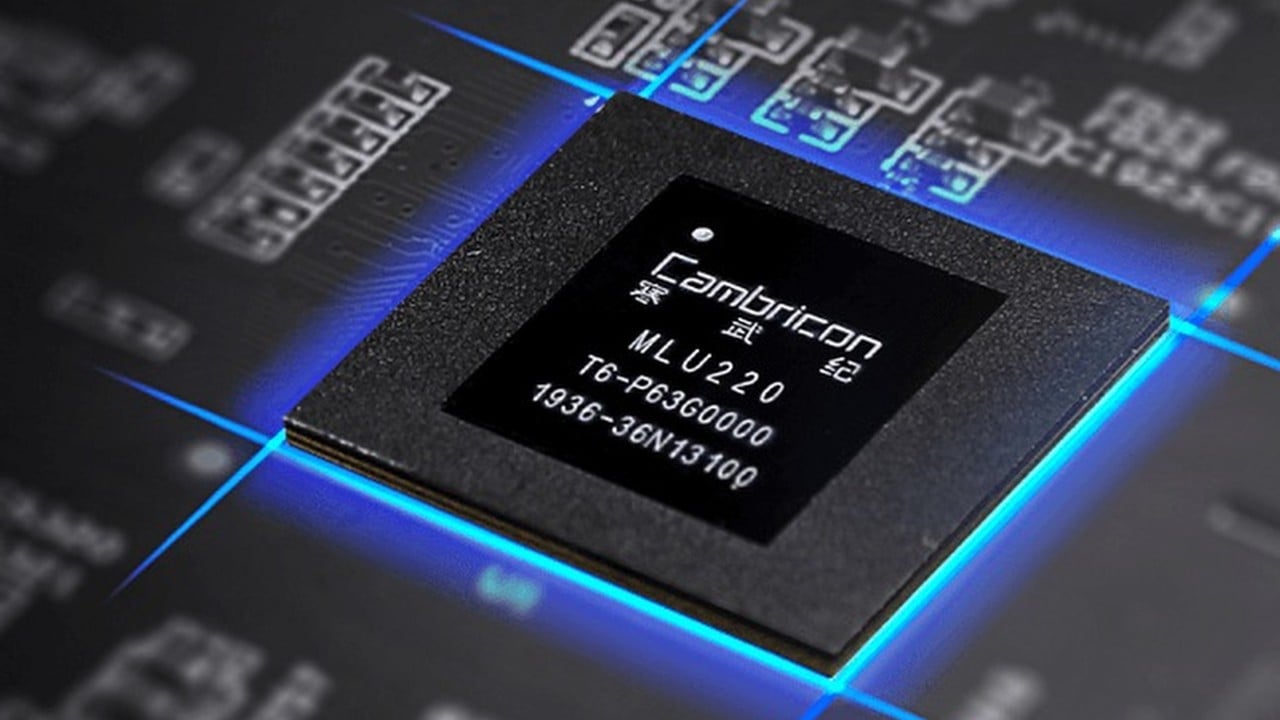

Shares of Cambricon Technologies on Monday closed lower on the Shanghai Stock Exchange after a representative of Alibaba Group Holding denied speculation that it had ordered 150,000 graphics processing units (GPUs) from the Beijing-based AI chip designer.

Advertisement

According to the representative, the platform of Alibaba Cloud – the artificial intelligence and cloud computing services unit of e-commerce giant Alibaba – was powered by multiple Chinese-designed GPUs. Alibaba owns the South China Morning Post.

Cambricon’s shares closed down 2.95 per cent to 1,448.39 yuan on Monday. Still, that marked the day’s largest turnover on the mainland, which recorded 25 billion yuan worth of trades. The stock has more than doubled in price as of August and surged fivefold in the previous 12 months.

The company, widely recognised for its potential to unseat Nvidia as China’s top AI chip supplier, has been at the centre of heightened speculation on the mainland after Goldman Sachs raised its 12-month target price on the stock to 2,104 yuan (US$295).

Notwithstanding that bullish forecast, Cambricon’s share price has declined for two consecutive trading days, which reflected a high divergence of sentiment on the stock.

Cambricon’s shares last month briefly surpassed those of liquor distiller Kweichow Moutai to become the most expensive stock in China. On Monday, Moutai’s Shanghai-listed shares closed flattish at 1,476.10 yuan to top Cambricon.

Advertisement