Homebuyers are flocking back to capital cities, reversing the so-called “sea change” or “tree change” trend during the Covid-19 pandemic, when homes in areas close to nature were the most sought after, according to analysts.

That shift has become evident in metropolises across the UK and Australia, as well as in compact cities like Singapore and Hong Kong, where home demand in core areas are outperforming those on the fringes.

“There was certainly a shift away from cities and urban centres … during Covid,” said Liam Bailey, partner and global head of research at Knight Frank. “Our experience was that most city markets underperformed suburban and rural markets substantially through 2020 to 2022, but since the middle of 2023, city markets have outperformed as buyers returned due to the draw of employment and convenience.”

Buying homes with easy access to modern conveniences and people’s workplace reflects a return to normalcy after the disruptions caused by the pandemic.

Given the current trend, Bailey said “prime city markets are set to outperform [other areas] over the next few years”.

Property consultancy Knight Frank estimates that home sales in the Greater London area will grow by 2 per cent this year, while sales of prime country homes – defined as cottages, farmhouses and manor houses that either have extensive grounds or at least one acre of land – will decline by 2 per cent. Specifically, this segment refers to the UK residential market outside London with homes above £750,000 (US$989,000).

A Santander Bank study released in June 2021 showed that demand for homes outside London boosted property prices across the UK to grow by 8 per cent a year after the coronavirus outbreak. Demand for homes in the British capital, however, saw a smaller increase of 5.7 per cent during that period.

In Australia, the current trend could be gleaned from the surge of new housing sales in capital cities and plummeting demand in regional areas, according to data tracked by OpenLot.com.au.

“Housing approvals growth was significantly faster in the capital city metro areas last year than in the regional areas,” said Qi Chen, co-founder and chief executive of the Australian new housing portal. “There’s a shift of gravity back to the big cities. The Covid-era dream living in a tree change or sea change town has lost its lustre. People today want to live as close to the capital city as they can, while still having a house.”

In Greater Perth, for example, the number of new houses increased by about a quarter in the financial year from April 2023 to March 2024, while in the Western Australian region, new homes fell by 1.1 per cent, according to data cited by Chen.

In Brisbane, capital of Queensland, new house approvals climbed by 8.8 per cent, while they fell 9 per cent in the state’s regional areas. In Greater Melbourne, new home approvals jumped by 2 per cent even as the number of new houses in Victorian regional areas fell by more than 13 per cent.

“In Adelaide and Sydney, the number of approved new houses fell in both metro areas, but fell by less than in the regional areas,” Chen said. “In Adelaide, new house approvals fell by 5.6 per cent, much less than the 13.2 per cent fall in regional South Australia. In Sydney, the difference in new house supply between regional areas and the capital city was the smallest, at only about half a percentage point.”

With buyers now flocking to city centres, prices of homes in regional towns “will increase more sluggishly than in the capital cities”, Juwai IQI co-founder and group managing director Daniel Ho said. At present, prices of homes in capital cities are as much as 50 per cent higher than in the regions, he added.

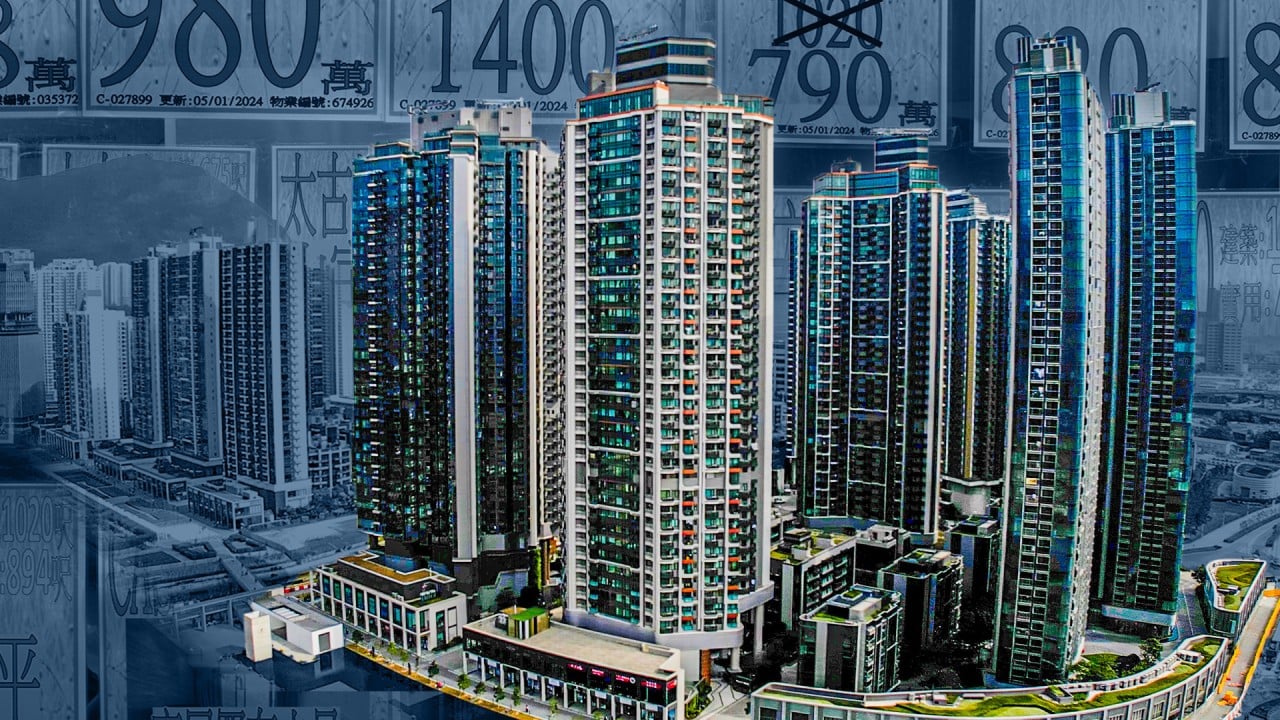

In Hong Kong, there is less demand for homes in areas such as Sai Kung in the New Territories, where buyers could get larger internal space and better outdoor spaces like terraces and gardens, according to boutique luxury property agency Habitat Property.

“We have seen a steep drop in demand for outer locations such as Sai Kung and this is putting downward pressure on prices,” Habitat founder and managing director Victoria Allan said. “People prefer to be located closer to Central or on Hong Kong Island, as they are happy to head to Thailand for the weekend.”

A comparison of recent home price trends on Hong Kong Island and the New Territories supports Allan’s observations.

Home prices on Hong Kong Island ranged from a decline of 2.36 per cent to a gain of as much as 18 per cent in the second quarter of the year compared to the preceding three months, latest data from the Rating and Valuation Department show. Meanwhile in the New Territories, the home price movements were between a decrease of 3.59 per cent to an increase of 7.1 per cent in the same period.

“I feel that prices in fringe areas will remain soft and actually decline further for some time as there is so much new supply on the market,” Allan said. “Core and prime Hong Kong Island locations … will bounce back faster as interest rates start to decline and demand picks up.”

Meanwhile in Singapore, the outlook for improving sales in the luxury segment – including properties in the central business district – is based on the narrowing gap of prices between upscale properties and the mass and mid-tier segments, said Alan Cheong, executive director for research and consultancy at Savills Singapore.

“Location commands a premium,” Cheong said.