A Hong Kong government land tender in the New Territories has received a better than expected response including bids from major developers, despite slumping property transactions and high inventory levels.

At least 10 developers submitted bids before the tender closed at noon on Friday, including CK Asset Holdings, Sino Land, Great Eagle, Citic Pacific, China Overseas Land & Investment and China Merchants Land. The amounts of the bids were not disclosed.

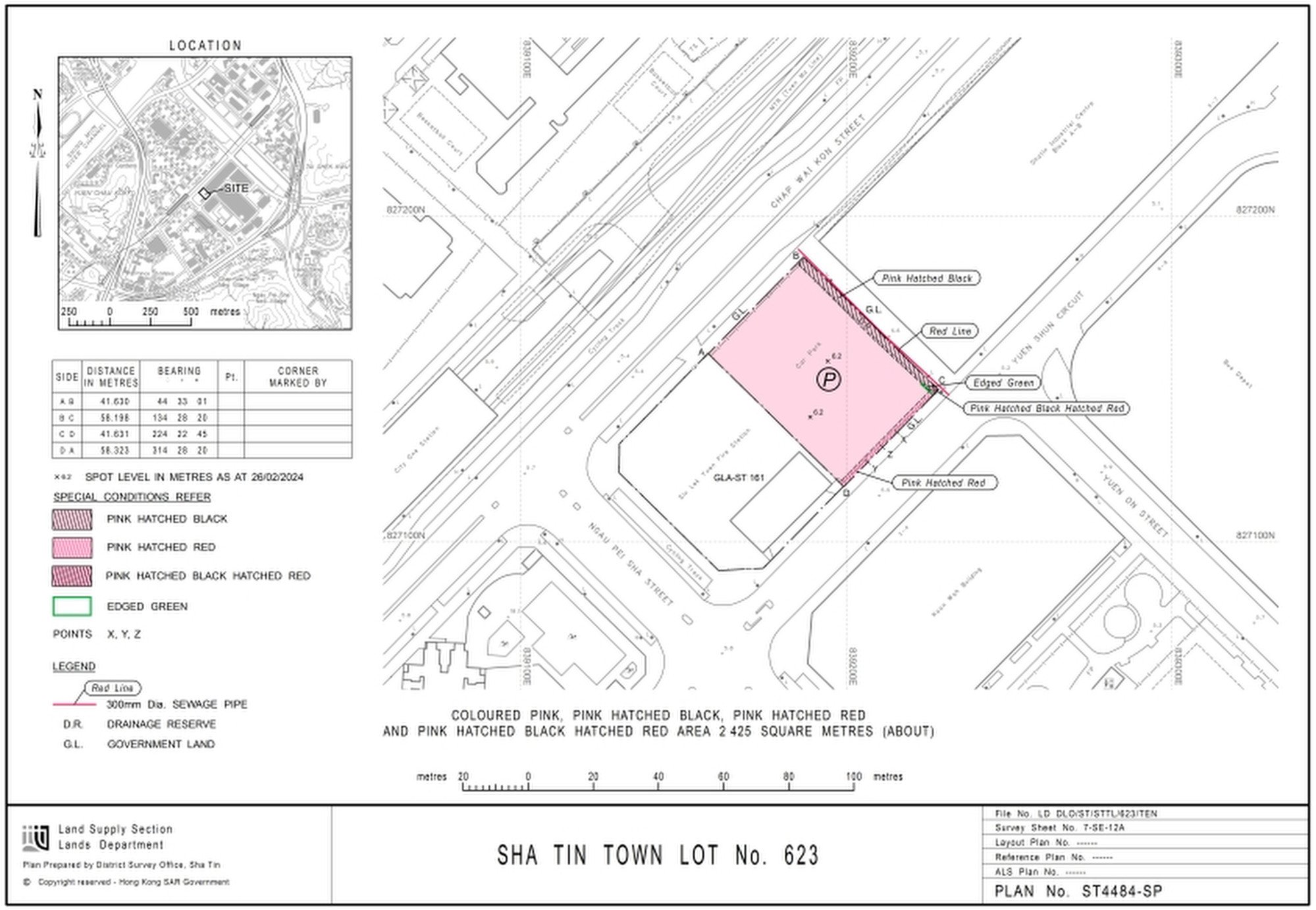

The 2,300-square-metre site in Yuen Shun Circuit, Siu Lek Yuen, Sha Tin – the sole residential site offered during the April to June quarter – can support around 280 flats. The tender opened in June.

CK Asset confirmed by email that it had submitted a bid, as well as an expression of interest for an Urban Housing Authority project in the Kai Tak area of Kowloon.

“As long as the price is right, [CK Asset] will continue to purchase land for new projects in Hong Kong,” the company said. “Real estate is [our] core business.”

The most recent previous residential land sale in Sha Tin, for a plot on Hin Wo Lane in September 2022, received 17 bids, according to Alex Leung, senior director at CHFT Advisory and Appraisal. That was also a relatively small development project, and therefore a good reference for the Yuen Shun Circuit sale.

“The market sentiment now is totally different from 2022, and 10 bids far exceed market expectations,” he said.

Midland Surveyors estimated that the project will be valued at about HK$548.2 million (US$70 million) based on a per-square-foot land premium of HK$3,500.

The high number of bids increases the likelihood that the sale will go through, said CHFT’s Leung.

“Given there are a high number of bids, there is less excuse for the government to withdraw, even if the highest bid is found to be lower than the internal ‘reserve price’,” he said.

The site is close to the City One MTR station and the scale is moderate, so the investment risk is relatively low, and it was expected to attract both large and small developers, said Alvin Lam, director of Midland Surveyors. However, developers were expected to be prudent in their bidding in view of the current market conditions and economic environment, as well as the future supply of new flats.

The market has an abundant supply of new developments and inventory, which, coupled with high interest rates and uncertainty about when rates will decline, should make developers conservative in their bidding, Lam said.

Transactions of residential units fell 30.5 per cent month on month to 3,856 in June, with sales value shrinking by 35 per cent to HK$34.5 billion, according to data released by the Land Registry on July 3. The drop follows a 35 per cent decline in residential transactions in May, compared with April.

Meanwhile, secondary home prices are also suffering, with the official price index from the Rating and Valuation Department falling 1.22 per cent in May, reversing a 0.5 per cent improvement in April. The May index reading of 305.9 was comparable to that of November 2016 at 306.7, JLL said.

The government plans to sell just a single plot of residential land in the July to September quarter as it continues a “prudent and paced” approach during the persistent housing slump, according to the secretary for development.

JLL predicted on Wednesday that property prices will drop by another 10 per cent this year.

However, Stewart Leung Chi-kin, who is the chairman of the Real Estate Developers Association of Hong Kong as well as Wheelock Properties, has a more optimistic outlook. The property market is not “a sleepy backwater”, and prices will improve by at least 5 per cent this year, he said on Wednesday.

Despite the challenges ahead, including the global economic downturn, the market can rebound quickly, he said, citing his more than 60 years of experience in the sector.