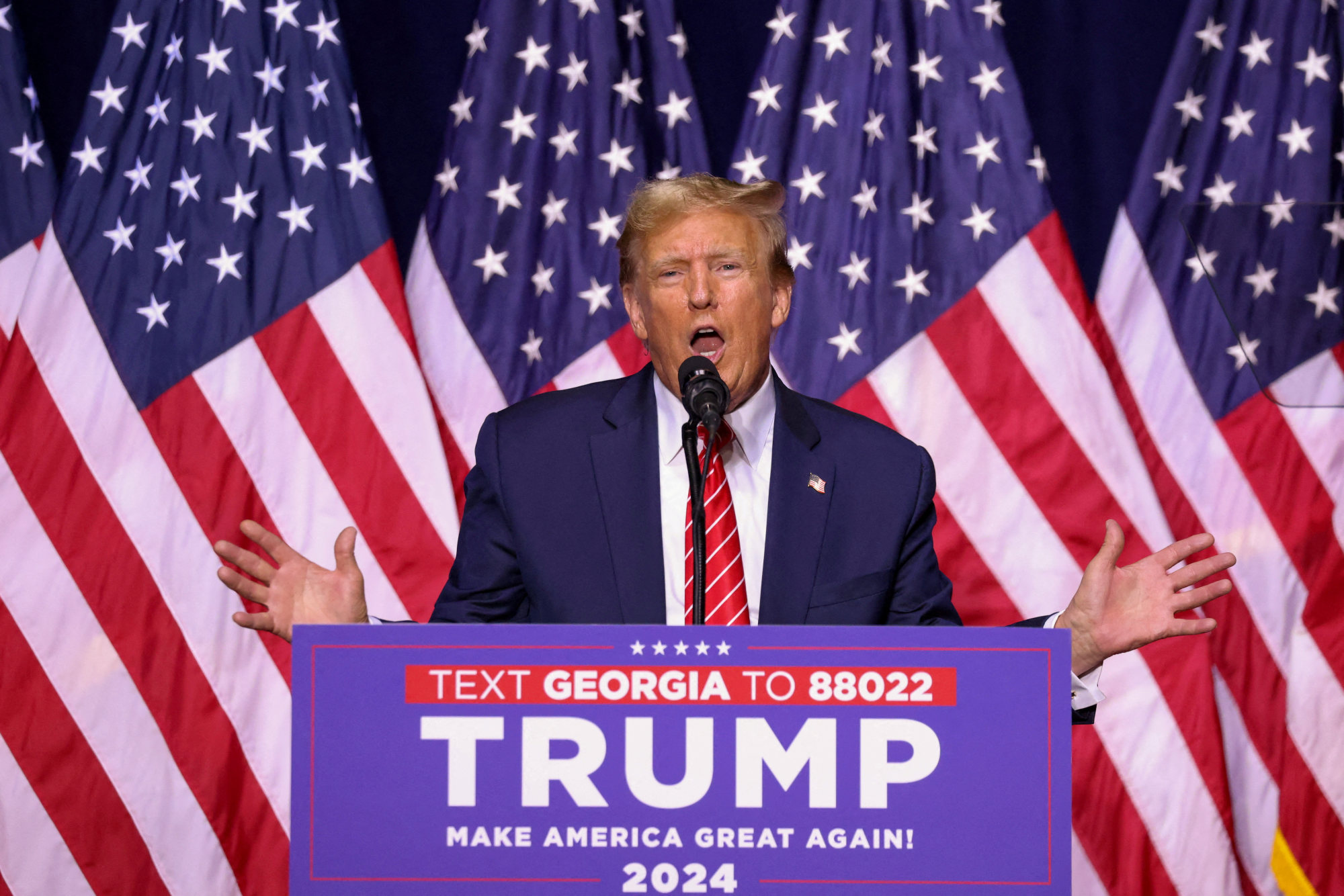

Trump, whose signature legislative accomplishment as president was a major 2017 tax cut, wants to sharply increase tariffs on imported foreign goods and cut regulations on energy producers.

On Monday, the Republican’s campaign sought to clarify his stance on the popular Social Security and Medicare entitlement programmes after the former president alluded to “cutting” them by targeting “theft and bad management”. Biden has vowed to shield the programmes from benefit cuts.

Democrats faulted the Trump tax cuts as widening the deficit and tilted to the wealthy but did not repeal them when they controlled Congress in 2021-2023. Key provisions expire next year, setting up a major showdown over tax policy.

Biden’s proposal to bring down deficit spending by US$3 trillion over 10 years would slow but not halt the growth of the US$34.5 trillion national debt.

Deficits would total US$1.8 trillion in the 2025 financial year, 6.1 per cent of GDP, before falling to under 4 per cent over a decade, the White House forecast.

The Committee for a Responsible Federal Budget, a deficit-reduction advocacy group, called the proposal a “welcome start” but said it “doesn’t go nearly far enough”.

The White House forecast 1.7 per cent real GDP growth in 2024, and 1.8 per cent in 2025, rising to 2.2 per cent by 2030. Consumer price inflation for 2024 was forecast at 2.9 per cent and 2.3 per cent in 2025, with 4 per cent unemployment, a figure that falls to 3.8 per cent later in the decade.

The forecasts were set in November, and officials said the figures would be more optimistic if they were fixed today.