Standard Chartered has advised more than 2.5 million of its affluent clients to diversify their portfolios and stick to core investment principles as fresh capital pours into bullish markets.

Advertisement

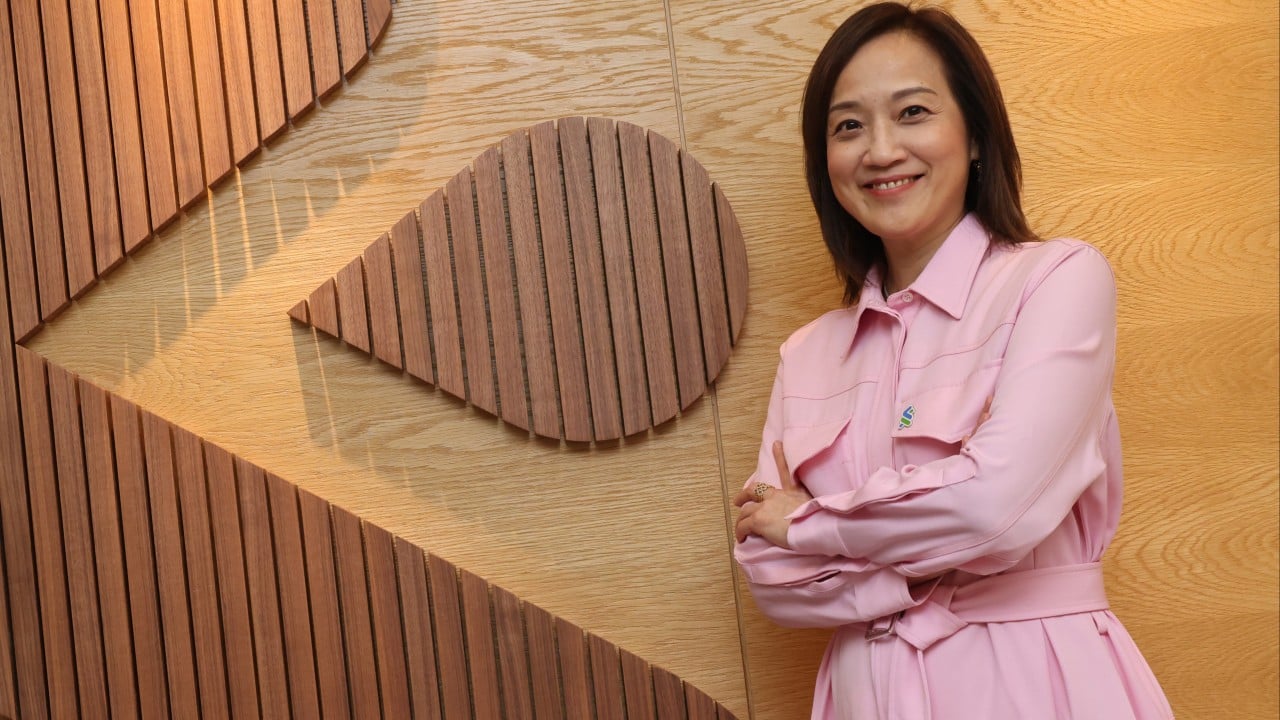

A risk-on mentality over the summer benefited some wealthy clients, but market corrections could lie ahead, said Judy Hsu, the bank’s CEO of wealth and retail banking, in an interview last week.

“In July and August, we [saw] more clients across the board deploying more cash into investment products and they are looking to put more of that deposit into the market,” said Hsu, who in October relocated to Hong Kong, the bank’s most profitable market.

Market sentiment stabilised after the US and China unveiled a 90-day tariff truce, reversing what had been a prevailing mood of caution since April, she said.

“The key here is really diversification,” Hsu said. “From our advisory perspective, we always go in with a portfolio approach.”

Advertisement

Hsu observed that clients invested in fixed-income assets expected interest rates to eventually decrease. On equities, while some allocations were shifted into Asia – specifically Hong Kong and mainland China – there was “still a lot of interest” in the US because of its strong technology sector, she said.

So far this year, Hong Kong’s Hang Seng Index was 26.7 per cent higher, while mainland China’s CSI300 Index rose 13.4 per cent. In the US, the Nasdaq and the S&P 500 reached record highs after rising by more than 10 per cent, according to Bloomberg data.