Alibaba Group Holding’s New York-listed stock gained 5 per cent in pre-market trading after it posted a surprise increase in its September quarter net profit, as strong growth in its cloud computing and offshore e-commerce businesses offset the fall in domestic retail sales caused by China’s consumption slump.

Advertisement

Net income surged 58 per cent to 43.9 billion yuan (US$6 billion) in the quarter, beating analysts’ estimates of 25.7 billion yuan. Revenue rose 5 per cent to 236.5 billion yuan, missing the 239.4 billion yuan expected by analysts, according to a Bloomberg survey.

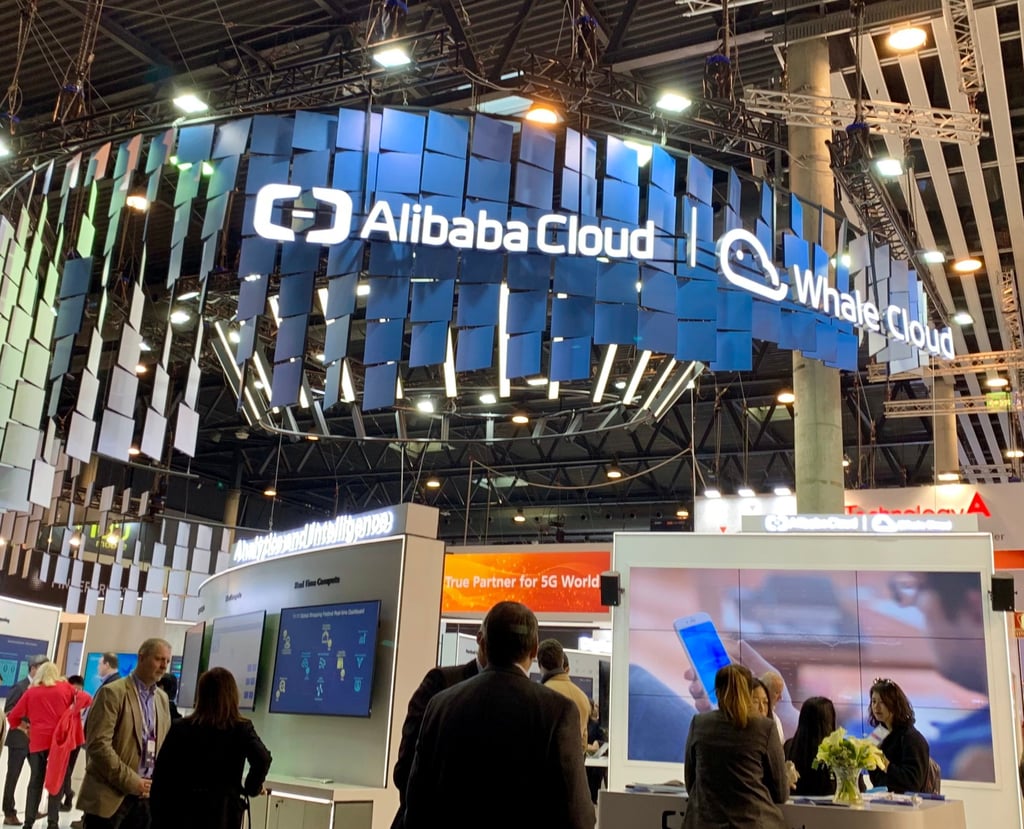

“Growth in our cloud business accelerated from prior quarters, with revenues from public cloud products growing in double digits and AI-related product revenue delivering triple-digit growth,” said Alibaba CEO Eddie Wu Yongming.

“We are more confident in our core businesses than ever and will continue to invest in supporting long-term growth. Our other businesses continued to improve their operating efficiency, with most of them continuing to increase their profitability or reduce losses,” Wu said.

Revenue for the Cloud Intelligence Group, one of the company’s most important growth engines, rose 7 per cent to 29.6 billion yuan. That beat the 6 per cent increase in the previous quarter, marking the unit’s fastest quarterly growth over the past two years.

Taobao and Tmall Group, the core e-commerce unit of Alibaba, saw revenue increase by 1 per cent to 99 billion yuan, on the back of improved monetisation and strong growth momentum in new consumers ahead of the Singles’ Day shopping festival. It recorded double-digit, year-on-year growth in gross merchandise value (GMV) during the quarter.

Advertisement

Alibaba International Digital Commerce Group (AIDC) continued its momentum from the past few quarters, posting 29 per cent growth in the September quarter to reach 31.7 billion yuan in revenue, thanks in part to increased sales from international marketplaces such as AliExpress and Trendyol, as well as improved operational and investment efficiency.