Mounting uncertainties are casting a shadow over the future of Chinese solar panel manufacturers in Southeast Asia, with many agonising over staying or leaving given the United States is moving to block a well-trodden tariff workaround.

Many firms have halted production in the name of “facility upgrades” or “maintenance”, or furloughed workers after the US Department of Commerce opened anti-dumping and anti-subsidy investigations into crystalline silicon photovoltaic cells from Cambodia, Malaysia, Thailand and Vietnam in May.

The US made the move after domestic solar companies alleged that China has been trying to circumvent tariffs by shifting manufacturing to Southeast Asian nations.

Analysts said investigations highlighted the challenges faced by Chinese manufacturers and the significance of finding alternative markets because the European Union or other Western countries could follow suit.

“If they don’t have the US market, they should capture the demand in the Middle East or other major developing countries,” said Terence Chong Tai-leung, an associate professor of economics at the Chinese University of Hong Kong.

A temporary exemption from anti-dumping and countervailing duties of 200 per cent granted by the US in 2022 on certain solar cells and modules from Cambodia, Malaysia, Thailand and Vietnam expired on Thursday, according to a report from international law firm Kilpatrick.

It’s not the first time and we will adjust our plan and production accordingly

Major Chinese manufacturers that assemble solar products and batteries in the four countries for export to the US said they are overhauling production in response to the potential mass production shutdown.

Longi, one of China’s largest solar firms which runs plants in Malaysia and Vietnam, said earlier this week that production adjustments were due to plans to upgrade plants, without specifying, and that it would uphold the rights and benefits of workers.

Jiangsu-based Trina Solar also said its plants in Thailand and Vietnam had been shut down for “routine maintenance”.

It said in a statement to the Post that products from the plants are primed for the US market and that the company was no stranger to policy changes and market volatility.

“It’s not the first time and we will adjust our plan and production accordingly,” the statement said.

More than 20 Chinese photovoltaic firms have production bases across Southeast Asia as the region lured Chinese investments due to its cheap production costs, proximity to China and exemptions from US tariffs, which had made exports from China no longer viable.

“The US is clearly determined to shore up its domestic solar industry and supply chains, so the question is if we should shut down factories in Southeast Asia or keep them there as a backup,” Longi founder Li Zhenguo said in an interview with the Beijing-based Green Energy Daily this week.

Several Chinese manufacturers, including Trina Solar, are already revving up construction of new plants in the US.

