The president warns that reversal of subsidies by the next administration would undo recent progress benefiting both Republican and Democratic districts.

WASHINGTON—As President Joe Biden nears the final stretch of his term, he is focused on communicating to the American public what he has accomplished over the past four years.

Amid low public approval of his economic record, the 46th president wants to show that his policies will have a lasting, positive impact on the U.S. economy.

In recent weeks, he has ordered his staff to release reports and statistics to prove his strategy has increased investment, revitalized manufacturing, and created jobs in America.

The 82-year-old president also reflected on the past four years in a recent essay he penned for the American Prospect, saying that his administration created a new chapter in America’s comeback story.

“It will take years to see the full effects in terms of new jobs and new investments all around the country, but we have planted the seeds that are making this happen,” he wrote.

On Dec. 19, the White House released a 383-page report titled “Quadrennial Supply Chain Review,” outlining the progress made to bolster the resilience of U.S. supply chains, starting in 2021.

The report details the administration’s response to supply disruptions during the COVID-19 pandemic, showcasing key investments in domestic manufacturing.

The document essentially serves as a pitch for Biden’s signature laws—the Inflation Reduction Act (IRA), Bipartisan Infrastructure Act, and the CHIPS and Science Act.

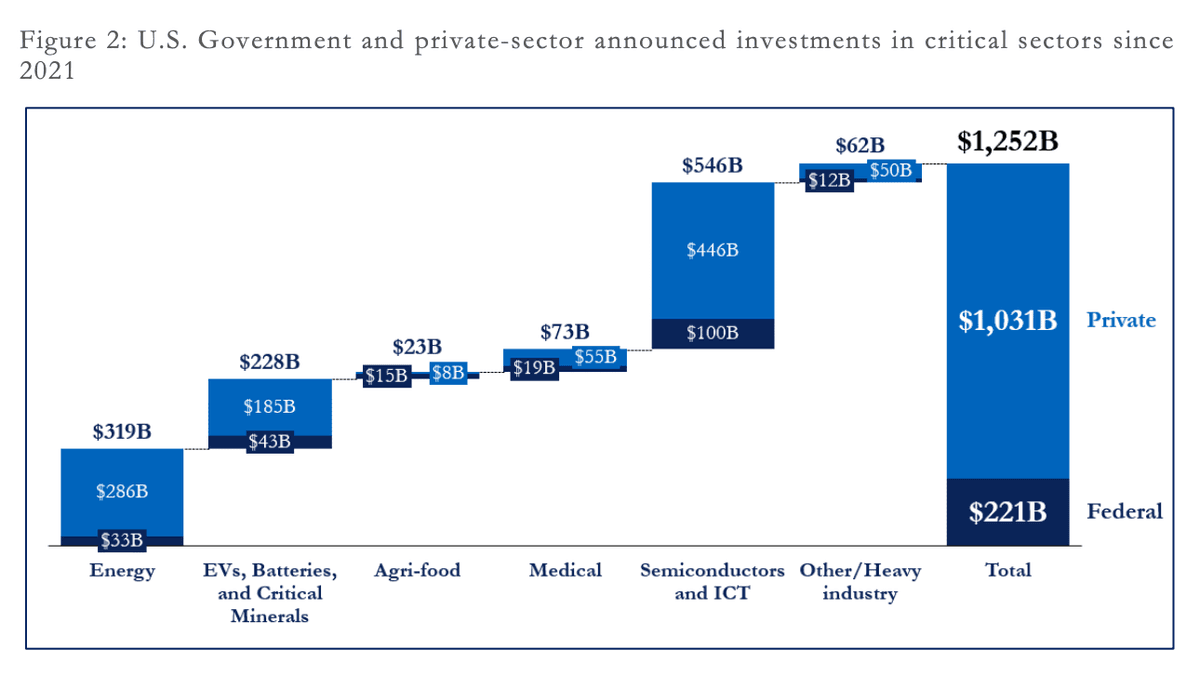

Biden directed nearly $221 billion in federal funds—through loans, grants, tax credits, and other incentives—into boosting domestic manufacturing. The report states that these incentives unlocked over $1 trillion in private-sector investment across industries such as semiconductors, solar energy, batteries, critical minerals, and nuclear energy.

Several manufacturers have already begun operations. Ultium Cells opened a battery manufacturing facility in Warren, Ohio, employing 2,200 workers and producing 100 million battery cells. Boom Supersonic invested $500 million in a factory in Greensboro, North Carolina, to build supersonic airliners. Nokia launched a plant in Kenosha County, Wisconsin, producing fiber-optic products. Additionally, Luxwall is investing $165 million in two clean energy manufacturing plants in Michigan, creating 450 jobs.

Larger investments are also on the horizon. With the support of a government grant, Micron is set to build chip facilities in New York and Idaho, creating at least 20,000 jobs and driving up to $125 billion in total investment.

Speaking at the Brookings Institution on Dec. 19, White House national economic adviser Lael Brainard said that the United States is now expected to account for nearly 30 percent of global leading-edge semiconductor manufacturing by 2032, a significant increase from zero in 2022.

Brainard also noted that the country is on track to supply over 20 percent of global lithium demand outside of China by 2030, supporting the production of grid storage batteries and electric vehicles.

