Beijing hopes for an anti-U.S. bloc, but the region’s governments must weigh their overall interests, analysts say.

News Analysis

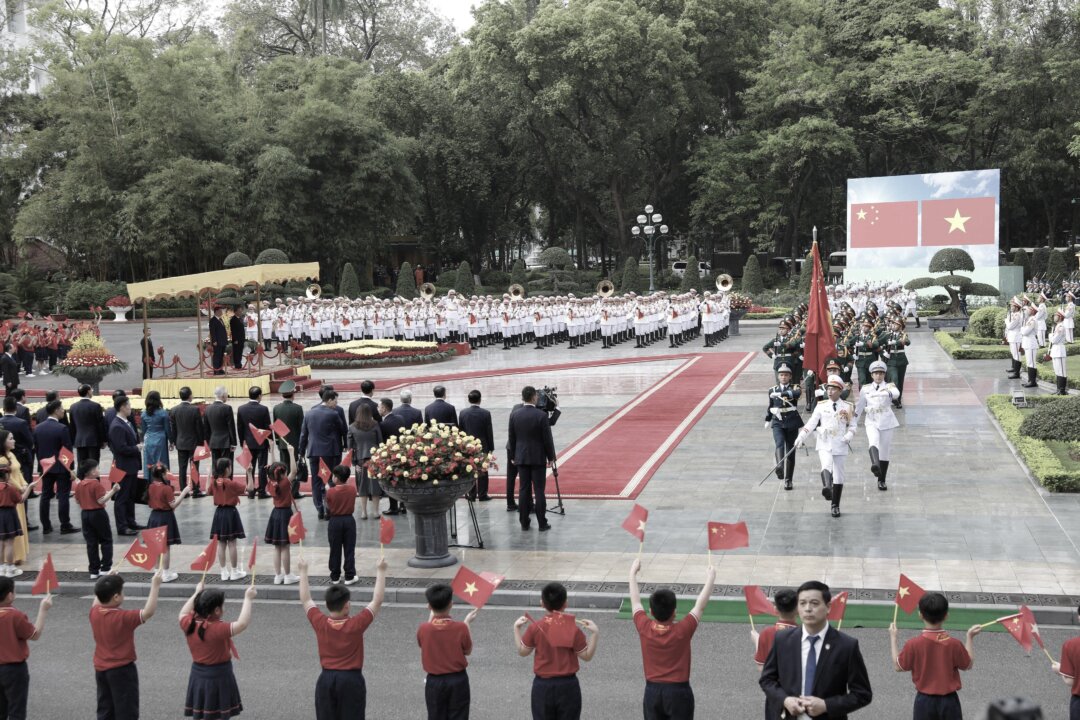

Beijing’s recent engagements with Southeast Asian countries—including a trip by Chinese leader Xi Jinping to Vietnam, Malaysia, and Cambodia—resulted in exchanges and commitments to deepen economic cooperation. Meanwhile, efforts by the Chinese Communist Party (CCP) to find common cause with those nations against the United States’ toughening trade policies have been less successful.

Xi’s first tour abroad of 2025, from April 14 to April 18, saw China ink dozens of agreements with each of the countries he visited. Many of these were memoranda of understanding on cooperation in fields such as infrastructure, artificial intelligence (AI), agriculture, and trade.

At the same time, Southeast Asian governments have been taking steps to reach deals with Washington after U.S. President Donald Trump put a three-month pause on his reciprocal tariffs targeting dozens of countries worldwide.

Southeast Asian countries, apart from building up their own industrial bases, have become attractive destinations for Chinese manufacturers looking to circumvent U.S. tariffs. These manufacturers sell their products and raw materials to those countries, which are then resold to the United States in a process called transshipment.

Trade volume between the United States and Southeast Asian countries reached $476.8 billion in 2024, with U.S. exports accounting for $124.6 billion of that total, according to the Office of the United States Trade Representative.

Meanwhile, the trade volume between China and Southeast Asia rose to $982.3 billion that year, according to the Chinese state-run Xinhua News Agency. A report by the Asia Society Policy Institute, published in February, notes that while China’s exports to the region have continued to increase, the volume of goods it imports from Southeast Asian countries has barely grown.

U.S. officials have called out transshipment, which took off following the tariffs Washington imposed on China during the first Trump administration. The issue, along with the rise in imports of American goods, is a significant factor in trade negotiations with Southeast Asian nations.

Anti-US Bloc Unlikely

Sun Kuo-hsiang, a professor at Nanhua University’s Department of International Affairs and Business in Chiayi, Taiwan, told the Chinese edition of The Epoch Times that the CCP’s outreach is aimed at winning over its neighbors to create a united front against the United States and establish China as the dominant force in Southeast Asia.

The U.S. duties on goods from Vietnam, Malaysia, and Cambodia were initially set at 46 percent, 24 percent, and 49 percent, respectively, but were reduced to the global rate of 10 percent on April 9.

At a press conference on April 17, He Yadong, spokesman for the Chinese Ministry of Commerce, did not explicitly mention the U.S. tariffs, but said Xi’s tour was an opportunity to work with neighboring countries and build stronger supply chains.

Although Xi received a warm welcome from his hosts, Sun believes that Beijing’s attempt to create “some form of an anti-U.S. alliance” is unlikely to bear fruit, given that Southeast Asian countries would “prefer to keep a distance [from China] and adopt a pragmatic diplomatic strategy” based on their core national interests.

