Nvidia is working on a version of its new flagship artificial intelligence (AI) chips for the China market that would be compatible with current US export controls, four sources familiar with the matter said.

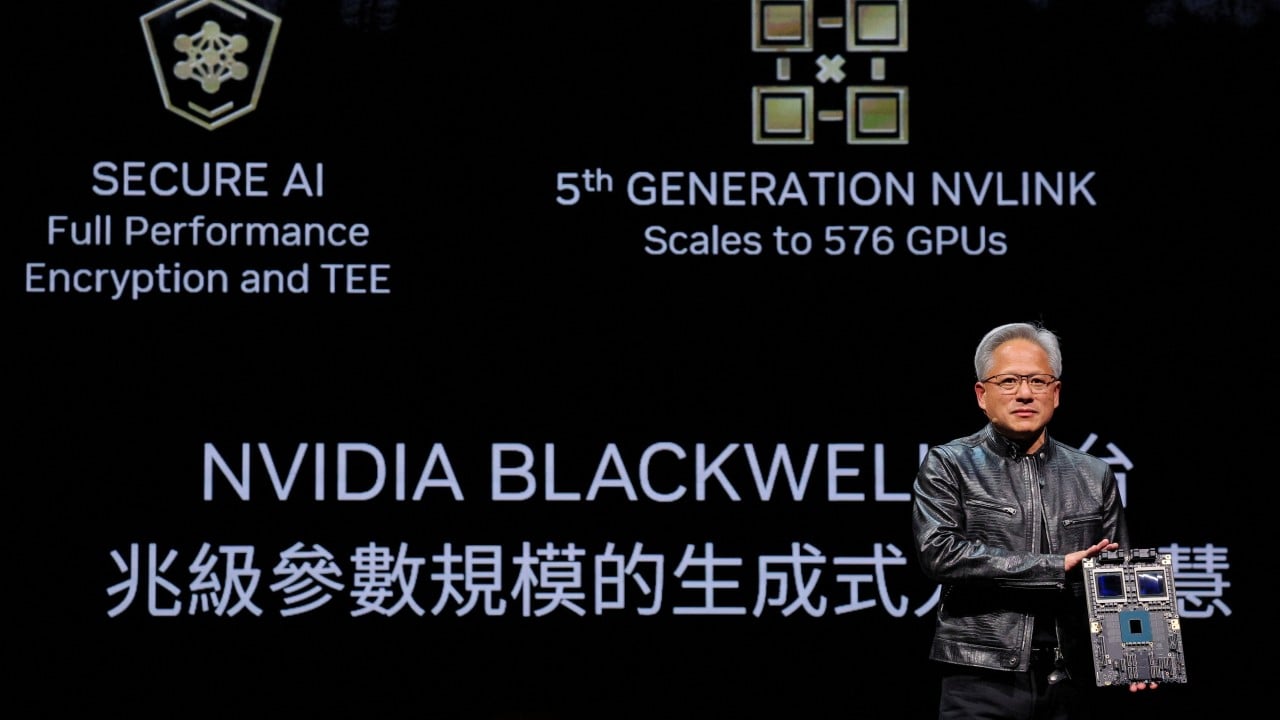

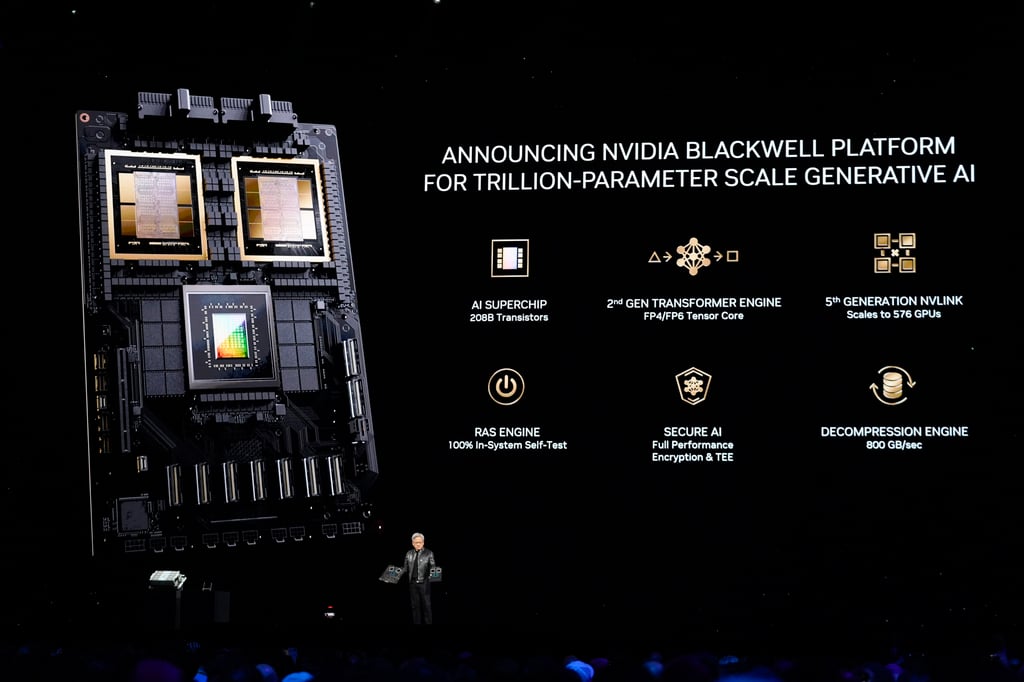

Chief executive Jensen Huang in March unveiled Nvidia’s Blackwell series, which is set for mass production later this year. The new graphics processing units (GPUs) combine two squares of silicon the size of the company’s previous offering. Within the series, the B200 is 30 times speedier than its predecessor at some tasks like serving up answers from chatbots.

Nvidia will work with Inspur, one of its major distributor partners in China, on the launch and distribution of the chip which is tentatively named the “B20”, two of the sources said. Shipments of the “B20” are planned to start in the second quarter of 2025, a separate source told Reuters.

The sources declined to be identified as Nvidia has yet to make a public announcement.

A spokesman for Nvidia declined to comment. Inspur did not respond to requests for comment.

Shares of Nvidia rose 1.4 per cent to US$119.67 in US premarket trading.

Washington tightened its controls on exports of cutting-edge semiconductors to China in 2023, seeking to prevent breakthroughs in supercomputing that would aid China’s military.

Since then, Nvidia has developed three GPUs tailored specifically for the China market.

