The bill targets investments with ties to the CCP, and specifically notes it doesn’t apply to Taiwan.

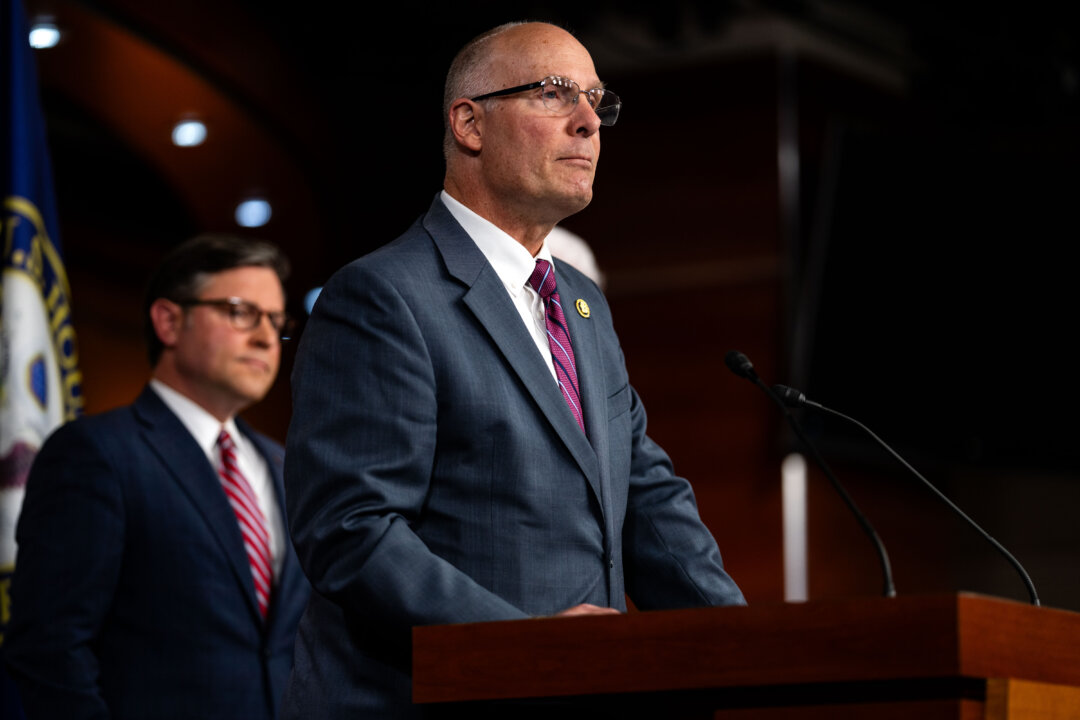

Rep. John Moolenaar (R-Mich.) and Sen. Marco Rubio (R-Fla.) introduced a bill on Sept. 26 that would revoke preferential capital gains rates for investments tied to China.

The proposed change to the tax code is meant to dissuade American businesses and funds from supporting the Chinese Communist Party (CCP), which lawmakers and the intelligence community have increasingly warned is a national security risk in recent years.

“For too long, Americans investing in China’s military-industrial complex have been given unfair tax breaks that allow them to profit from funding our adversary,“ Moolenaar stated in the announcement. ”Our nation’s tax code should be incentivizing investment in the United States, not collaboration with the CCP.”

Capital gains tax policy allows for the deferment of paying taxes for profit on an investment. It’s meant to encourage investment, and currently has no location-based restriction. The bill, titled the Patriotic Investment Act, targets investments with ties to the CCP, and specifically notes it doesn’t apply to Taiwan.

Chinese investments would instead be taxed at the highest income rate. If the bill is passed into law, companies would have six months to divest from China before the new rate kicks in, and can pay in three installments.

“The Capital gains tax rate was meant to encourage investment in American innovation, not fund an oppressive communist regime,“ Rubio stated. ”But Wall Street continues to give money to our adversaries and reap rewards from the American tax system. Enough is enough.”

In addition to national security concerns, the lawmakers noted that the CCP pours “hundreds of billions of dollars” into enterprises to maintain its military, which aids its persecution of ethnic and religious minority groups via torture and slave labor, and violates international trade rules in a way that has “dismantled” American industries, businesses, and jobs.

The bill comes a day after Moolenaar previewed the action at a talk at the American Enterprise Institute, calling divestment from the CCP a “No. 1 priority.”

China, the world’s second largest economy, is currently facing an economic crisis, with record levels of foreign investment pulling out.

Still, its economy is deeply intertwined with international supply chains, and Chinese companies, most of which have CCP ties, still supply critical components to American companies, even in competitive industries.

When the White House earlier this week proposed a ban on Chinese software and firmware for connected vehicles, the Commerce Department noted that implementation would need to be delayed until 2027 because American manufacturers have said that they do not know where all of their parts components originate and the new due diligence processes will be complex.

In the chip industry, the United States has taken many steps to block China’s access to advanced semiconductors, but China is still a top exporter of larger chips, and American companies still depend on them.