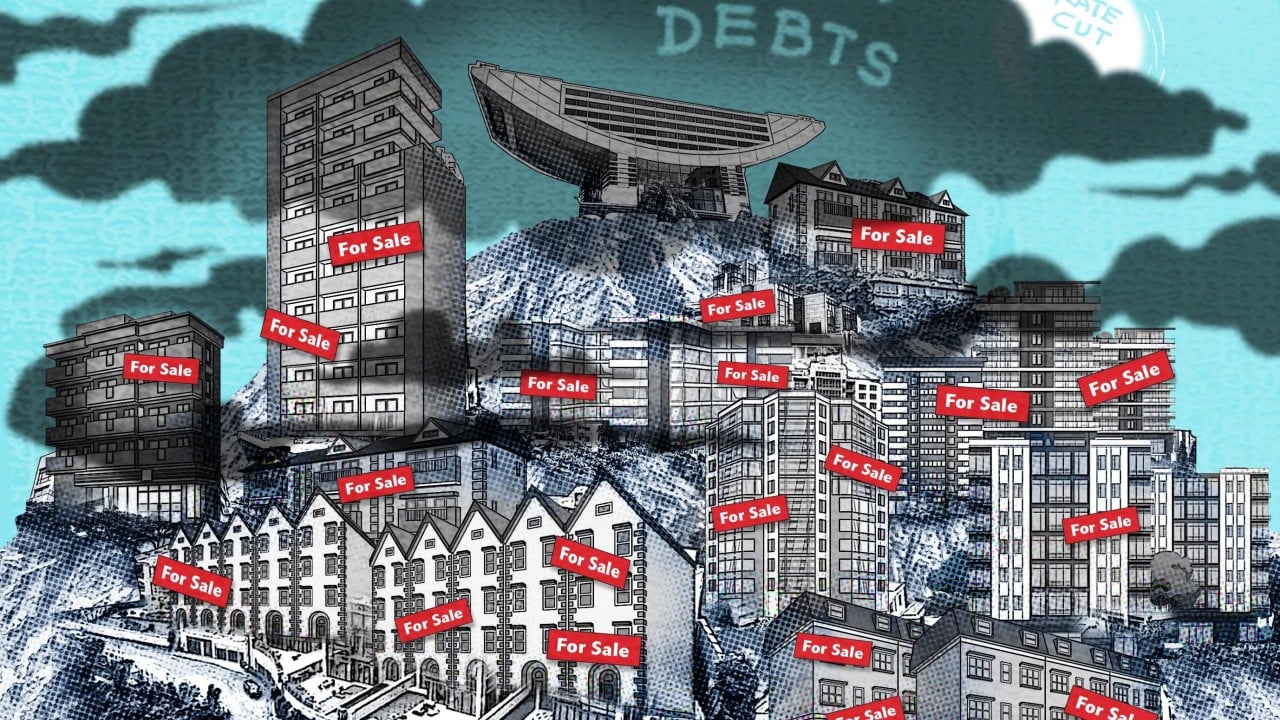

In the first of a two-part series, Salina Li, Aileen Chuang and Jiaxing Li explore the effects of high interest rates on the city’s tycoons and their trophy real-estate holdings.

In the rarefied air up on The Peak, the owner of the penthouse in the Opus Hong Kong development – which has been called the city’s most expensive apartment building – unexpectedly put his unit up for sale.

Some of the city’s wealthiest residents rub shoulders here. But it is rare that a unit in the 12-floor building, which twists upwards toward the clouds and was designed by the famed architect Frank Gehry – his first residential project in Asia – would come on the market for a second-hand sale.

Advertisement

The penthouse belongs to tycoon Chen Changwei, chairman of Hengli Investments, who developed residential and commercial projects in China and managed properties in Hong Kong, London and on the mainland.

The 5,444 sq ft unit, which changed hands for HK$509 million (US$65.3 million) in 2015, was offered with another asset that Chen wanted to offload, some ground floor shops at Pearl City Mansion in Causeway Bay. He bought them from New World Development in 2021 for HK$1.1 billion, according to people familiar with the matter.

Chen’s rush to cash out came as Hengli and Hong Kong-based private equity firm Gaw Capital sought last month to sell two grade-A office buildings in eastern Hong Kong Island that they bought five years earlier at a market peak for HK$15 billion.

Advertisement

Adverse conditions in the office market have touched a HK$10.3 billion loan that Gaw and Hengli took out, which was backed by the buildings. Rental income was not sufficient to cover the interest payments, so the two companies had to inject equity into the borrowing entity of the loan to cover the shortfall, people familiar with the matter said. Hengli, however, has not paid its share since late last year, the people said.

This is illustrative of a broader trend. All across Hong Kong – from The Peak to South Island and elsewhere – high-net-worth individuals have found themselves caught in a tight spot between their ritzy, overleveraged properties and a quickly draining pool of liquidity. This is because their businesses are slowing, borrowing costs are high and their financial strains are becoming more severe. Analysts say high interest rates have caused borrowing costs for developers to skyrocket as lenders raised prime rates five times – for a total of 87.5 basis points – to their highest levels since 2007.