For the first time since China became a major trading partner of Latin American and Caribbean (LAC) nations, frozen beef ranked among the top five imports from the region into China in 2023, displacing refined copper, a US university study shows.

A new economic bulletin for 2024 from Boston University’s Global Development Policy Centre said beef imports – mainly from Brazil, Argentina and Uruguay – to China had doubled in volume in the past five years and roughly quintupled in the past decade.

The region now accounts for more than three-quarters of China’s beef imports.

Last year, China bought 2.084 billion tonnes of frozen beef from Latin America and the Caribbean, mostly from Brazil (1.18 billion tonnes), Argentina (524.7 million tonnes) and Uruguay (274 million tonnes).

China’s beef imports from LAC have grown from about 256 million tonnes a decade ago, boosted by many new trade agreements Beijing has signed with LAC countries, although the increase has attracted concern about potential environmental damage from China’s agricultural demand.

Researchers at Boston University Global Development Policy Centre said the rise to fifth-top import was due in part to the falling price of refined copper, which has traditionally been the fifth largest commodity export to China.

Last year, there was a fall in copper production in Chile, the world’s largest producer of the metal, because of tougher mining conditions, lower ore grades and water shortages, but copper output has since rebounded.

Chinese imports from the region are dominated by unprocessed forms of two major transition minerals: lithium carbonate and copper ores and concentrates. Beijing also imports large volumes of soybeans, iron ore and concentrates, crude oil and copper – mostly from Brazil, Chile, Peru and Argentina.

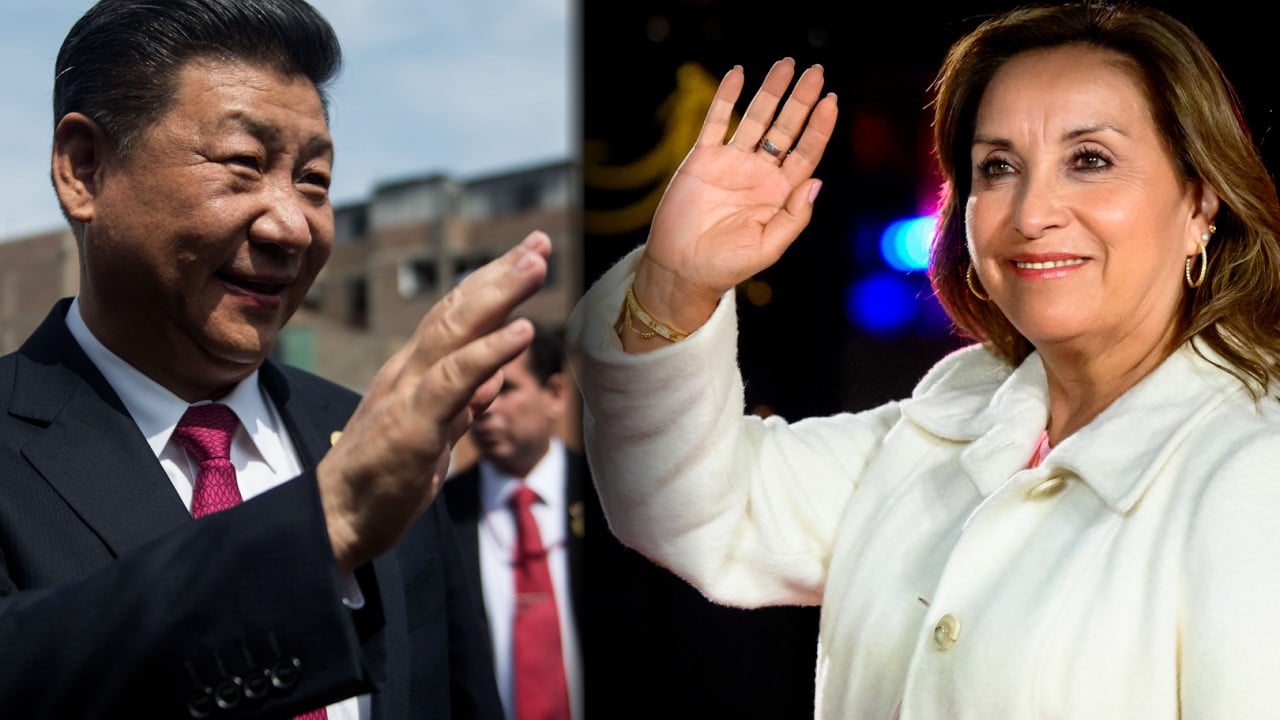

It comes as LAC governments have strengthened their relationship with China with a record number of presidential visits to Beijing in recent years. Last year, for example, eight presidents from the region visited China.

During their trips, the leaders from the region articulated their priorities for the future of the relationship, with a particular focus on infrastructure, commodity exports and renewable energy supply chains.

When Brazilian, Colombian and Uruguayan presidents visited China last year, a key item on the agenda was exporting beef and minerals – particularly transition metals – to China.

According to the Boston University study, Chinese imports of beef from Latin America and the Caribbean expanded dramatically from 2018, when Beijing raised tariffs on agricultural imports from the United States in response to Washington’s move to impose tariffs on Chinese products.

The struggle with African swine fever inside China also prompted more beef imports from LAC in 2018.

Soybean is the China’s second top agricultural import from Latin American countries. Last year, Beijing bought 62 million tonnes of soybeans from LAC countries, mostly from Brazil, which is the top source of the agricultural product at 60 million tonnes of soybeans.

China has the world’s largest number of pigs, and soybeans are a vital source of food for the animals.

Lithium, an essential metal used for making lithium-ion batteries, is also growing quickly among China-LAC exports, although still trading at relatively low levels as a newly important commodity in global trade.

The Boston study said LAC-China lithium exports were growing even faster than beef. Chinese imports of lithium carbonate had quintupled over just the 2020-23 period as China positioned itself to control the EV and battery-making industry.

Additionally, Latin American and Caribbean countries have attracted billions of dollars from Chinese investors, such as Chengxin Lithium Group’s US$823 million investment in the SDSA lithium project in Argentina, BYD’s investment of US$290 million in a lithium cathode factory in Chile and Minerals and Metals Group’s (MMG’s) investment of US$350 million to expand its Las Bambas copper mine in Peru.

Further, Chinese development finance institutions (DFIs) made US$1.3 billion in new commitments in 2023, comprising two loans from the China Development Bank to its Brazilian counterpart, the National Bank for Economic and Social Development (BNDES).

Rebecca Ray, a senior academic researcher at the Boston University Global Development Policy Centre and a co-author of the China-LAC economic bulletin, said as Chinese firms gained experience operating in Latin America and the Caribbean, they relied less on the intermediation of Chinese DFIs and instead opted for direct investment or the direct provision of infrastructure contracts.

“It is unlikely that development finance will rebound to the record highs of its peak years, 2009-2015,” Ray said.

However, Ray and her co-authors of the Boston University study raised concern that trade in South American beef and soy was associated with environmental and social risks, which needed significant collaboration to be managed successfully.

The study traces the deforestation risk from Brazil’s global beef exports and finds that China’s demand carries the greatest exposure among Brazil’s trading partners.

Nevertheless, the study said Chinese meat industry had adopted a zero-deforestation commitment for its purchases of Brazilian soy. It said Jun Lyu, chairman of Chinese agricultural giant COFCO Corporation, had called to expand the Soy Moratorium – a voluntary industry agreement to end the purchase of soy from the Amazon biome – to include the Cerrado, the surrounding tropical savannah.

“Such an extension could have a significant impact on the sustainability of the soy industry, as the Cerrado is home to most Brazilian soy production,” the Boston University study said.