The Democratic candidate said her ‘Opportunity Economy’ plan would include increased childcare support, including a revival of the expanded child tax credit.

Vice President Kamala Harris, the Democratic Party’s presidential nominee, said she would push for a cap on working families’ child care costs at 7 percent of their income if elected.

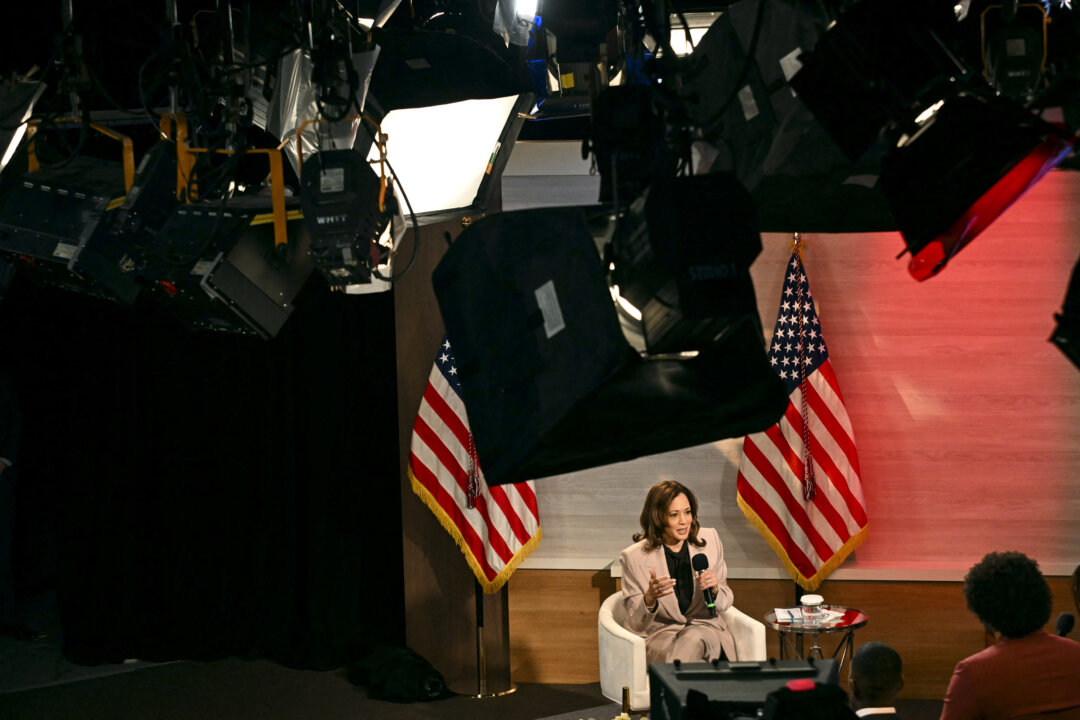

“It is sadly the state of affairs in our country that working people often have to decide to either be able to work or be able to afford childcare,” Harris told Tonya Mosley, a moderator at a National Association of Black Journalists event on Tuesday.

“No working family should pay more than 7 percent of their income in child care … Allowing people to work, allowing people to pursue their dreams in terms of how they want to work, where they want to work, benefits us all. It strengthens the entire economy.”

Mosley, a PBS co-host of WHYY’s Fresh Air with Terry Gross, asked the vice president about her plan for economic relief, citing a Bloomberg report that said in the United States, a family of four is “in many cases spending $33,000 a year for two kids in day care”—more than is spent on housing.

Harris called her economic initiative the “Opportunity Economy” and said she wants to remedy the financial strains of the middle class by cutting taxes for families and small businesses.

Regarding her plan for a $3,000 to $6,000 child tax credit, Harris said the goal is for “young families in particular, for the first year of their child’s life—which is an extraordinarily important time in their development—[to] have the resources to be able to buy a crib, buy a car seat, buy children’s clothing, and not have to worry about whether they’re going to be able to meet their other needs.”

The vice president’s campaign statements are in line with the current administration’s push for increased childcare funding.

A part of President Joe Biden’s 2021 “Build Back Better Framework”—in which the 7 percent cap was first proposed—is a plan to offer “universal and free preschool for all 3- and 4-year-olds,” which the administration called “the largest expansion of universal and free education since states and communities across the country established public high schools 100 years ago.”

Negotiations over the Build Back Better proposal led to the 2022 Inflation Reduction Act (IRA) which was promoted to reduce the federal deficit, lower prescription drug prices, reduce health care costs, and invest in domestic green energy.

However, an expansion of the child tax credit and other child care provisions were components left out, primarily over Republicans’ concerns over inflation.

Separately, the 7 percent cap found its way into law as a Health and Human Services rule that went into effect this year, capping co-payments for families enrolled in the federal Child Care and Development Block Grant program at 7 percent of their income.

The administration has also pushed to bring back the pandemic-era child tax credit. The monthly payments to parents lapsed in 2022.

Although Republican opposition has slowed the expanded tax credit’s return, there is bipartisan support for child tax credits.

Former President Donald Trump has voiced support for a child tax credit, but hasn’t elaborated on his proposal.

The Epoch Times contacted Trump’s campaign for a statement on his plans for the child tax credit and other childcare provisions.

Republican vice presidential candidate Sen. JD Vance (R-Ohio) recently said he favors a $5,000 child tax credit, more than doubling the current $2,000 credit. He has also criticized current policies for prioritizing certain types of care over others.

In an X post on Sept. 5, Vance said, “Many don’t fully appreciate how federal (and state) policy penalizes particular family models—particularly in-home care and kinship care—over others. That’s true of the Child Care Development Block Grant and the Dependent Care Tax Credit, though in different ways for each.”

Estimates from the Joint Committee on Taxation placed the annual cost of the Child Tax Credit at $120.6 billion in 2023. The Tax Foundation has estimated that reinstating the expanded tax credit could cost $1.6 trillion in the next decade.