China may be under pressure to let its currency appreciate and should reduce reliance on the US market, Chinese analysts said, after a former protégé of billionaire George Soros was tapped to become Washington’s top economic official.

Advertisement

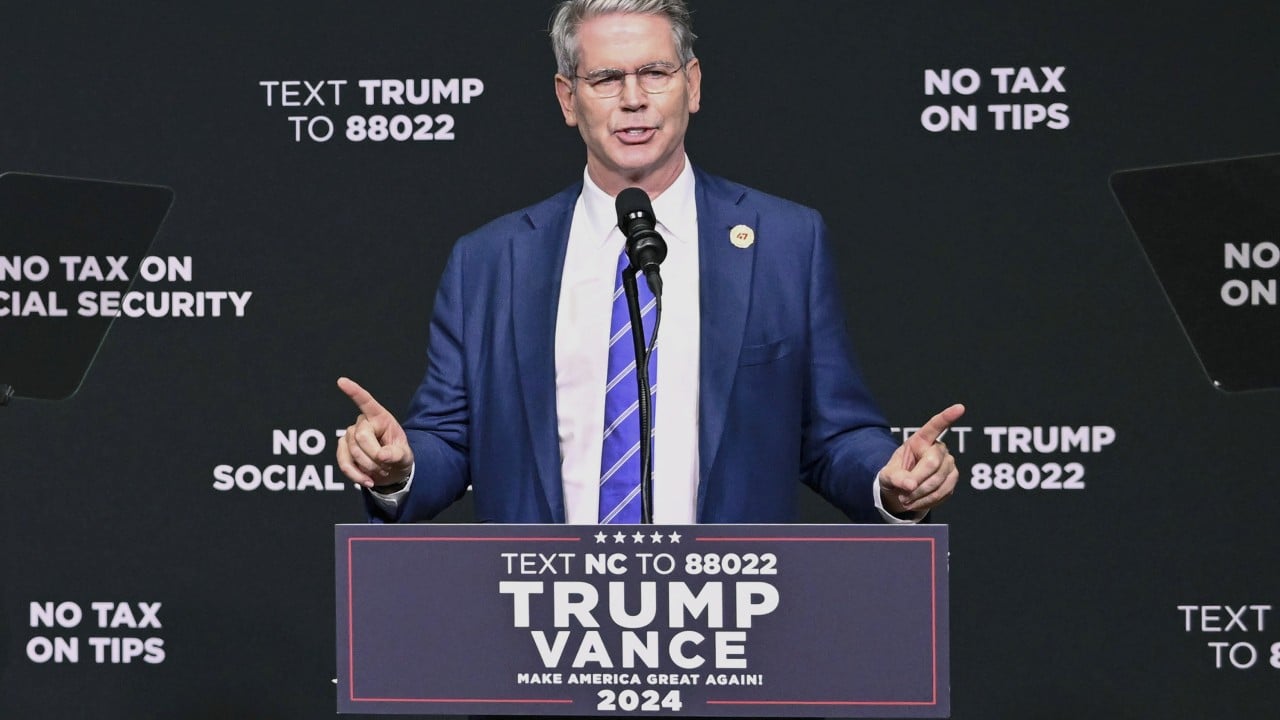

US president-elect Donald Trump on Friday picked hedge fund manager Scott Bessent, founder of investment firm Key Square Capital Management, as his nominee for Treasury secretary.

The role would see Bessent tasked with leading US economic policy, financial markets and sanctions policy. He would also be a key player in implementing what is expected to be a tough economic agenda against China.

Bessent, a major economic adviser and fundraiser during Trump’s presidential campaign, is a supporter of the returning leader’s tariffs policy. He has also advocated tax cuts, market deregulation and increased energy production.

Recruited by Soros Fund Management in 1991, Bessent was among those pushing for shorting the pound sterling in 1992, which saw Soros reportedly pocket as much as US$1 billion.

Advertisement

As the fund’s chief investment officer between 2011 and 2015, Bessent gained further fame for successfully shorting the Japanese yen in 2013.