Published: 10:00am, 17 May 2025Updated: 10:15am, 17 May 2025

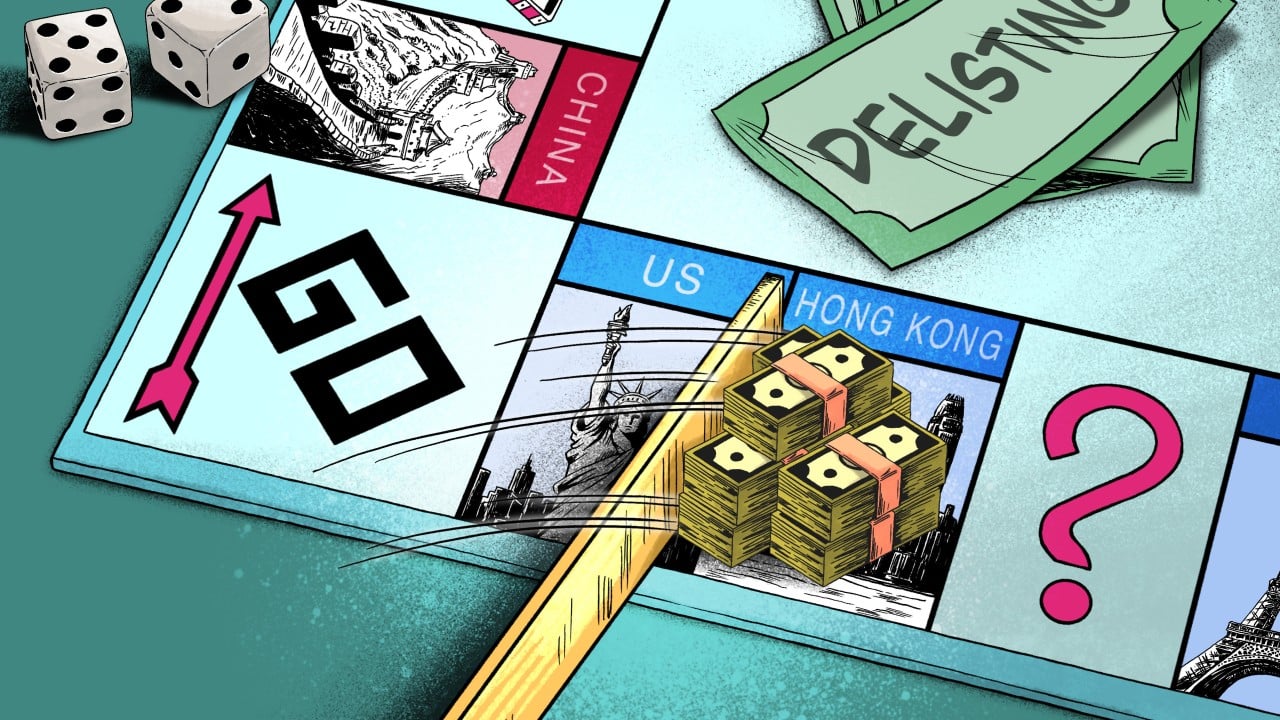

In the second instalment of a three-part series on financial decoupling between China and the US, experts tell the Post how pressure on US-listed companies from the mainland could be a windfall for Hong Kong’s markets. Read the first part here.

Advertisement

A month ago, Patrick Tsang, the CEO of Deloitte China, learned that the US government had declined to rule out the possibility that Washington could delist Chinese stocks from American exchanges.

For Tsang, a long-time accountant who is also a member of Chief Executive John Lee Ka-chiu’s policy unit, the delisting threat seemed like a golden opportunity for Hong Kong.

Around 286 mainland companies trading in the US came under threat of delisting after Treasury Secretary Scott Bessent said in early April that “everything’s on the table”, as worries about decoupling emerged amid a US-China tariff war.

Tsang immediately rounded up a capital markets team at Deloitte to produce proposals on how Hong Kong could prepare for the situation.

Last week, he submitted a paper to the Chief Executive’s Policy Unit, outlining four major strategies to bolster Hong Kong’s financial preparedness, including simplifying listing procedures and finding funding for these companies.

Advertisement