“Now it is important to build on this new playbook for resilient supply chains,” she said.

According to an August report by Washington-based analyst group Atlas Public Policy, the United States has become the second-largest destination for EV and battery manufacturing, following Europe, since the passage of the IRA.

While domestic manufacturers have made the largest investments, “foreign companies are increasingly viewing the United States as an attractive destination for EV investments,” the report said.

Christopher Tang, a supply chain management professor at the University of California–Los Angeles, praised Biden’s investments in strengthening the supply chain, but he also saw challenges.

“President Biden is really the first to focus on supply chain resilience, particularly because COVID-19 highlighted how vulnerable the United States is due to its over-dependence on China,” he told The Epoch Times.

Tang noted these investment projects are facing roadblocks. Some companies are either delaying or evaluating their investment plans, including Taiwan Semiconductor Manufacturing Company Limited (TSMC), Intel, and Ford.

“For example, TSMC tried to build factories in Arizona, but it faced challenges because they couldn’t hire enough qualified engineers and technical staff to open the plant,” Tang said.

According to the White House, TSMC has pledged to invest $65 billion for three chip facilities in Arizona.

Biden Races to Spend the Money

In his recent speeches, Biden has sounded the alarm that any reversal of his policies by the next administration would threaten the progress made so far.

In an effort to expedite the distribution of remaining funds, he recently announced new steps, including providing up to $6 billion in incentives to energy supply chains.

On Dec. 20, the administration also granted $1.6 billion in direct funding to Texas Instruments to support the construction of three chip facilities in Texas and Utah.

Biden is concerned that President-elect Donald Trump could claw back any unspent funds from the IRA.

“Look, my hope and belief is that the decisions and investments are now so deeply rooted in the nation that it’s going to be politically costly and economically unsound for the next president to disrupt or cut,” Biden said during a speech at the Brookings Institution on Dec. 10.

“The historic investments we’ve made went to more red states than blue states.”

The White House said that 98 percent of the funds have already been awarded.

“A wide range of private-sector investments spurred by the Inflation Reduction Act are based on the expectation that tax incentives would remain available for 10 years or longer,” according to a White House memo shared with The Epoch Times.

The White House said repealing the IRA’s tax incentives would hand manufacturing and clean energy leadership to China.

These tax credits benefit American drivers who buy electric cars or homeowners who install energy-efficient heat pumps. They also incentivize companies to build factories and power plants to facilitate the transition to renewable energy production or encourage the adoption of EVs.

“Will the next president stop a new electric battery factory in Liberty, North Carolina, that will create thousands of jobs?” Biden said at the Brookings Institution.

“Will he shut down a new solar factory being built in Cartersville, Georgia? Are they going to do that?”

Can Trump Cancel the IRA Incentives?

Republicans are likely to pursue a major tax reform bill next year, including an extension of the 2017 Tax Cuts and Jobs Act. To offset costs, many predict that Republicans will seek to claw back some of the IRA’s tax incentives, such as EV credits.

Tax credits under the IRA were initially estimated to cost around $300 billion over the law’s 10-year lifespan.

However, the Treasury Department interpreted the rules in a more generous way over the past couple of years, which contributed to the increased cost of these credits, according to Garrett Watson, senior policy analyst at the Tax Foundation.

He predicts that repealing these tax credits could increase federal government revenue by $800 billion to $1 trillion over the next 10 years.

“That’s why they’re a top candidate,” Watson told The Epoch Times, referring to Republican efforts to repeal these incentives.

Since Democrats passed the IRA, Republicans have voted 54 times to repeal its provisions, according to Climate Power, an organization that advocates for the IRA.

Repealing all tax credits will be complicated, as some projects have already started and many of them have benefited Republican districts.

In August, 18 House GOP members wrote a letter to House Speaker Mike Johnson, raising concerns about the Republican efforts to repeal the IRA.

Prematurely repealing energy tax credits, the letter said, “would undermine private investments.”

“A full repeal would create a worst-case scenario where we would have spent billions of taxpayer dollars and received next to nothing in return.”

According to a December 2023 report by the Center for American Progress, of the top 10 congressional districts ranked by the size of their investment in wind and solar energy since the IRA was passed, eight are represented by Republicans.

In addition, Republican strongholds, including Alabama, Georgia, North Carolina, South Carolina, and Tennessee, have become a major hub for EV manufacturing, according to the Atlas report.

Watson believes that instead of repealing all IRA tax incentives, Republicans may opt to target specific tax credits to offset the costs of their tax cut plans.

“It seems like the more likely option based on some initial discussion is looking at the electric vehicle credits in particular and repealing those that would bring in a few hundred billion dollars,” he said.

According to Tang, EV manufacturers and chipmakers might also have to return grants or loans they received from the federal government, because some of the funds haven’t been spent yet.

“I believe the new administration under Trump may have legitimate reasons to either suspend [these funds] or renegotiate how the funds are being used,” he said.

Some critics say that the government-driven investment has been a mistake.

In a September op-ed, the Wall Street Journal editorial board criticized the administration stating, “U.S. industry output has been flat for two years, despite huge subsidies.”