Nvidia CEO Jensen Huang expressed confidence in the continued strong demand for the company’s graphics processing units (GPUs) following the surging popularity of DeepSeek’s compute-efficient models, which comes after the artificial intelligence (AI) chip designer delivered stronger-than-expected results for last quarter.

Advertisement

The rise of DeepSeek, which developed large language models at a fraction of the cost and computing resources of Western counterparts, initially led to speculation that demand for Nvidia GPUs could slow. Nvidia experienced a nearly US$600 billion drop in market value last month in the largest single-day drop for any US company, before it started to rebound the next day.

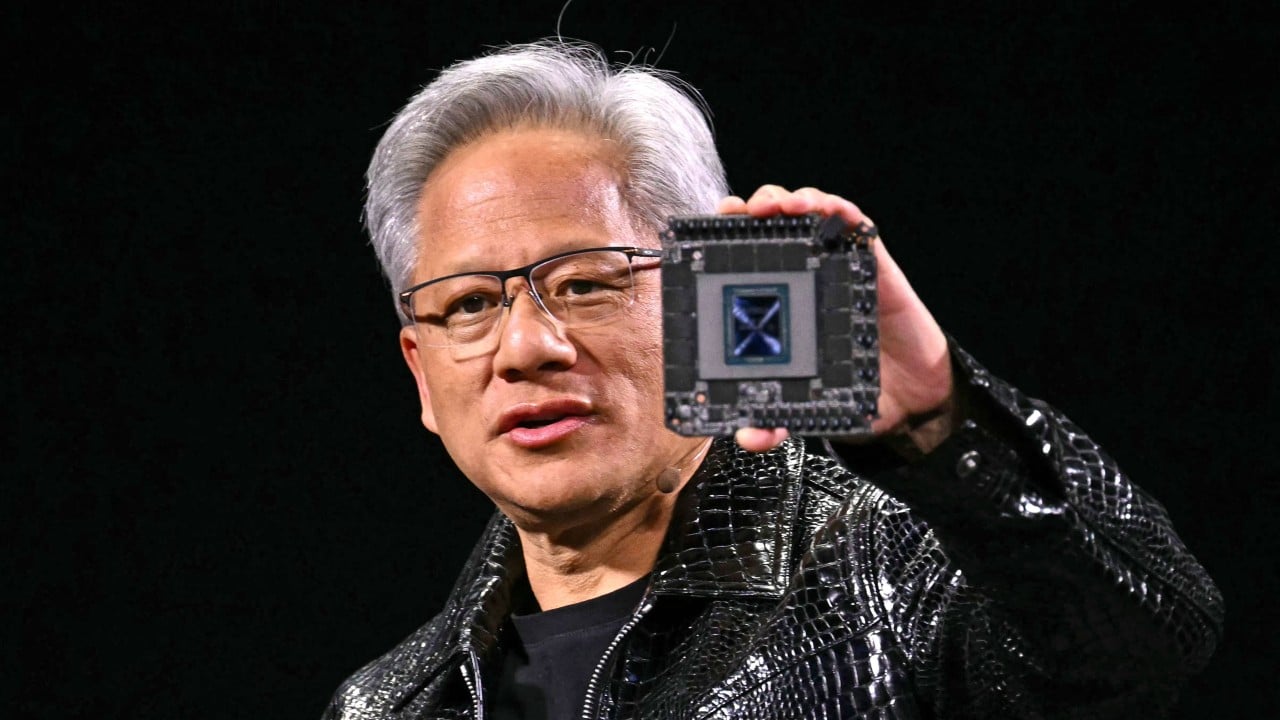

The latest data from the Santa Clara, California-based company showed that demand for its products remained strong, as sales in the data centre segment grew 93 per cent to US$35.6 billion. During a conference call on Wednesday, Huang highlighted “extraordinary” demand for the company’s Blackwell products, after its stock price rose by 3.7 per cent.

Huang said the emergence of reasoning models has led to a new scaling law – the principle that larger training data and model parameters enhance a model’s intelligence – necessitating the deployment of even more computing resources. “OpenAI, Grok3, DeepSeek-R1 are reasoning models that apply inference time scaling,” he said.

Demand for Blackwell, Nvidia’s latest GPU package designed for large-scale AI deployments, remains strong, according to Huang. “Data centres will dedicate most of capital expenditure to accelerated computing and AI,” he said.

Morningstar strategist Brian Colello wrote in a research note that there were “no meaningful signs that data centre demand is waning in the near-term”, despite the Nvidia sell-off in late January.

Advertisement

Nvidia reported a 78 per cent year-on-year revenue increase to US$39.3 billion for its fourth quarter, ended January 26. Full-year revenue surged 114 per cent to US$130.5 billion, solidifying Nvidia’s position as a major beneficiary of the AI boom. China accounted for about 13 per cent of the company’s revenue for the 2025 financial year, as US restrictions limited the sale of its most advanced products to the country.