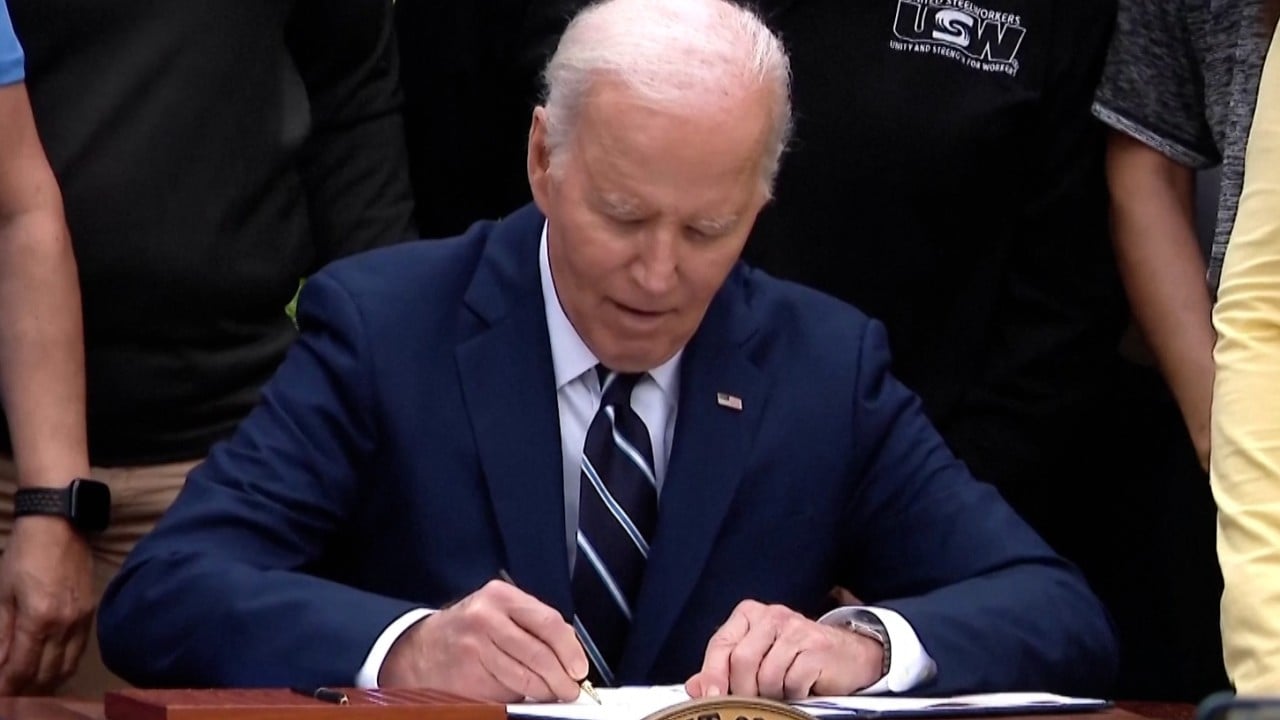

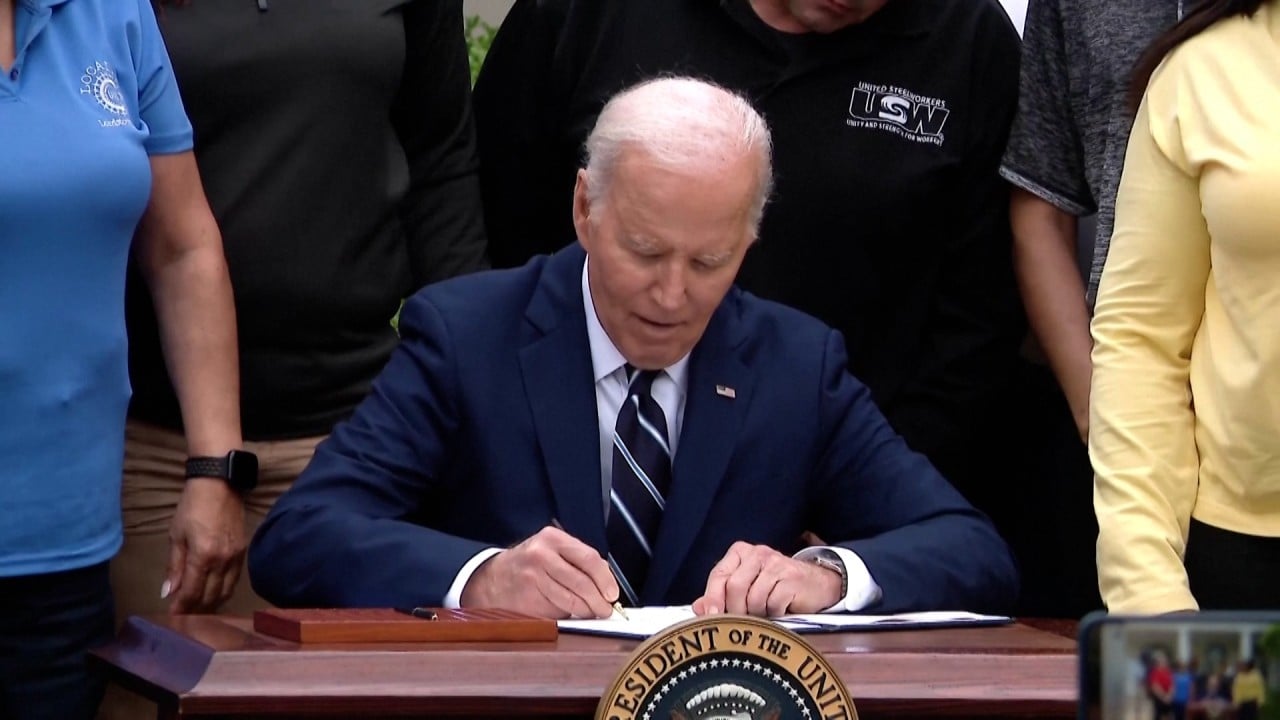

Shanghai-based Jinko Solar has built plants in the US with a total output of 2 gigawatts, and it is applying for US government subsidies after the Biden administration vowed to distribute financial aid to solar products produced domestically.

“The US suppression will continue, and in the future, it will find various excuses to target Chinese companies. There seems to be a pattern: in whatever industry or sector that China is establishing a lead or dislodging the dominance of American firms, the US will find ways to suppress the Chinese,” added Chong at the Chinese University of Hong Kong.

“I suspect Europe may also impose similar tariffs [on Chinese new energy products].”

Liu Yiyang, a deputy director with the China Photovoltaic Industry Association, told a forum in Beijing last month that the US moves against exports from Southeast Asia were a thinly veiled tactic to plug what it deemed a “loophole” in its containment of China’s new energy sectors.

“It’s all about China, and even though the US Commerce Department’s investigation may take some time to finish, Chinese companies taking a detour in Southeast Asia to sell products to the US should make contingency plans now,” said Liu.

The US and EU have already highlighted China’s overcapacity issues in new energy industries with a series of investigations and countermeasures.

The US and EU have also singled out Chinese electric vehicles and lithium batteries in their bid to protect local industries.

Analysts said since the US is not prioritising environmental protection, and while its business environment has become politicised, Chinese exporters should look elsewhere.

“They can export to places without tariffs. They can sell at lower prices with government subsidies through diplomatic means,” said Chong.

And the Middle East, known for its scorching summer sun and appetite for clean energy, is already on the radar.

Trina Solar already runs a plant in the United Arab Emirates, while fellow Chinese solar firms TZE and Jinko Solar have announced plans for expansion.