China has called on government investment funds to better track investment performance and tolerate risk – behaviour that prioritises long-term outcomes – to foster a financial environment that encourages innovation while accepting the possibility of failure.

Advertisement

“Government investment funds should act as patient capital, playing a cross-cycle and countercyclical role,” said the General Office of the State Council on Tuesday in a release of the country’s first national-level guidelines to promote the funds’ development.

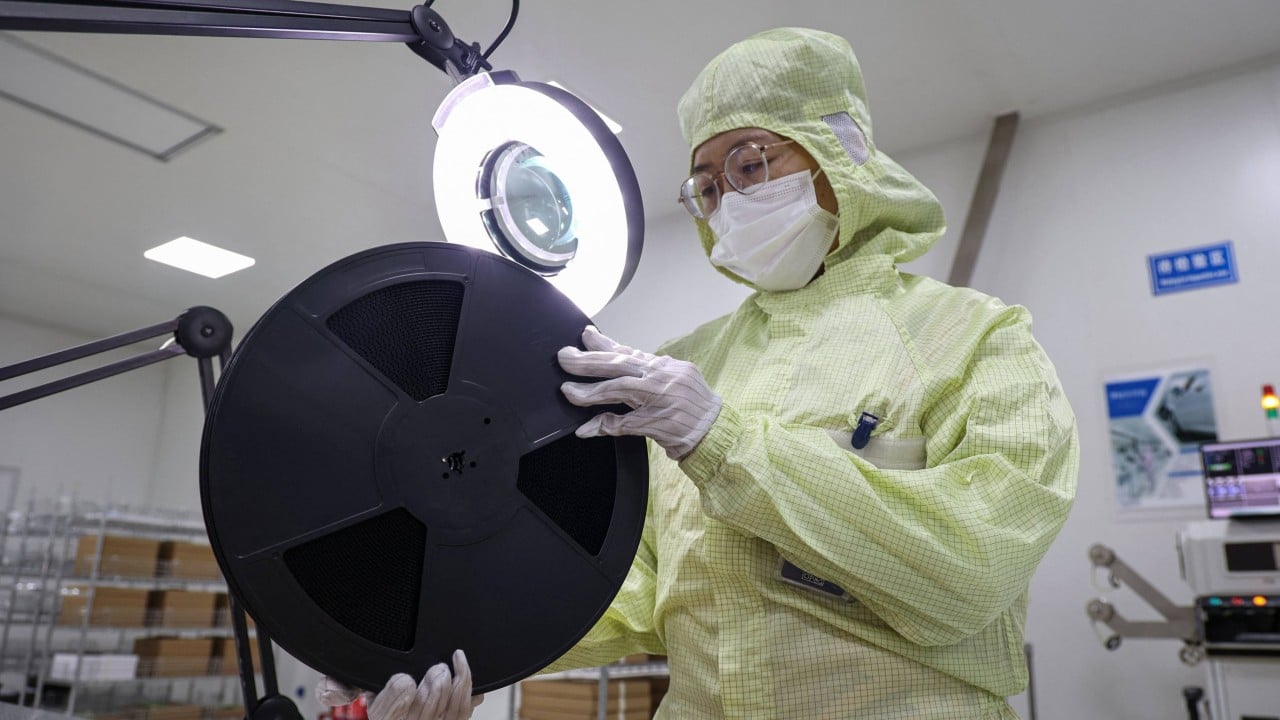

State funds should be focused on “major strategies, key areas and weak links where the market falls short” to “attract and leverage” private capital into supporting a “modern industrial system,” the 25-point list of guidelines said.

The instructions came as Beijing calls for more “patient capital” – funding sources focused on long-term investment that are less averse to potential hazard – as part of its drive for innovation.

That mission for self-reliance has become more urgent as the country seeks new drivers of growth and looks to outpace rapidly expanding sanctions from the United States against its tech trade.

Advertisement

Long-term sources of capital like the national social security and insurance funds, the document added, should be steered towards fostering patient capital, with follow-up investments in areas requiring long-term planning to ensure continuity.