The analysis relied on a blend of campaign statements, previous budget outlooks, social media posts, and other wide-ranging reports.

Public policies proposed by Vice President Kamala Harris and former President Donald Trump would add trillions of dollars to the national debt, according to the Committee for a Responsible Federal Budget (CRFB).

The nonpartisan group analyzed the fiscal impacts behind the presidential candidates’ proposals, relying on a blend of campaign and candidate statements, previous budget outlooks, social media posts, and other wide-ranging reports.

Under a central estimate, Harris’s policies could raise the national debt by $3.5 trillion over the next decade, including $500 billion in interest charges.

Harris’s two top policy proposals are extending the Tax Cuts and Jobs Act (TCJA) for households earning less than $400,000 and expanding the Child Tax Credit and Earned Income Tax Credit. Both are projected to reduce revenues by $3 trillion and $1.4 trillion, respectively.

Harris has suggested offsetting the projected revenue decline by raising the corporate tax rate from 21 percent to 28 percent and increasing taxes on capital income. These could generate tax receipts of $900 billion and $850 billion, respectively, over 10 years.

By comparison, Trump’s plans could increase the debt by $7.5 trillion, including $1 trillion in interest costs, through fiscal year 2035.

Trump has three policies that could have a $1 trillion-plus impact on revenues. These include the extension and modification of the Trump-era tax cuts ($5.35 trillion), exemption of overtime income from taxes ($2 trillion), and elimination of taxes on Social Security benefits ($1.3 trillion).

The ex-president also has proposed establishing universal across-the-board tariffs that could bring in an estimated $2.7 trillion. In addition, he has recommended reversing current energy and environmental policies and expanding oil and gas production. This, the CRFB says, could boost revenues by $700 billion.

The former president has said that he expects his economic policies to spur economic growth and lead to a “national economic renaissance.”

“My plan will rapidly defeat inflation, quickly bring down prices, and reignite explosive economic growth,” Trump said at the Economic Club of New York last month.

The Tax Cuts and Jobs Act (TCJA) signed into law by Trump in 2017 stimulated the national economy and generated higher government revenues, defying forecasts from the Congressional Budget Office (CBO), House Budget Committee Chairman Jodey Arrington (R-Texas) said in a statement in May.

Fiscal effects also vary based on the group’s low and high estimates.

Under a low-cost scenario, Harris’s initiatives would not add to the national debt. However, the high-cost estimate suggests the vice president’s efforts would boost the debt by $8.1 trillion.

A low-cost projection for Trump’s proposals would increase the debt by $1.45 trillion. The high-cost estimate totals $15.15 trillion.

The CRFB analysis stated that there is a “high degree of uncertainty” regarding estimates based on the absence of vital details of the candidates’ platforms.

CRFB to Candidates: Address the National Debt

While the impact on the debt may differ between both campaigns, “neither major candidate running in the 2024 presidential election has put forward a plan to address this rising debt burden,” the group noted.

The CRFB stated that without substantial fiscal changes, debt will continue to swallow a greater share of the economy in the next decade.

“Debt would continue to grow faster than the economy under either candidate’s plan and in most scenarios would grow faster and higher than under current law,” the CRFB said.

The vice president’s plan would increase the debt-to-GDP ratio by 8 percent, to 133 percent in fiscal year 2025, while Trump’s policies would bolster it by 17 percent, to 142 percent.

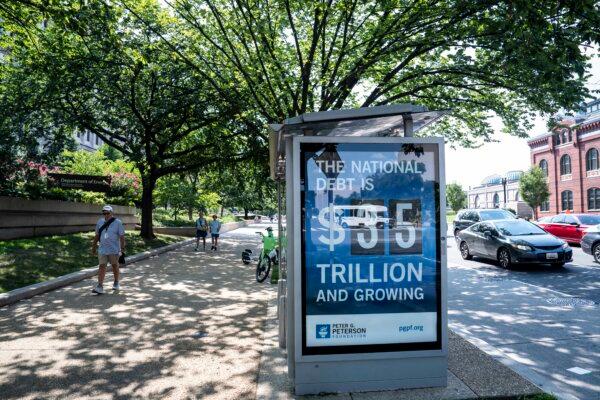

The national debt presently stands at nearly $35.7 trillion, up roughly $8 trillion since January 2021, according to Treasury Department data.

In an Oct. 3 letter, CRFB board members urged Harris and Trump to address the ballooning national debt.

“Unfortunately, high and rising debt carries significant repercussions for all Americans, including slower economic growth and higher interest rates,” they wrote. “Rising debt also limits our ability to respond to unexpected emergencies like natural disasters and pandemics, and it is a national security threat as well.”

Other Fiscal Projections

As the nation heads toward the November election, budget forecasts have crunched the dollars and cents of how much the presidential contenders will contribute to the ballooning debt and deficit.

This past summer, the University of Pennsylvania’s Penn Wharton Budget Model, for example, projected that the Harris campaign’s policy proposals would expand primary deficits by between $1.2 trillion and $2 trillion over the next decade.

The Trump campaign’s policy proposals are estimated to raise primary deficits by between $4.1 trillion and $5.8 trillion over the next 10 years.

The White House hopefuls’ proposals also have different effects on the broader economy.

Although Harris said during a live stream event with Oprah Winfrey that Penn Wharton’s estimates show she would stimulate the economy, the group forecasts that her policies would trim the GDP by 1.3 percent by 2034.

“We estimate that the Harris campaign proposals reduce GDP over time,” Kent Smetters, the Boettner Chair Professor at the University of Pennsylvania’s Wharton School, recently told The Epoch Times.

Penn Wharton anticipates “GDP increases during part of the first decade,” but “GDP eventually falls relative to current law, falling by 0.4 percent in 2034 and by 2.1 percent in 30 years.”

In September, The Tax Foundation compared the economic and fiscal effects of the Harris and Trump campaigns.

Analysts projected that the deficit would grow by $1.3 trillion under a Trump presidency over the next decade. Long-run GDP is expected to tumble 0.2 percent, while long-run wages are predicted to grow 0.6 percent. Full-time employment jobs could plunge by 387,000.

The net effect of Harris’s policies would increase deficits by $1.5 trillion in the same span. Long-run GDP and wages are forecast to fall 2 percent and 1.2 percent, respectively. Full-time employment jobs could crater by 786,000.

In June, the Congressional Budget Office updated the 10-year window to its budget and economic outlook. The nonpartisan budget watchdog highlighted that cumulative deficits would total $22 trillion, bringing the national debt above $50 trillion by 2034.

The full fiscal year 2024 federal deficit will be released on Oct. 10. In the first 11 months of fiscal year 2024, the budget shortfall reached $1.9 trillion, driven by spending for Social Security ($1.337 trillion), debt interest ($1.05 trillion), Medicare ($850 billion), and national defense ($798 billion).

The Epoch Times reached out to the CRFB for comment.