Producers of tungsten products in developed nations, including those in the defence sector, are waking up to the need to diversify their raw material supply sources after three decades of readily available exports from China came to a sudden halt, according to a mines developer.

Advertisement

On February 4, Beijing added five critical industrial metals including tungsten to its export restriction list while announcing tariffs on certain American imports, as part of its retaliation against Washington’s decision to raise duties on all Chinese imports by 10 per cent. Export permits have not been issued so far, said Lewis Black, CEO of Canada-based Almonty Industries.

“The vast majority of our industry is in absolute panic, because for 30 years, they have been able to procure raw materials from China,” he said. “Since February they have been unable to do so … some of our customers have asked us to try to recover tungsten from tailings for different products.”

US defence contractors face another looming supply chain challenge: they must stop using Chinese tungsten by January 1, 2027, he said.

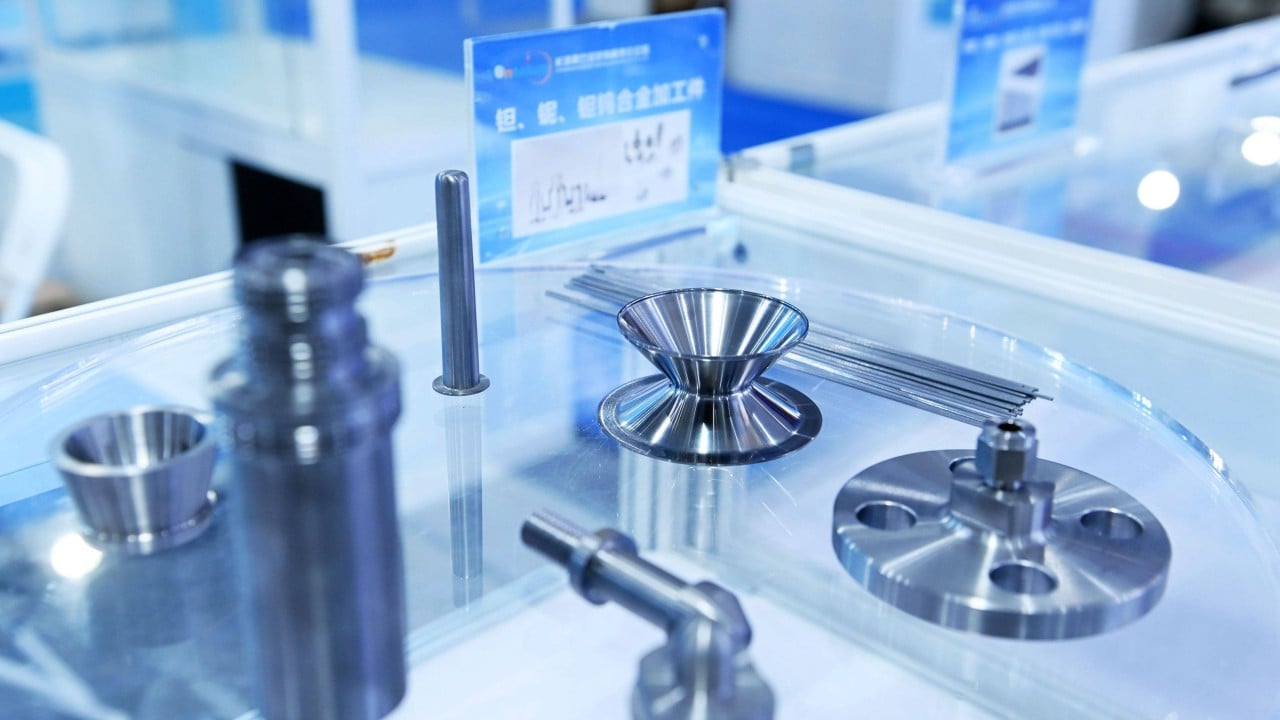

The element, known for its hardness and the highest melting point on the periodic table at 3,422 degrees Celsius, is used to make cutting tools, drill bits and heavy machinery parts. It is a component in certain types of ammunition and armour. In clean energy, it finds use in alloys for turbine blades and as a wire to divide silicon wafers for solar panels.

Advertisement

Tungsten has not been mined commercially in the US in a decade. China accounted for 82.7 per cent of global raw tungsten ore mined last year, followed by Vietnam at 4.2 per cent, Russia at 2.5 per cent and North Korea at 2 per cent, according to the US Geological Survey.