Published: 10:00pm, 6 Sep 2024Updated: 10:58pm, 6 Sep 2024

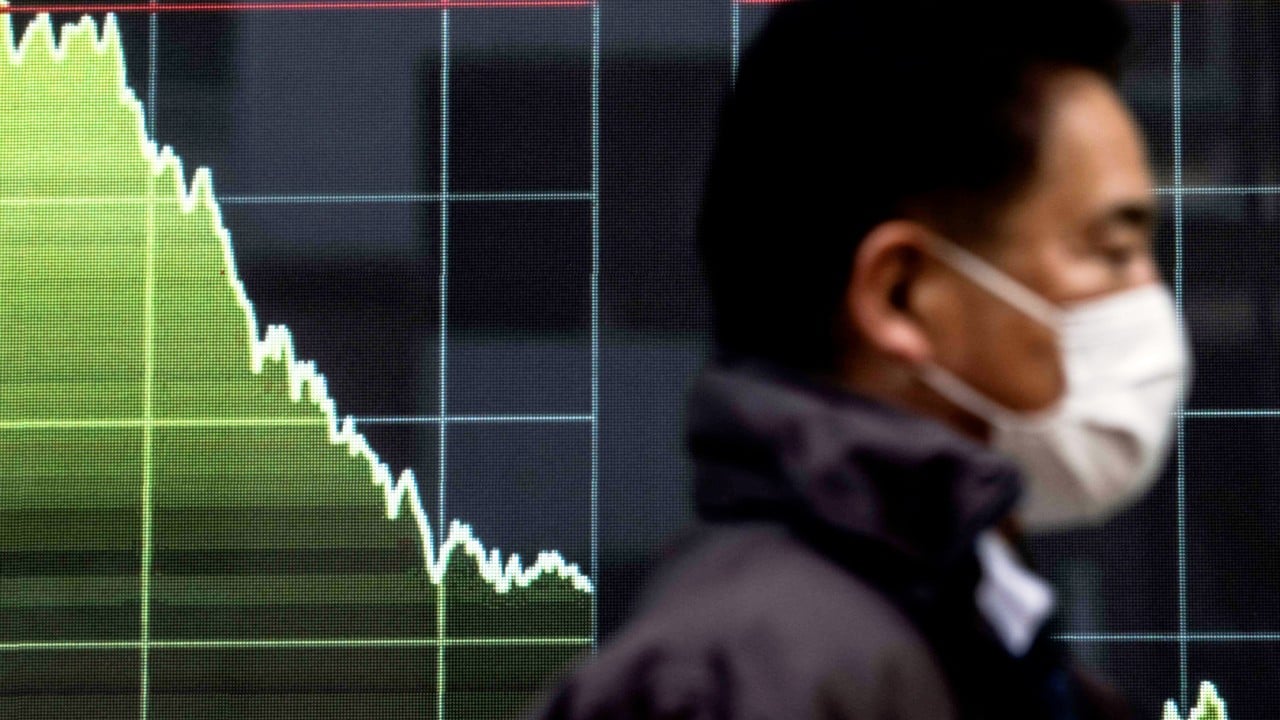

China needs to act to avoid a fate similar to Japan’s as the country has recorded hefty declines in its GDP deflator as well as the producer price index (PPI), a former governor of Japan’s central bank said at Shanghai’s Bund Summit on Friday.

Advertisement

The warning came amid heated discussions among academics and policy experts over the potential “Japanification” of China, as a slump in the property market, deflationary pressure and demographic challenges have all combined to evoke the memory of the lost decades suffered by its East Asian neighbour.

Haruhiko Kuroda, a former governor of the Bank of Japan, discussed the deflation that plagued his country between 1998 and 2012, and named wage stagnation as the most pressing challenge of that time.

During his tenure from 2013 to 2023, Japan introduced rounds of quantitative easing and structural reforms, eventually escaping a deflationary spiral.

However, he said China’s deflation was “not as serious as Japan’s”, and reiterated the importance of maintaining wage increases.