Published: 12:12am, 26 Nov 2025Updated: 12:48am, 26 Nov 2025

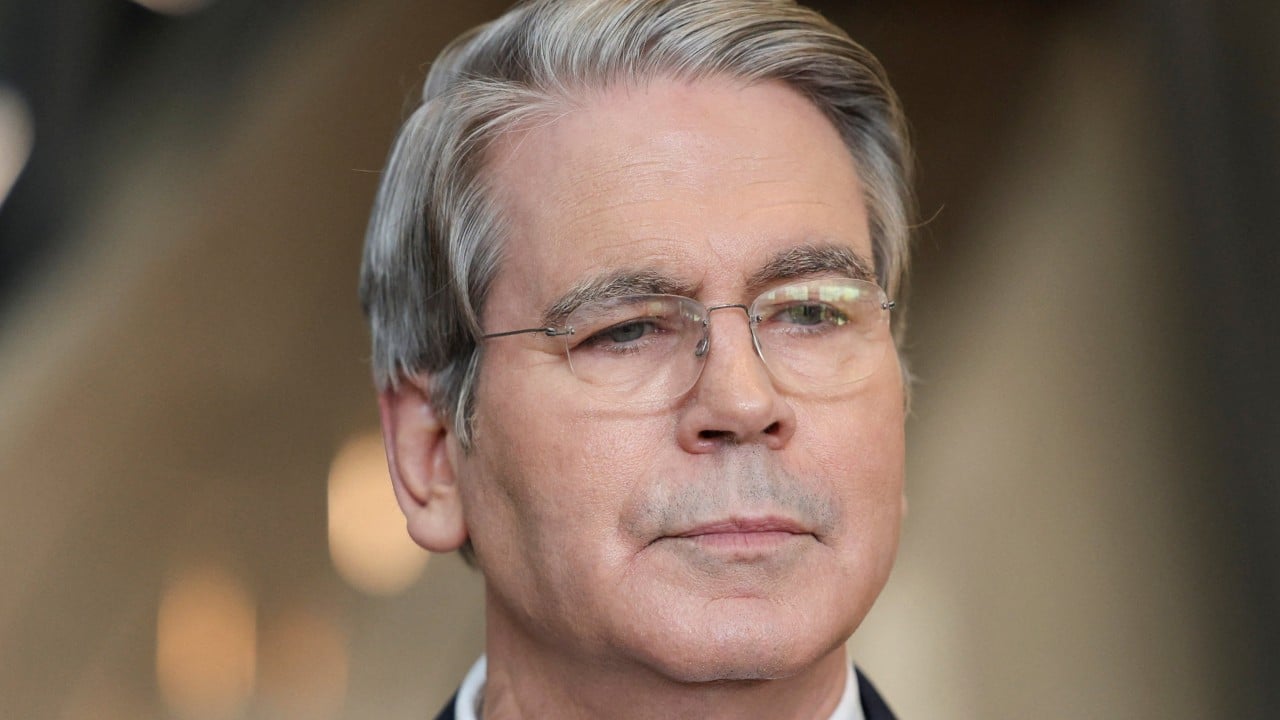

US Treasury Secretary Scott Bessent said that a key theme of his interviews for the next chair of the Federal Reserve has been simplifying the US central bank, which he indicated has become too complex in how it manages money markets.

Advertisement

“One of the things in terms of the criteria that I’ve been looking for” has been the interplay of the Fed’s various instruments, Bessent said on CNBC Tuesday. “I realise the Fed has become this very complicated operation.”

Bessent said his final second-round interview with the five candidates to succeed Chair Jerome Powell will be today, and reiterated that US President Donald Trump may make his announcement on the nomination before December 25.

The administration has previously said the finalists are Fed Governors Christopher Waller and Michelle Bowman, former Governor Kevin Warsh, National Economic Council Director Kevin Hassett and BlackRock executive Rick Rieder.

The Fed now maintains a so-called ample reserves approach in controlling its policy interest rate, which involves holding a sizeable amount of Treasuries on its balance sheet.

Advertisement

As part of the current operating system, it pays interest on the reserves that banks park with it, and for any cash that money market funds temporarily place at the Fed.