Morgan Stanley has become the latest organisation to upgrade China’s 2025 economic growth forecast, citing a fast start to the year’s economic activities despite new US tariffs.

Advertisement

The revision on Monday, up by 50 basis points to 4.5 per cent, followed similar moves by HSBC and the Organisation for Economic Co-operation and Development (OECD) last week.

According to Morgan Stanley’s chief China economist, Robin Xing, the change was made because of a “stronger-than-expected starting point” plus growth in capital expenditures, the bank said in an emailed statement.

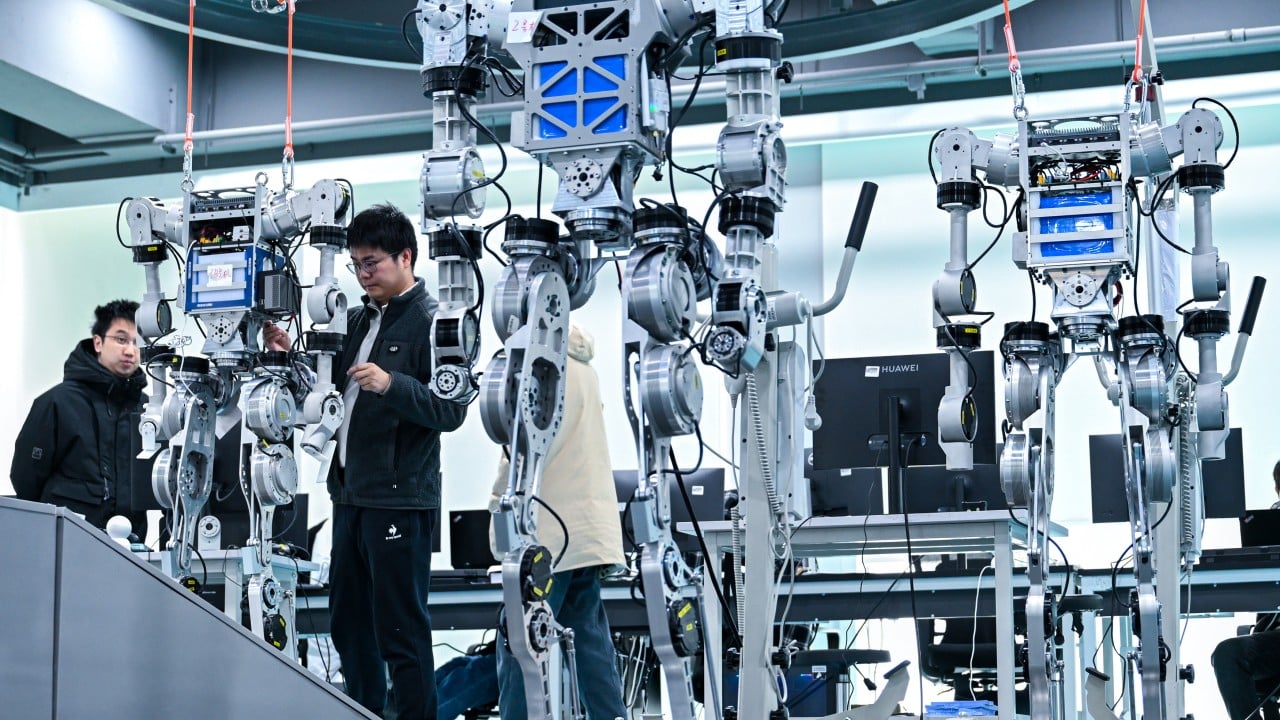

The first quarter to date has shown “robust activity data” despite the long Lunar New Year holiday, Morgan Stanley said. The bank further expects a “higher contribution from capital formation to GDP, supported by emerging industries amid AI adoption and public funding support”.

However, despite forecasts being revised upwards, some remain shy of the world’s second-largest economy’s official target of “around 5 per cent” while simultaneously auguring well for resilience against a 20 per cent increase in US tariffs followed by retaliatory sanctions and tariffs imposed by Beijing against select American imports.

Advertisement

“The government’s increased resolve to support growth, stronger and more urgent policy response to bolster domestic consumption, and better-than-expected activity data are the key reasons we are more constructive on growth,” HSBC said in a research note on Tuesday announcing that its China economic growth forecast had risen 0.3 percentage points to 4.8 per cent.

“Policy follow-through and further roll-out of plans to boost private sector confidence and support technology and innovation will help to round out growth,” the bank said.