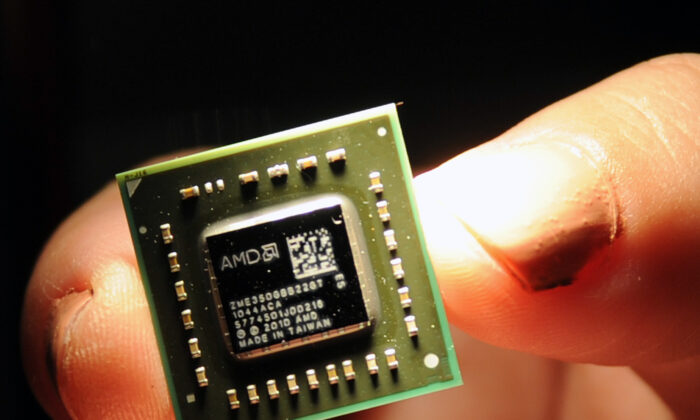

The warning was issued after the United States expanded rules to block China from accessing advanced semiconductor technology.

In a rare coordinated response to Washington, Chinese industry associations told Chinese companies on Dec. 3 that U.S. chips are “no longer safe” to buy.

The warning was issued a day after the U.S. Commerce Department expanded rules to block China from accessing advanced semiconductor technology and added 140 entities to an export control list.

The four Chinese industry associations represent approximately 6,400 companies across the country’s largest industries, which include telecommunications, digital technology, automotive, and semiconductor sectors.

The Internet Society of China has urged companies to expand cooperation with chip firms from other countries and prioritize using Chinese-made chips, stating that U.S. export controls have caused “substantial harm” to the Chinese internet industry.

The China Association of Communication Enterprises stated that it no longer viewed U.S. chip products as safe or reliable and that Beijing should investigate how to secure the country’s critical information infrastructure and supply chain.

Since 2022, the United States has sought to cut off China’s supply of advanced semiconductor technology, determining that the Chinese Communist Party (CCP) was modernizing its military and posed a national security risk. The CCP is considered a foreign adversary deemed responsible for mass trade secret theft, espionage, and cyberattacks, according to U.S. lawmakers.

Despite the export controls, Chinese state-backed chip companies used intermediaries and loopholes to continue obtaining technology, according to the U.S. Commerce Department, leading the United States to tighten restrictions in 2023 and 2024.

The United States and China have been vocal about their goal of creating a domestic semiconductor industry that is not reliant on foreign suppliers but both face challenges.

Semiconductor manufacturing is among the most advanced processes in the world, requiring specialized equipment and knowledge, which are split across about a dozen companies worldwide. Each company’s home nation has geopolitical interests, as officials have noted in recent years while announcing billion-dollar investments into the industry.

Experts and officials have said China is deeply embedded in the global semiconductor supply chain, especially when it comes to less advanced chips. The smallest and, thus, most advanced chips have artificial intelligence and military applications, but larger “legacy“ chips are used in everything electronic.

China is currently a major buyer and seller of larger chips. Many foreign chipmakers have plants in China, and Chinese consumer goods manufacturers need large quantities of chips. U.S. Commerce Secretary Gina Raimondo said earlier this year that some 60 percent of all legacy chips will come from China over the next few years.

While foreign chipmakers have noted to investors that they are preparing for further restrictions on selling to China, many said that China remains a key market for legacy chips and that they expected it to remain one for years to come despite further export controls related to national security.

“But it seems pretty clear that now the gloves are off,” said Tom Nunlist, associate director at research firm Trivium China.

On Dec. 3, Beijing also announced export controls on critical minerals to the United States specifically, differing from past restrictions on critical minerals, which applied generally.

The new restriction covers gallium, germanium, antimony, super-hard materials, and graphite.

Gallium and germanium are vital for semiconductor manufacturing, and China remains the world’s leading producer of both minerals.

In recent years, Western nations have sought to lessen their dependency on China for critical minerals, which are essential for technology and military development. The CCP has a history of using China’s position in the supply chain as leverage for international negotiations.

In June, Congress established a bipartisan Critical Minerals Policy Working Group to counter CCP threats in the sector.

Reuters contributed to this report.