Southeast Asian countries place greater value on trade relations with the United States and the market opportunities that this relationship affords them, and as such, treat China’s initiatives with a high degree of caution, Sun said.

“They are concerned about appearing overly pro-China lest this invites sanctions from the United States,” he added, and are unwilling to sacrifice their economic bargaining ability to help the CCP further its strategic goals.

Clamping Down on Chinese ‘Production Laundering’

The countries Xi visited have not been as keen to repeat the CCP’s narrative on the United States.

On April 18, the last day of Xi’s tour, Vietnamese Prime Minister Pham Minh Chinh emphasized his country’s “unique bond” with the United States, adding that Hanoi has “largely addressed U.S. concerns” by reducing taxes and increasing imports of American goods. Vietnam “remains ready to engage in discussions and negotiations,” according to a Vietnamese government website post.

In a Vietnamese trade ministry directive seen by Reuters, Hanoi has instructed officials to crack down on transshipment and other forms of “trade fraud,” noting that such practices would complicate the country’s efforts to “avoid sanctions that countries will apply to foreign goods.”

Though the directive did not name China or the United States, “Vietnam’s goods imports are nearly 40 percent from China and Washington has openly accused Beijing of using the Southeast Asian nation as a transhipment hub to dodge U.S. duties,” the April 22 Reuters article reads.

The directive is dated April 15, the day Xi left Vietnam for Malaysia.

Bloomberg noted in an April 18 piece that Vietnam was one of the first countries to reach out to the United States, with Communist Party General Secretary To Lam giving Trump a call to discuss trade on April 4, two days after the 46 percent tariff on Vietnam was announced along with other “Liberation Day” tariffs.

Vietnam is a supplier for many Western companies in Southeast Asia, and is heavily reliant on imported Chinese raw materials.

According to Vietnamese customs data, the country’s trade surplus with the United States in 2024 was $123 billion; meanwhile, in the first three months of 2025, Hanoi exported $31.4 billion in goods to U.S. buyers, while the value of Chinese imports to Vietnam in the same period was $30 billion.

Cambodia, seen as having a closer relationship with communist China than Vietnam, has also taken steps to clamp down on the transshipment of Chinese goods.

According to the Cambodia China Times, a Chinese-language outlet based in the country, the Cambodian government issued amended regulations immediately following Xi’s return to China, stipulating greater measures to prevent Cambodia from being used as a “production laundering hub” for Chinese goods.

On April 16, Cambodian Deputy Prime Minister Sun Chanthol led a delegation in holding an initial round of trade talks with U.S. Trade Representative Jamieson Greer via video conference. The proposed regulations on transshipments were discussed as part of Phnom Penh’s attempts to have Washington waive or lower its planned 49 percent tariff on the country.

Balancing Ties

As with Vietnam, the Trump administration has also criticized Cambodia for helping Chinese producers evade U.S. tariffs.

Regarding Cambodia–China cooperation, Cambodian Prime Minister Hun Manet stressed that the “all-weather ties” he and Xi promoted during their meeting were based on equality and mutual benefit, and that claims of Cambodia “being controlled” by or “losing sovereignty” to Beijing were out of the question.

Hun Manet added that while the recently opened Ream Naval Base was modernized with Chinese support, and the two countries launched joint military exercises after Xi’s visit, the base is not for China’s exclusive use. On April 19, two Japanese military vessels docked at the port, becoming the first foreign ships to do so. Ships from Vietnam, Russia, the United States, and other countries will also be allowed to dock there, the prime minister said.

While facing a lower 24 percent tariff, Malaysia on April 25 also announced that it would increase imports from the United States, “signalling a weakening of any united regional front against the pressures of a trade war,” according to the South China Morning Post.

Huang Tsung-ting, a scholar of the CCP’s political and military strategy at Taiwan’s Institute for National Defense and Security Research, told Radio France Internationale that although the tariffs on Southeast Asian countries will impact the transshipment of Chinese goods, it will take time for these countries to move away from their reliance on important Chinese materials.

Although Southeast Asian nations choose to “rely on the United States” for their economic and trade relations, Huang believes that Washington would be wise to offer the region incentives to avoid further siding with China.

Tang Jingyuan, a commentator on Chinese current affairs, told The Epoch Times that most of the agreements signed between Beijing and the three Southeast Asian countries were unilateral concessions by the CCP, such as exports of rail and AI technology, and hardly represent a meaningful deepening of ties. In Cambodia, Xi pledged to help the country finish a stalled dam project worth more than $1 billion.

On April 21, after Xi’s trip, the Chinese commerce ministry said that Beijing “firmly opposes any party reaching a deal at the expense of China’s interests,” and that “appeasement will not bring peace, and compromise will not be respected.”

Should countries reach trade deals that harm the CCP’s interests, “China will never accept it and will resolutely take reciprocal countermeasures,” the ministry warned.

The CCP “lacks trust and appeal,” Sun Kuo-hsiang, the Taiwanese professor, said on an April 22 program with The Epoch Times’ sister broadcaster NTD News. “Trump’s punitive tariffs are real and direct. This reflects how China’s ability to marshal [international] support pales in the face of actual strength.”

Luo Ya and Yang Xu contributed to this report.