When Alibaba Group Holding held its eleventh Singles’ Day shopping festival in 2019, it culminated in Shanghai that November with a performance by American pop sensation Taylor Swift to help get consumers in a cheerful mood.

Advertisement

Five years later, China’s largest e-commerce company decided a party for the world’s largest online shopping festival was no longer necessary, and it will instead spend those resources on merchants and consumers.

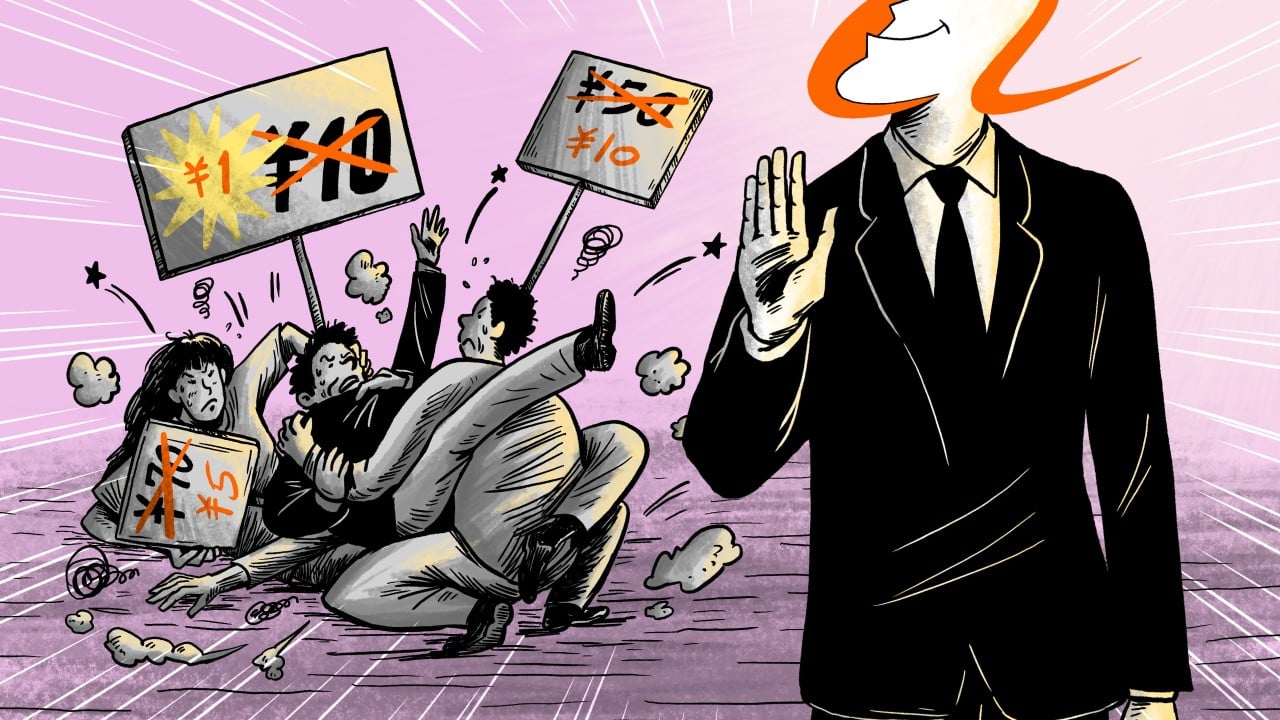

The last five years have witnessed a sea change in the Chinese economy, as disruptions from the Covid-19 pandemic and deflationary pressures weigh on consumer spending. For Alibaba, whose Taobao and Tmall platforms dominate Chinese e-commerce, the barbarians are at the gate. Newer market entrants such as Pinduoduo, PDD Holdings’ platform that concentrates on bargain hunting, and ByteDance’s Douyin, the sister app of TikTok that has made an aggressive expansion into live-streaming e-commerce, are slowly accumulating market share.

Alibaba, owner of the South China Morning Post, has in response been quietly adjusting its tactics. It has turned away from the brutal price war that emerged in this space and sought to create a new balance between buyers and sellers in which the consumer is not always right. That change is now paying off, according to analysts and merchants.

Strong growth from key consumers – the 42 million big spenders referred to as 88VIP members – shows Alibaba is on the right path, according to Jacob Cooke, co-founder and chief executive of WPIC Marketing + Technologies, an e-commerce and technology consultancy.

Advertisement

“They talked a lot about their 88VIP users, [meaning] they are really focusing on getting in the high-end big spenders, as opposed to a ton of people that spend a little money,” Cooke said. “And that’s where Alibaba really stands out.”