Hong Kong’s stock exchange dropped to tenth place globally in the first quarter, raising only HK$4.7 billion ($600 million), according to data from Deloitte.

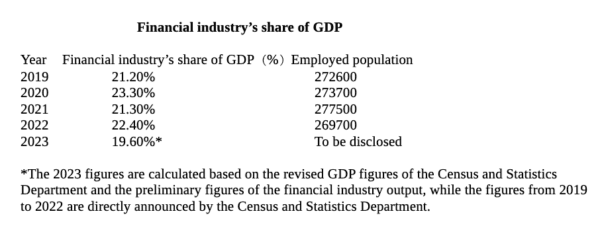

While the shipping industry, another economic pillar of Hong Kong, has similarly dropped from first to tenth place globally, the finance industry, one of Hong Kong’s four major industries, ranked first globally in fundraising in 2019, is shrinking faster. According to official data, the finance industry’s contribution to Hong Kong’s GDP fell to less than 20 percent in 2023.

Hong Kong IPO Market Hits 15-Year Low

According to Deloitte, as of late March, Hong Kong’s stock exchange has experienced the quietest first quarter since 2009, with only HK$4.7 billion ($600 million) raised and only 12 listings. Based on this, if the numbers for the remaining three quarters are similar, the total fundraising for the year may be less than HK$20 billion ($2.55 billion).

Bonnie Chan, the CEO of the Hong Kong Stock Exchange, stated in early April to the Legislative Council’s Financial Affairs Committee that the Exchange received 65 new listing applications in the first quarter of 2024, an increase of over 30 percent year over year.

According to a report from Chinese media, Securities Times, Chinese brokerage firms were more prominent among the 12 new listings in the first quarter. Among foreign investors, only JP Morgan Chase sponsors new stock listings, and foreign investors have successively withdrawn from new stock underwriting activities, including Goldman Sachs’ withdrawal from Fourth Paradigm last year.

The financial industry in Hong Kong once thrived from 2019 to 2021.

Due to tense U.S.-China relations, the trade war extended to the financial industry. At the end of 2020, then-U.S. President Donald Trump signed into law the Holding Foreign Companies Accountable Act, requiring foreign companies listed on U.S. exchanges to comply with U.S. auditing standards, Chinese companies were no longer permitted to store audit documents in China on national security grounds. This led to a wave of Chinese companies listed in the U.S. returning to the Hong Kong Stock Exchange, which once made Hong Kong’s new stock activities frequent.

In 2019, Alibaba (9988) was listed in Hong Kong with a dual listing, raising HK$101.2 billion ($12.92 billion), the third-largest fundraising in history. The fundraising amount of Hong Kong stocks that year was also the first globally.

In 2020, JD.com (9618), NetEase (9999), and Yum China (9987) were listed in Hong Kong; in 2021, there was Baidu (9888), Bilibili Inc. – SW (9626), and Xiaopeng Motors (9868), all making the move after U.S. policy changed.

However, as time passed, Chinese companies have adapted to U.S. regulations, and the wave has slowed.

According to a Nikkei Asia report, since 2022, 16 U.S.-listed Chinese companies have changed their Chinese auditors to those in the United States and Singapore. The number of companies undergoing audits in China or Hong Kong has decreased from 22 to 8, with Singapore being the major beneficiary.

In addition, Alibaba canceled its plan to list mainly in Hong Kong last year, retaining its main listing in the United States, as did its subsidiary Cainiao. Xiaohongshu, which had been rumored to list in Hong Kong, stated in late 2023 that it had no plans to go public in the city.

The wave of Chinese concept stocks in 2022 has faded, with the total fundraising amount of new stocks being less than HK$100 billion ($12.77 billion). The listed company with the largest amount of funds raised was China Tourism (1880), which only raised HK$18.39 billion ($2.35 billion); the listed company with the largest amount of funds raised in 2023, Zhenjiu Lidu (6979), only raised HK$5.31 billion ($0.68 billion), and the number of new shares raised for the year was only HK$41.6 billion ($5.31 billion).

