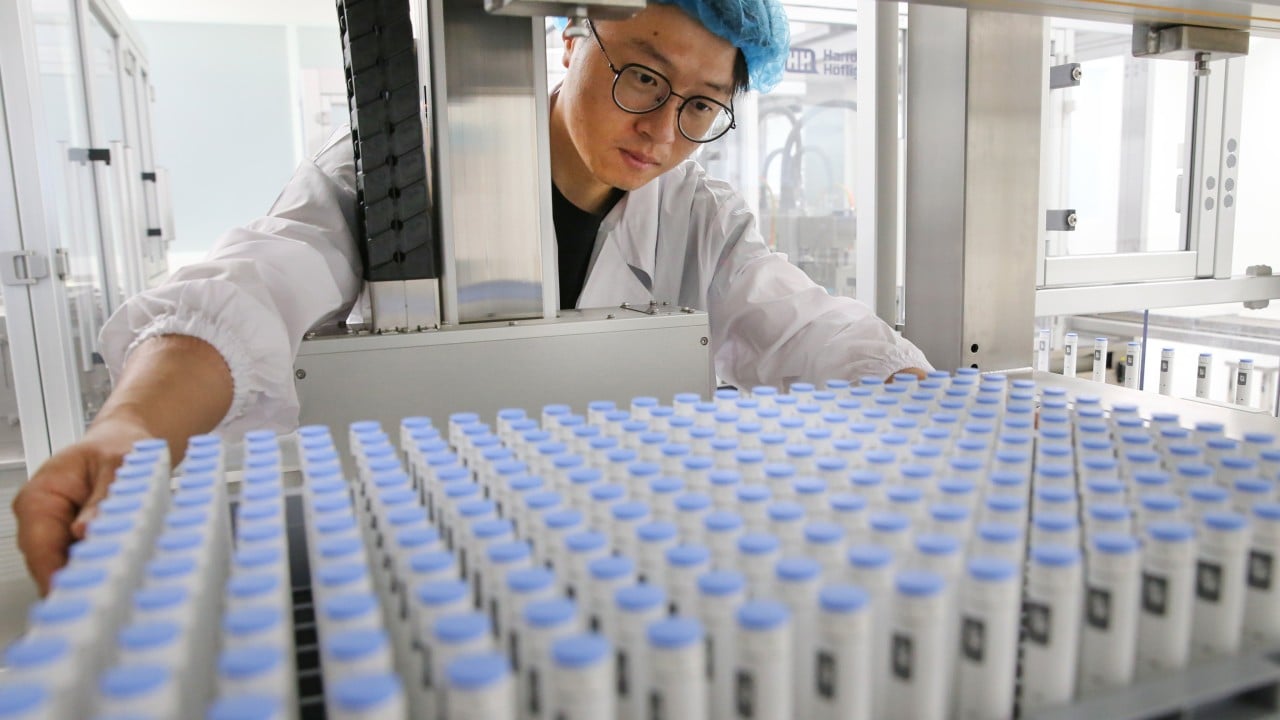

China’s pharmaceutical industry is on the brink of enormous growth and transformation. In just a few years, it has moved on from being the world’s cheapest source of active pharmaceutical ingredients to becoming a major hub for pharmaceutical innovation – a place where new, more effective drugs are born.

It is now the second-largest developer of drugs, trailing only the United States. In the global drug development pipeline, China’s growth rate is phenomenal, leaping from 3 per cent in 2013 to 28 per cent in 2023. The drug companies developing these innovations have grown as well. The market value of Chinese pharmaceutical innovation companies listed on Nasdaq, the Hong Kong stock exchange and Shanghai’s Star Market rose from US$3 billion in 2016 to over US$380 billion in 2021.

The past several years have been the most productive for drug companies in China. According to the Organisation for Economic Co-operation and Development, by 2023, China’s 8.7 per cent annual growth in research and development expenditure had surpassed that of the US (1.7 per cent) and European Union (1.6 per cent). The repercussions of this transformation are evident on the global stage as pharmaceutical giants make a beeline for Chinese drugs. All that innovative strength is now attracting international partners.

Advertisement

According to a July report by global investment bank ARC Group, China’s innovative drug industry is having its “DeepSeek” moment: in the first half of this year, more than 50 major cross-border deals worth nearly US$50 billion were recorded, with several Chinese drugs receiving US Food and Drug Administration approvals or entering key clinical trials in the US and Europe.

In May, major US drug maker Pfizer announced a deal to pay US$1.25 billion upfront to Chinese biotech company 3SBio for the exclusive rights to manufacture and sell its new cancer drug outside China, in a record licensing deal for China. Soon after, British rival GlaxoSmithKline struck a deal to pay US$500 million upfront to Jiangsu Hengrui Pharmaceuticals for a lung-disease treatment and the option to buy 11 more drugs at a further US$12 billion.

Advertisement

Around that time, US biotech firm Regeneron Pharmaceuticals agreed to pay US$80 million upfront for an experimental obesity and diabetes drug from China’s Hansoh Pharmaceutical in a deal worth up to about US$2 billion.