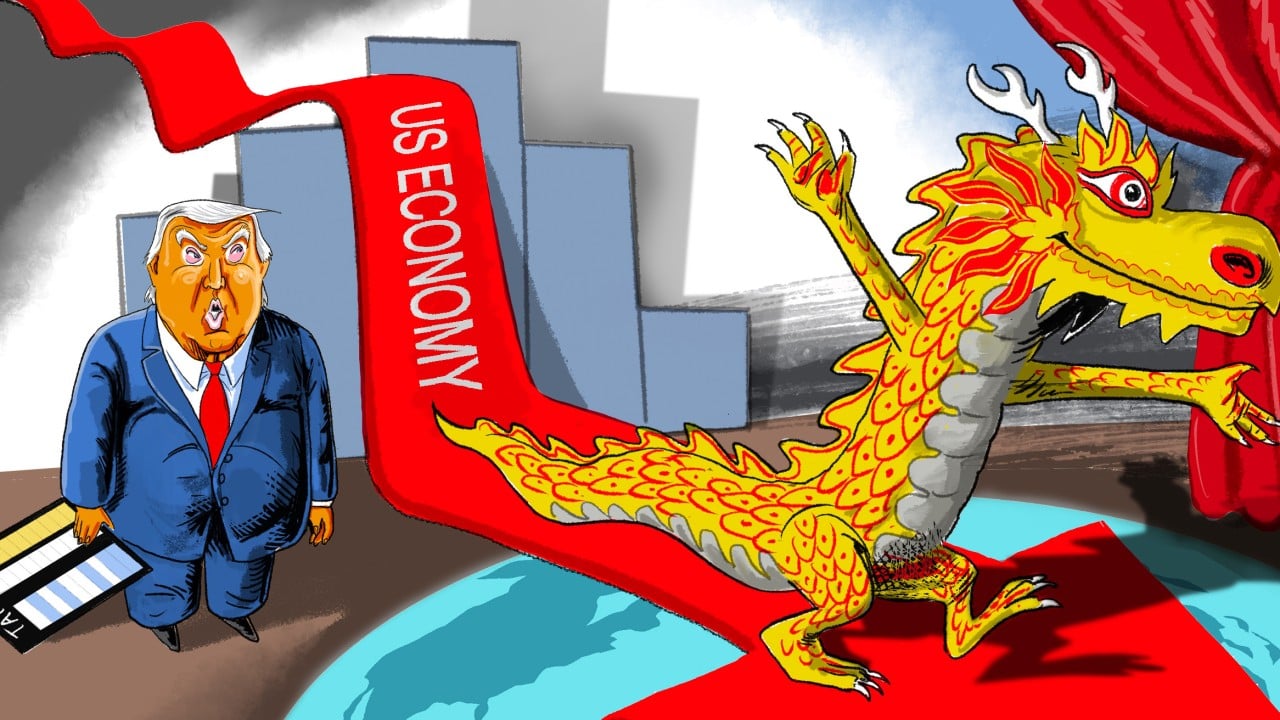

Instead of retaliating, China should celebrate: US President Donald Trump’s economic and tariff plans are making China great again.

Advertisement

What Trump called “Liberation Day” – as he announced global import tariffs ranging from 10 per cent to as much as 34 per cent for China, 46 per cent for Vietnam and 49 per cent for Cambodia – House Minority Leader Hakeem Jeffries denounced as “recession day”. Indeed, economists expect Trump’s tariffs to accelerate inflation and dampen US economic growth, causing stagflation as prices remain painfully high.

The stock market reacted sharply the day after the announcement, with trillions of dollars wiped out.

Since then, the US’ trade war with China has only escalated. After China raised its levies on US imports to 84 per cent in response to further tariff increases by the US, Trump raised the US tariff rate on China to 125 per cent and instituted a 90-day pause on steep “reciprocal” tariffs on non-retaliating countries such as Switzerland. The 10 per cent baseline tariff on all US imports stands.

The US stock market remained volatile to the tit-for-tat tariff war between the two. This dramatic sell-off was driven by investor fears over the potential economic impact of the tariffs, which are expected to also disrupt global supply chains.

Advertisement

As companies scramble to restructure their supply chains to mitigate the impact, American consumers rushed to buy cars and other goods before the new tariffs took effect. Dealerships reported a surge in sales, particularly for vehicles from manufacturers like Honda and Toyota. This rush highlighted the more immediate economic disruptions caused by Trump’s trade policies.