The advent of tighter export US controls has helped China’s Huawei Technologies and start-ups like Tencent Holdings-backed Enflame make some inroads into the domestic market for advanced AI processors.

A version of a chip from Nvidia’s Blackwell series for China would boost the Santa Clara, California-based firm’s efforts to fend off those challenges.

China accounted for around 17 per cent of Nvidia’s revenue in the 12 months to end-January in the wake of US sanctions, sliding from 26 per cent two years earlier.

Nvidia’s most advanced chip for the China market, the H20, initially got off to a weak start when deliveries began this year and the US firm priced it below a rival chip from Huawei, Reuters reported in May.

But sales are now growing rapidly, two of the sources said.

Nvidia is on track to sell over 1 million of its H20 chips in China this year, worth upwards of US$12 billion, according to an estimate from research group SemiAnalysis.

Expectations are high that the US will continue to keep up the pressure on semiconductor-related export controls.

The US wants the Netherlands and Japan to further restrict China’s access to advanced chip-making equipment, sources have said.

The Biden administration also has preliminary plans to place guardrails around the most advanced large language models, the core software behind generative AI services like ChatGPT, sources have said.

Chip stocks globally tumbled last week after Bloomberg News reported that Biden’s administration was weighing a measure called the foreign direct product rule that would allow the US to stop a product from being sold if it was made using American technology.