S&P Global Ratings, in an October 2024 report, estimated that U.S. data centers’ increasing energy demands will lead to additional demand for gas.

HOUSTON—President Donald Trump’s pledge to lower energy costs primarily by boosting oil and natural gas production will require a corresponding increase in infrastructure investment to get fuel to market to meet growing demand, U.S. Energy Secretary Chris Wright said on March 10.

If “‘Drill, baby, drill’ is to [lower energy costs], we’re going to have to ‘Build, baby, build’” more combined cycle turbines, compression metering stations, cryogenic storage tanks, and pipelines, Wright told reporters after delivering the keynote address at the 43rd annual CERAWeek by S&P Global energy conference at the Americas Hilton-Houston.

The Trump administration is encouraging capital investment in building infrastructure to ensure oil and gas producers “have the capability to move it,” he said.

According to the U.S. Energy Information Administration (EIA), more than 210 pipeline systems spanning 305,000 miles in the United States transported 32.5 trillion cubic feet (Tcf) of natural gas in 2023.

EIA documents show that natural gas provided 36 percent of the nation’s total energy consumption in 2023, including 43 percent of electricity.

Natural gas production in some parts of the country, including North Dakota’s Bakken and Pennsylvania’s Marcellus shale formations, is constrained by a lack of pipeline capacity to accommodate more output.

This inability to move more natural gas comes as demand for power in a rapidly electrifying digital economy is projected to increase dramatically in the coming decade, especially to power data centers, bitcoin “mines,” and supercomputers.

S&P Global Ratings, in an October 2024 report, estimated that U.S. data centers’ increasing energy demands “will lead to additional gas demand of between 3 billion cubic feet per day (bcf/d) and 6 bcf/d by 2030, from a starting point of almost none today.”

Wright said natural gas is needlessly expensive in New England, for instance, because of a lack of infrastructure—pipelines—which makes little sense since it “is right near Pennsylvania.”

In January 2024, the Biden administration paused liquefied natural gas (LNG) exports for the Department of Energy (DOE) to assess whether shipping fuel overseas would increase domestic energy costs.

Wright said when DOE released the study in December, former Energy Secretary Jennifer Granholm said in her summary that exporting LNG would harm domestic consumers.

But the summary “does not match the data” in the report, nor did the Biden administration’s DOE estimate how increased natural gas production could offset those projected cost increases, Wright said.

The Trump DOE did not pull the plug on the study, and public comments are open through March 20, he said, noting it is legitimate “to study the impacts of LNG exports.”

Wright said he is certain the report will confirm why “U.S. LNG is going to grow” and why domestic “production capacity needs to grow” to drive economic development.

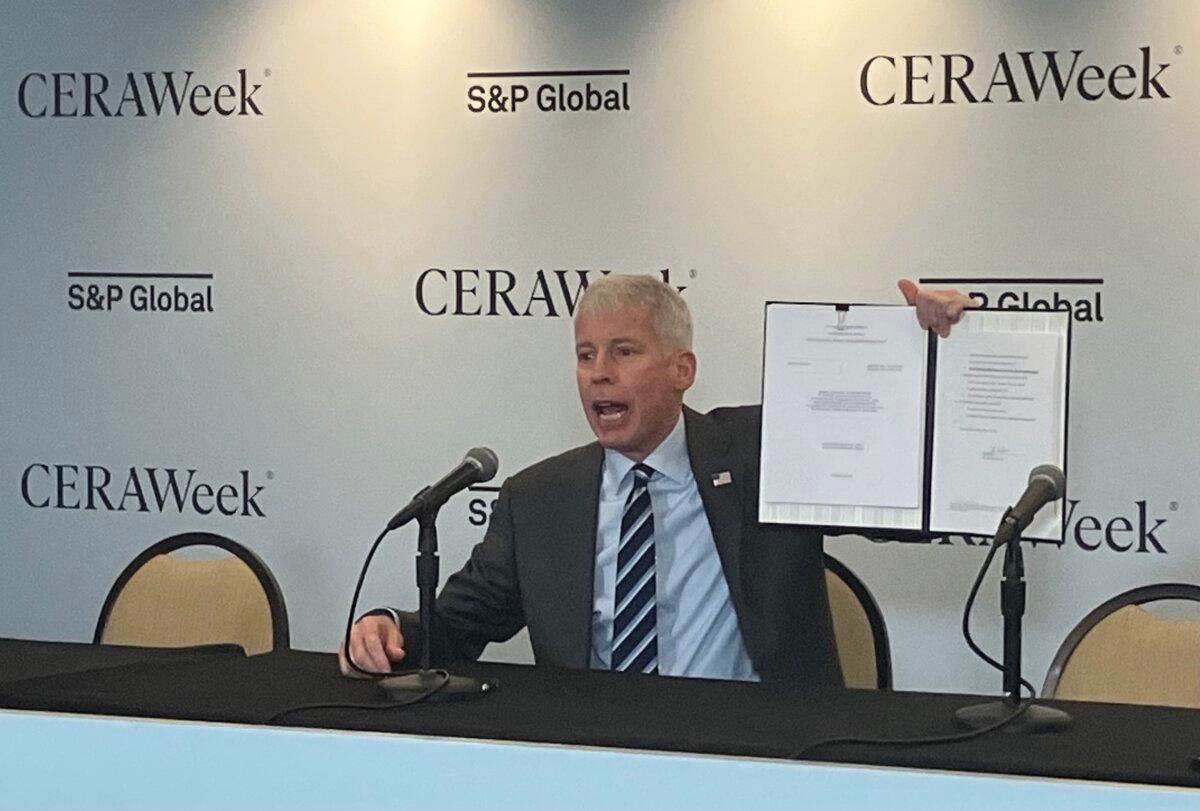

The secretary opened the press conference by signing an order approving an LNG export permit extension for Delfin LNG LLC to begin exporting LNG from its offshore Louisiana terminal.

The permit extension, which the Biden administration had delayed, is the fourth LNG-related approval from DOE since President Trump took office.

The order extends Delfin’s permit to begin exporting 1.8 Bcf/d of LNG to non-free trade agreement countries to June 1, 2029.

The annual CERAWeek conference is among the most significant gatherings of energy corporations in the world and the largest in the United States.

More than 8,000 people are attending the event, where 450 corporate CEOs, including from Saudi Aramco, Chevron, Shell, BP, and TotalEnergies, and energy officials from 80 countries, including ministers from Nigeria, Libya, and Kazakhstan, are among the featured speakers.

U.S. Interior Secretary Doug Burgum was in the audience to hear Wright’s keynote address and will deliver an address on March 12.

CERAWeek comes as crude oil prices hit a three-year low, slipping below $70 a barrel after the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to increase output in April.

Oil and gas prices dipped through 2024 even as many large oil producers reported increased operational costs and slackening demand. Chevron, the second-largest oil producer in the United States, has announced plans to lay off up to 9,000 workers.

Wright said the Trump administration is “pleased to see OPEC return barrels to the market,” even if most attendees of CERAWeek are not.

“The market sets the prices,” he said, and the more markets for more U.S. oil and natural gas, the more its energy corporations will profit, and the more Americans will benefit with lower fuel costs and greater economic development.

The administration supports “anything to make it easier to produce new oil and gas” to lower costs, Wright said. “More energy means better lives.”

He said it is uncertain how tariffs on imports, especially Canadian crude and natural gas, could impair or enhance that effort.

“We have, behind closed doors, rigorous debates about tariffs. The dialogue is, ‘What is the best way to benefit the American people?’” Wright said.

“We’re early on in this. [It’s] too early to say. I’m pretty optimistic on the outcome.”