Singapore’s S$389 billion (US$288 billion) sovereign wealth fund Temasek Holdings has outlined a resilient, diversified investment strategy for its 50th year of operations, focused on long-term plays in China and key sectors like healthcare and agriculture.

In its annual review, the fund announced a S$7 billion (US$5.18 billion) increase in its net portfolio this week, cementing its status as the world’s 11th largest sovereign wealth fund, according to Global SWF, a platform that tracks such funds.

For the full year to March this year, Temasek weathered volatility to post a 1.6 per cent annual return, rebounding from the previous year’s 5.07 per cent decline.

The fund’s long-term returns held steady at 6 per cent over 10 years and 7 per cent over 20 years, as it maintained a focus on long-term returns with a mix of financial, transport, telecoms, real estate and agriculture investments.

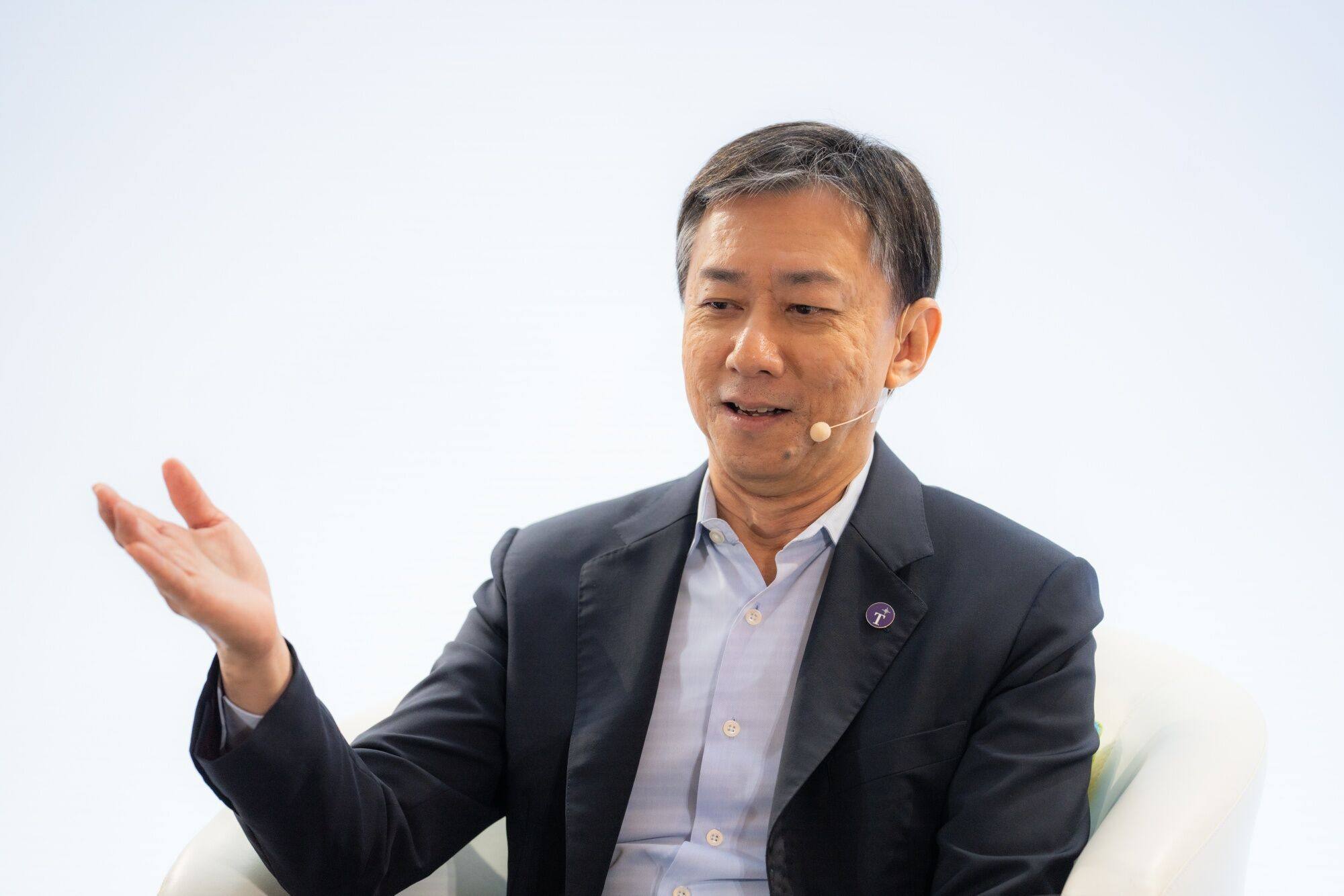

Temasek’s “main focus” was 10- and 20-year returns, said Chia Song Hwee, the fund’s deputy chief executive officer, at the results announcement on Tuesday. “We take a long-term view and invest with that in mind. We’re not a kind of a day trader investor.”

Another key priority for Temasek was to build a “resilient portfolio that could withstand market dislocations”, Chia said.

“During the bull market, we may not be at the top in performance, but hopefully at the low of the market, our portfolio will be able to withstand better. Our portfolio is never static because the environment always changes on us.”

While rising interest rates have affected parts of Temasek’s holdings, Chia said some assets actually gained ground during the rate-tightening cycle.

“We have to accept the annual fluctuations in the numbers,” he said. “What is important is the underlying assets, whether or not the performance can continue.”

Despite China’s economic slowdown, with growth expected around 4-5 per cent this year and sectors like property remaining weak, Chia said Temasek will maintain its investment focus on the country.

The fund’s strategic approach prizes resilience over chasing short-term gains. As Chia put it: “When we had a 35 per cent return three years ago, we didn’t spend a second celebrating because it’s not that important.”

Temasek sees opportunity in China’s structural challenges, with Chia noting the fund will target companies driving domestic consumption and innovation in sectors like biotech, robotics, EVs and import substitution.

“While some of these businesses have export potential, given the geopolitical risks, we are focusing on companies that only solely rely on the domestic market and less reliant on exporting to other countries,” he said.

The fund also views agricultural technology as crucial, with investments like Israeli irrigation firm Rivulis, the world’s second-largest in the space.

Temasek head of financial services, Connie Chan, said the fund was diversifying beyond banking, stocks and assets – a move it started 10 years ago – particularly towards “secular trends” in digitisation, digital payments and financial software.

Despite the slowdown in certain segments of the commercial property sector, Temasek’s head of real estate Alpin Mehta said there were properties that remained lucrative, such as data centres, due to strong demand from large cloud service providers.

Temasek said the United States would continue to be its main target for investments, as it was a deep market with extensive innovation.

The fund also intends to scale up its investments in India, where it sees strong growth potential, driven by factors such as infrastructure-led investments.

Although the Indian stock market has hit new heights recently, there were still value and investment opportunities such as in the country’s banking sector, Temasek’s chief financial officer Png Chin Yee said.

Temasek has investments in India’s hospitals and would continue to explore its healthcare sector, Png said.