For the first time in a decade, Southeast Asia has attracted more foreign direct investment (FDI) than China as investors shift faster towards building “China + 1” supply chains amid increasing manufacturing costs and rising tariffs that have reduced Beijing’s competitiveness.

That is according to a new report on the state of investments in the region released by the Angsana Council, Bain & Company, and DBS Bank on Thursday. The report forecasts that the growth in foreign investments in Southeast Asia will continue to outpace China’s over the next 10 years, reversing the underinvestment in the region in the past three decades. Much of those lost investments had gone to China.

In 2023, foreign direct investments in Southeast Asia’s top six economies (SEA-6) – Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam – reached US$206 billion, compared with US$43 billion for China, according to the report, titled “Navigating High Winds: Southeast Asia Outlook 2024-2034”.

Between 2018 and 2022, FDI in SEA-6 grew by 37 per cent while in China, FDI grew 10 per cent, the report found.

“As a result of strong domestic growth and the China +1 strategy, we are increasingly optimistic that Southeast Asia will outpace China’s growth in both GDP and FDI in the next decade,” said Charles Ormiston, Advisory Partner at Bain & Company and Chair of Angsana Council.

“However, multinational investments will be highly contested, with the competition between countries improving outcomes for both businesses and consumers.”

FDI is also growing quickly in India and faster than China in the last decade, but it still lags behind the FDI growth and size in Southeast Asia.

Among the SEA-6, Singapore holds the top spot with the highest amount of FDI per capita, while Indonesia and the Philippines have the lowest. However, the pace of growth in FDI in these two countries between 2018 and 2022 are the highest, alongside Vietnam.

Malaysia has the slowest growth in FDI but has pledged efforts to reverse this trend, particularly in boosting interests in its semiconductor, electronics and data centre industries.

Research in the report suggests FDI in Southeast Asia can outpace China’s in the next 10 years, particularly given that the region has already drawn major foreign capital to the key emerging sectors of electric vehicle (EV) manufacturing, EV battery manufacturing, semiconductor manufacturing and the provision of data centres.

In EV manufacturing, Thailand and Indonesia have attracted the most FDI of about US$14 billion in the past five years, given their strong original equipment manufacturer base that is making products for specific brands and labels, and government support and incentives.

Indonesia dominates in EV battery manufacturing due to its nickel reserves, with FDI in the sector reaching US$26 billion in the last five years.

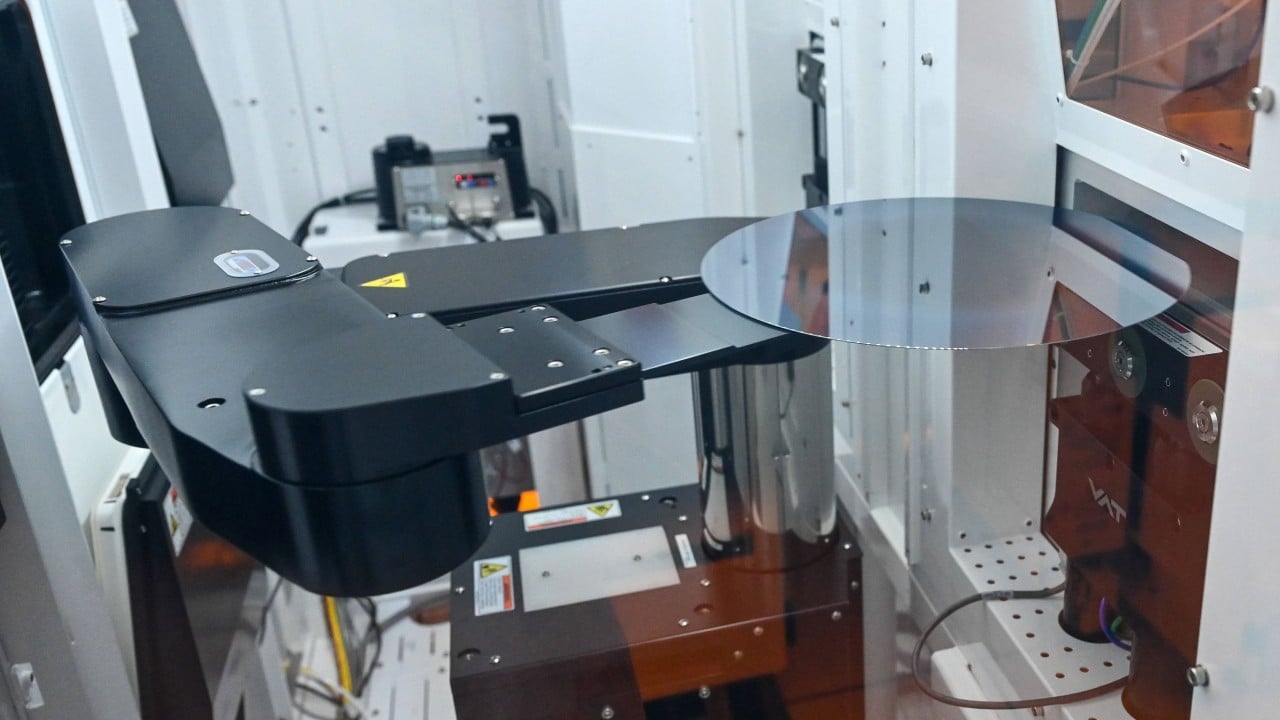

In semiconductor manufacturing, Malaysia and Singapore top the list with US$38 billion in FDI. Singapore specialised in wafer fabrication or converting raw materials into small chips, while Malaysia led in packaging and testing.

Thailand, Indonesia and Malaysia were the Southeast Asian juggernauts in the provision of data centres given Malaysia and Thailand’s reliable infrastructure and Indonesia’s growing digital economy. Indonesia is home to some of the biggest e-commerce companies in the region.

But to maintain the momentum in FDI, Southeast Asia needs to improve its service provision and innovation, which still lags behind China’s.

More investments in technology in Southeast Asia would solve this problem, as seen with China and the United States, said Peng T. Ong, trustee of the Angsana Council and Co-Founder and managing partner of Monk’s Hill Ventures.

“Southeast Asia is at an inflection point. We have the opportunity to think about leveraging tech meaningfully – to be using tech to drive more innovation in our private sector,” Ong said.

Southeast Asia’s transformation comes at a time when the world has become increasingly protectionist, with many businesses diversifying away from China to avoid over-reliance on one market, rising tariffs against China which reduce the competitiveness of its products, and increased costs of inputs like labour.

Still, China remains the lowest-cost producer in the world, according to the report.

“As companies seek to diversify from China sourcing, it is important to recognise the continuing competitiveness of Chinese sourcing,” the report said, noting that investors would not be able to look past China’s state-directed “hyper-competition” which drives innovation and efficiency “to levels rarely seen in more mature markets”.

Even with labour costs rising, they are still low relative to G7 countries and China is set to have the largest global pool of engineering and research talent.

China’s large domestic market for most products and the scale of its manufacturing facilities are also difficult to replicate elsewhere, the report added.