Chinese stocks do not need a turnaround in property prices to chalk up further gains despite an entrenched bearish consensus that says they do, according to a top market strategist who called the timing of the reopening rally in late 2022 and the 2015 stock-market meltdown.

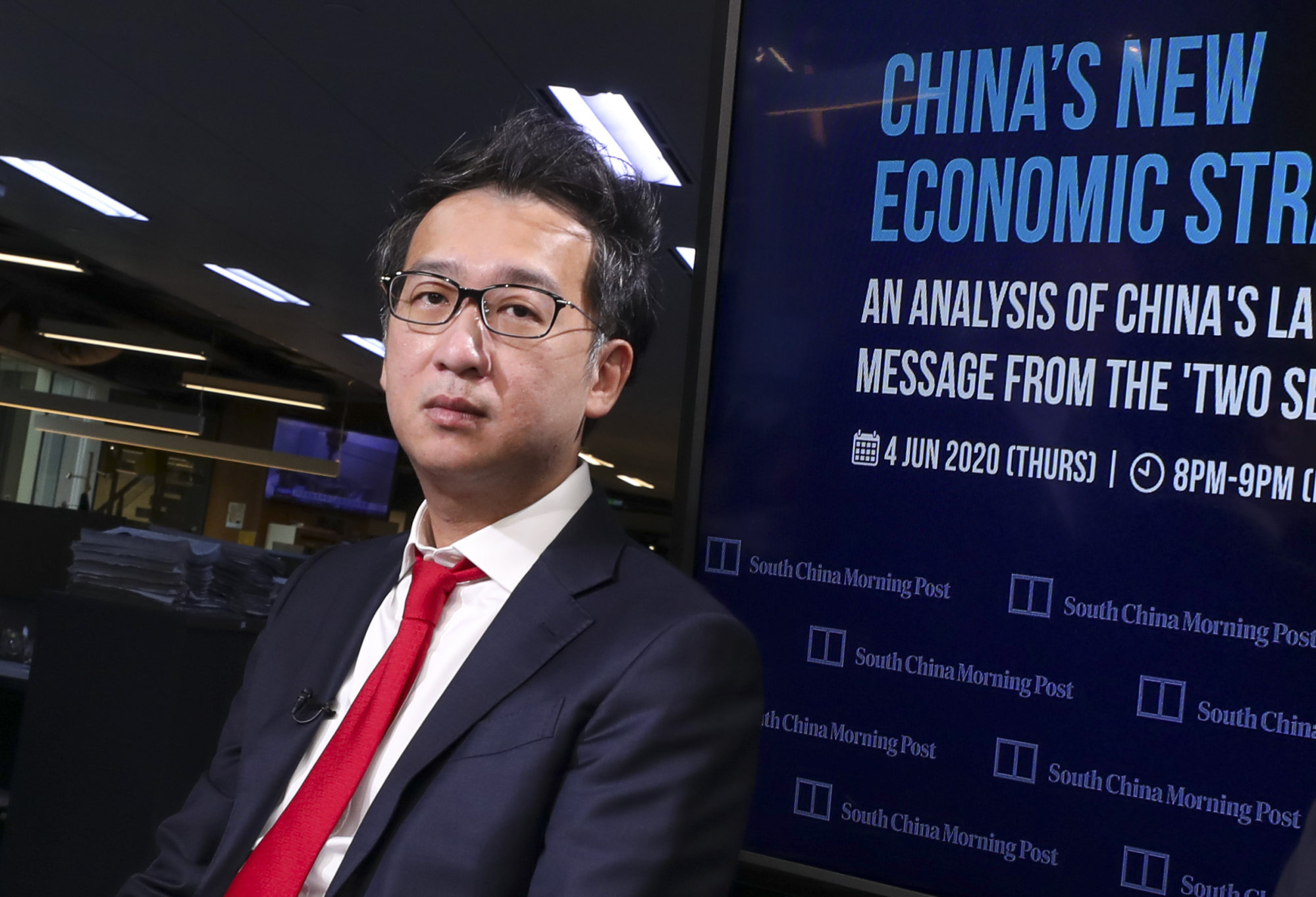

Cheaper property prices could boost household spending power and savings, potentially redirecting funds into the stock market once domestic confidence improves, according to Hong Hao, partner and chief economist in Hong Kong at Grow Investment Group, a Chinese hedge fund.

“The rally in April and May could be a prelude of what is to come,” he said in a note to clients on Monday. “Chinese stocks can rebound without a rebound in property.”

The Hang Seng Index, which tracks the largest and most liquid stocks listed in Hong Kong, surged 21 per cent between a low on April 19 and a high on May 20 as mainland and global investors scooped up cheap local shares in an effort to diversify their assets.

That happened despite the property market showing little sign of stabilising, with prices of new homes in 70 medium and large Chinese cities falling by the most in nearly 10 years as Beijing’s ambitious 300 billion yuan (US$41.3 billion) relending facility for excess housing inventory has yet to trickle through.

“The more property prices decline, potentially the bigger the household spending budget will be, and hence better discretionary spending,” Hong said. That could help ease the deflationary pressure and prompt the economic cycle to tick up, he added.

Hong worked for China International Capital Corp and Bocom International Holdings before joining Grow Investment. He recommended buying Chinese stocks at the end of October 2022, just before a 54 per cent run-up in the Hang Seng Index. He also correctly predicted the 2015 market meltdown that wiped away US$5 trillion in value.

Hong’s argument has added to a recent chorus of optimistic calls on China’s market prospects from the likes of Societe Generale and UBS, at a time when doubts about the strength of China’s recovery and geopolitical concerns continue to put off investors.

To be sure, trade friction remains an overhang on Chinese stocks, particularly for companies heavily reliant on exports. Concerns about capital outflows amid weakening foreign investor confidence are valid, Hong said.

Meanwhile, Chinese mom-and-pop investors are putting much of their household deposits in Chinese treasury bonds and higher-yield wealth-management products instead of stocks at the moment, indicating that domestic investor confidence has yet to fully recover.

Hong remains optimistic, suggesting that China’s economic cycle is bottoming out. A 3.7 per cent increase in retail sales and a 7.6 per cent jump in exports last month show that the economy is not faltering as much as headlines suggest, he said.

“China’s economy is bottoming with some upticks, not stalling,” Hong said. Capital outflow has not entirely stopped but has slowed rather sharply, as there will always be some investors who see opportunities in such a vast market.