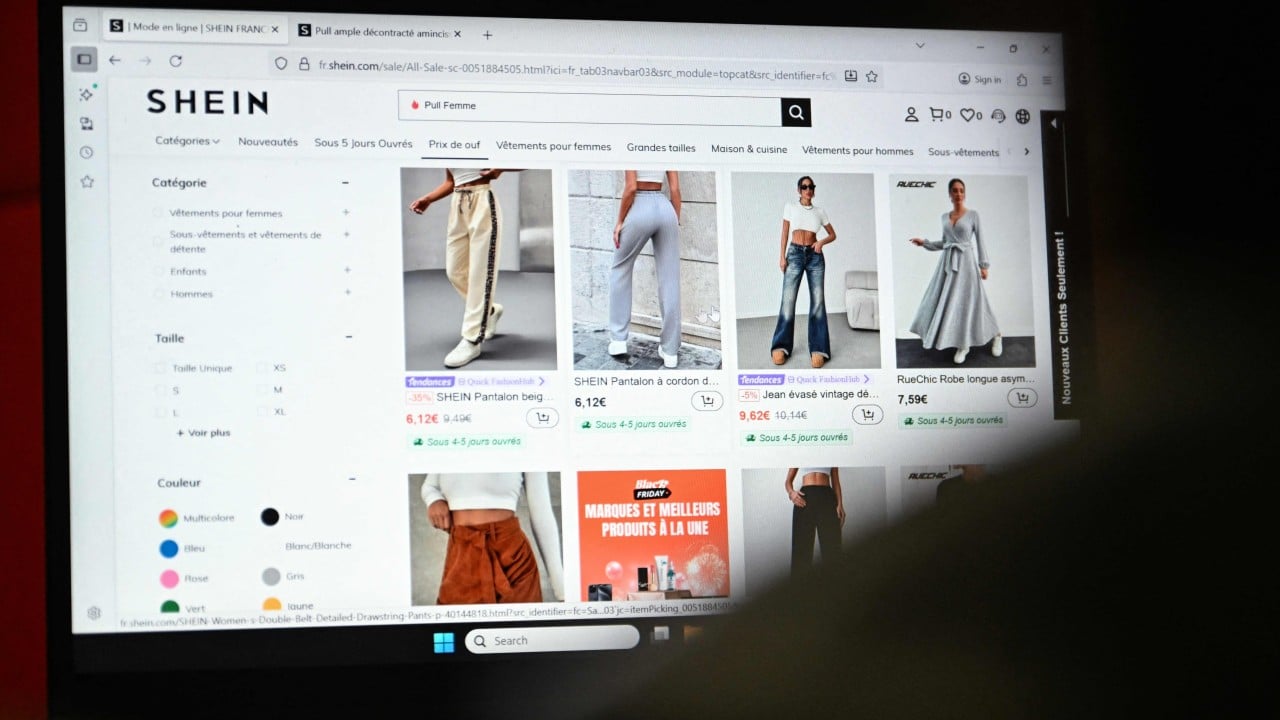

Chinese merchants who sell to overseas markets via popular sites like Shein and Temu are struggling with escalating tax and compliance burdens from both their main export market, the European Union, and the domestic tax authority.

Advertisement

The latest pressure came from the EU, which on Thursday agreed to abolish a rule that allowed goods worth less than €150 (US$174) to enter the region without customs duties. The new rule will apply once an EU customs data hub is ready, scheduled for 2028. However, the bloc said it was working towards a “simple, temporary solution” to levy customs duties on low-value goods as soon as next year.

The move targets Chinese goods, as the European Council said that 91 per cent of all e-commerce shipments valued under €150 came from China in 2024. The influx of small parcels caused problems that led to “unfair competition” for EU sellers and raised environmental concerns, it said in a statement.

A Shenzhen-based merchant surnamed Liu, who sells household goods on Temu, said she was still waiting for details, as it was not clear whether the duty would include the extra €2 handling fee proposed by the region in February.

She said the solution would be similar to how merchants coped when the US axed the “de minimis” duty-free rule on low-value goods in April. Liu said that some sellers like her simply reported the value of every product as US$1, which resulted in tariffs of 3.93 yuan (55 US cents) for a 126-gram item, increasing freight costs by 12 per cent. This was “acceptable”, Liu said, as she did not raise prices for US customers.

Advertisement

However, the biggest challenge for Liu and her peers in the cross-border community now is a reform of China’s tax regime. Starting in October, the tax authority demanded that all online marketplaces, even if they do not operate on the mainland, report transaction data on Chinese merchants, including sales and refunds, to collect taxes.