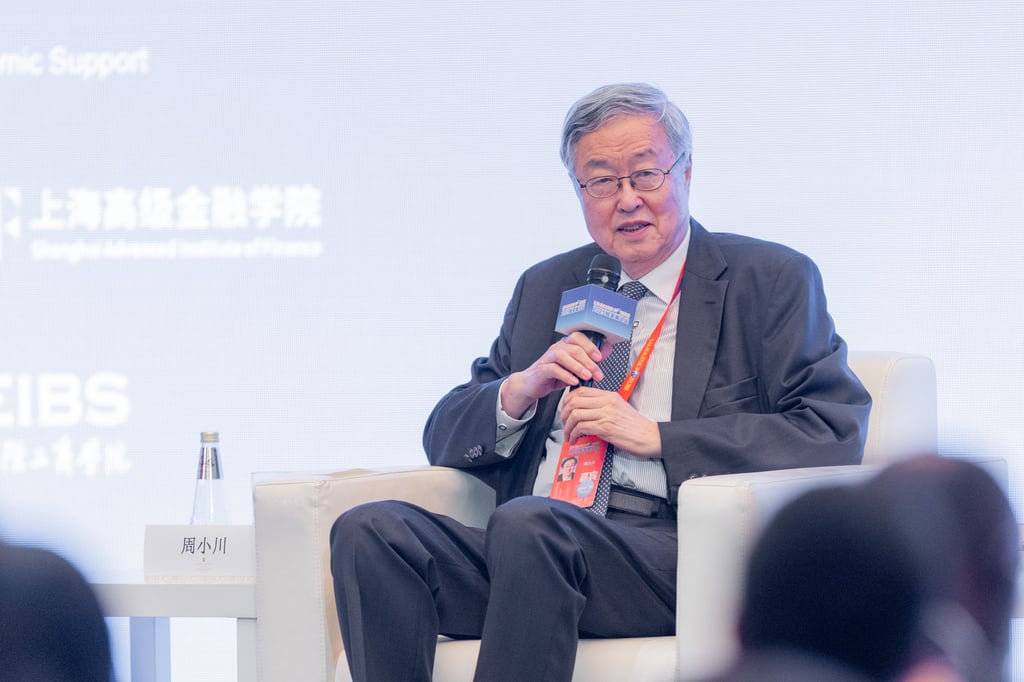

With major economies gearing up for the rising ubiquity of stablecoins and their impact on the global economy, former Chinese central bank chief Zhou Xiaochuan has warned that US dollar-backed stablecoins could accelerate the “dollarisation” of the international monetary system.

Advertisement

Amid the explosive growth of cryptocurrency in the past few years, continued focus from high-level figures reflects the Chinese government’s interest in underlying technologies and their potential role in cross-border finance, despite cryptocurrency trading being banned on the mainland.

“Although other countries are considering issuing their own local-currency stablecoins, their potential global impact remains uncertain, whereas USD-backed stablecoins could have worldwide influence,” said Zhou, the architect of many of China’s early financial reforms, at the Lujiazui Forum in Shanghai on Wednesday. “USD-backed stablecoins may facilitate US dollarisation, and the effects of this remain highly debated.

“Unless facing extreme, dire circumstances – such as [fighting] high inflation or heavy debt burdens – pursuing dollarisation could bring many adverse side effects.”

The US Senate this week passed landmark stablecoin legislation that, for the first time, established federal guardrails for US dollar-pegged stablecoins, creating a regulated pathway for private companies to issue digital dollars with the blessing of the federal government.

Unlike volatile cryptocurrencies such as bitcoin or ethereum, whose prices experience drastic fluctuations, stablecoins aim to combine the efficiency of digital assets with the reliability of traditional money. By pegging their value to fiat currencies such as the US dollar or Hong Kong dollar, or to other reserve assets, stablecoin prices are meant to live up to their name – as long as the currency behind them remains strong.