Global coordinators are responsible for finding cornerstone investors and anchoring investors, but with the weak performance of the Hong Kong stock market and insufficient liquidity, if foreign underwriters cannot find enough subscribing investors, they can only choose to withdraw, a Hong Kong securities firm told Securities Times in October 2023. The withdrawal of foreign banks reflects the lack of interest from their clients in Hong Kong’s new stock market.

GDP’s Finance Proportion Declines, Employees Decrease

According to GDP data released by the Hong Kong Census and Statistics Department on March 19, the financial and insurance industry declined by 0.5 percent in the fourth quarter of 2023 and by 1.7 percent for the year.

The Department has not yet released the proportion of finance in GDP for 2023 but has announced that the revised GDP figure for Hong Kong in 2023 is HK$2.85 trillion ($360 billion).

The preliminary figure for the output value of the financial and insurance industry for the whole year is HK$558.8 billion ($71.36 billion), accounting for 19.6 percent of the local GDP, falling below the 20 percent mark for the first time since 2019. The number of finance professionals in 2022 also fell by 2.81 percent compared to 2021, to 269,700.

Data from the Securities and Futures Commission shows that the total number of licensed professionals in 2023 was 48,091, a decrease of 587 from the previous year.

All these figures above indicate that the finance industry in Hong Kong is shrinking.

However, a few years ago, during the boom of Chinese concept stocks, coupled withreportsof a lack of listing talent in Hong Kong, posts emerged in mainland China about strategies for obtaining the financial license in Hong Kong, attracting more newcomers to the industry.

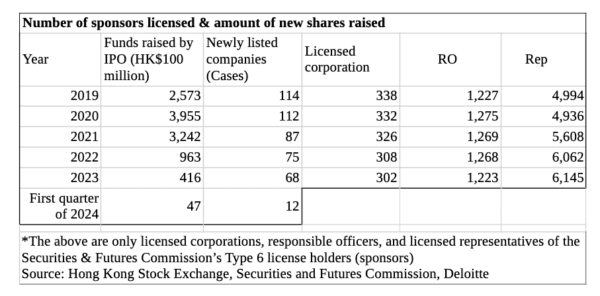

However, a few years ago, during the boom of Chinese concept stocks, coupled withreportsof a lack of listing talent in Hong Kong, posts emerged in mainland China about strategies for obtaining the financial license in Hong Kong, attracting more newcomers to the industry.Securities and Futures Commission data shows that from 2019 to 2023, the number of “Type 6 license” holders (financial services licensed to advise on institutional finance) representatives increased significantly by 23 percent.

Nevertheless, the number of new listings and the amount of fundraising continue to decline. The number of listings per licensed corporation per year has dropped from 0.33 in 2019 to 0.23, while the number of grassroots personnel has increased against the market trend, leading to greater pressure for future layoffs.

If the scale represented by the “Type 6 license” returns to the level of 2019, at least a thousand jobs will need to be cut. Given that the fundraising amount in 2019 was HK$257.3 billion ($32.85 billion), the contraction is likely to be even higher. The Securities and Futures Commission regulates that a licensed corporation must hire at least two responsible officers (ROs). Currently, there are 302 licensed corporations requiring 604 ROs to maintain license compliance. The total number of ROs is currently 1,223. If business continues to decline, even relatively stable ROs will face pressure to lay off staff.

UBS has laid off about 70 people in its Asian private banking division, including client relationship managers, mainly in Hong Kong and Singapore, Bloomberg reported. Other banks, including Goldman Sachs, Morgan Stanley, Credit Suisse, and HSBC, have focused their layoffs on employees in Hong Kong and China, with even managing directors facing layoffs, equivalent to closing for some businesses.

With the weak Hong Kong stock market, Hong Kong is no longer the preferred listing venue for major Chinese enterprises.