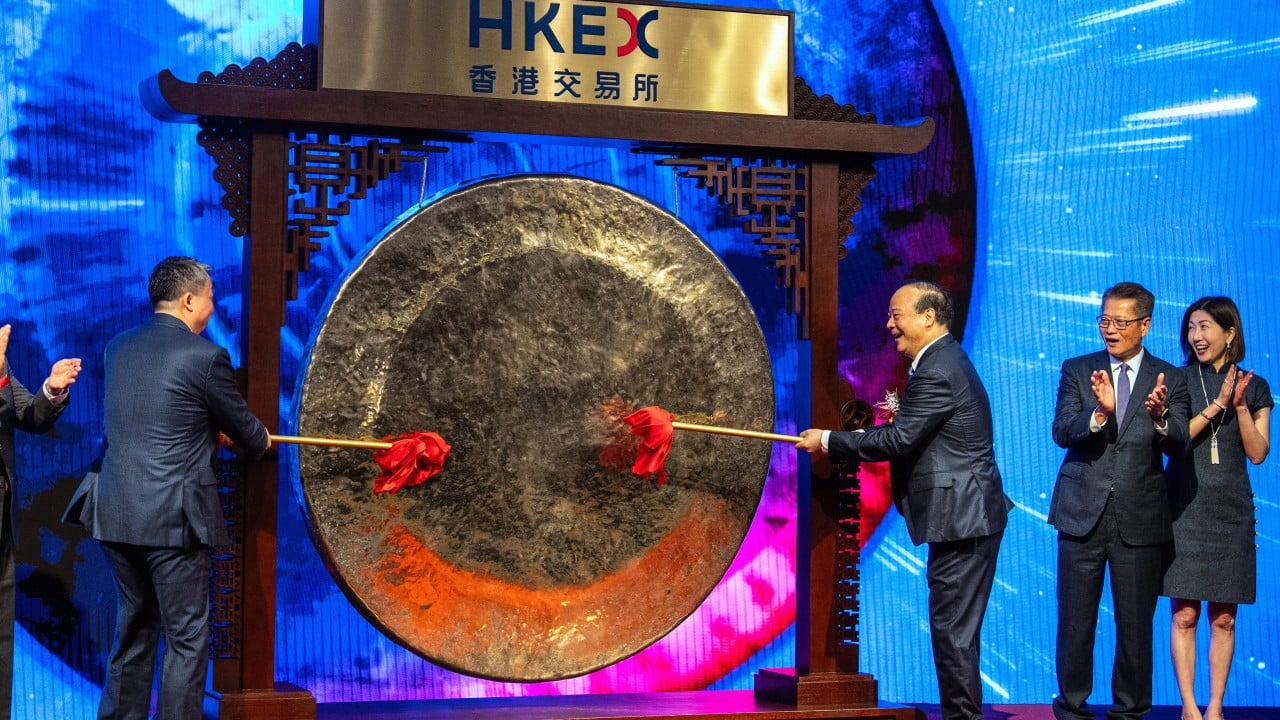

Funds raised from new share sales in Hong Kong jumped 221 per cent in the first nine months of 2025, strengthening the local stock exchange’s grip on the top spot in the global rankings, while analysts predicted that the initial public offering (IPO) market would continue to pop well into next year.

Advertisement

A total of 66 companies raised US$23.27 billion on the main board of the Hong Kong stock exchange during the first nine months, according to data released on Tuesday by the London Stock Exchange Group (LSEG).

That put the city’s bourse well ahead of the New York Stock Exchange, which ranked second with US$16.53 billion and the Nasdaq in third with US$15.32 billion, the data showed.

This marks the first time Hong Kong has ranked first in the first three quarters of the year since 2018, the LSEG said.

“We expect the IPO market in Hong Kong will have a strong finish this year, and the outlook remains positive next year,” said John Lee Chen-kwok, vice-chairman and co-head of Asia coverage at UBS in Hong Kong.

Advertisement

“A lower interest rate, positive economic outlook and strong liquidity flow will all provide a positive background for a strong IPO market in Hong Kong. Sectors such as [technology, media and telecoms], healthcare, industrials and consumer will likely be active and well received by investors.”