The Swiss Federal Criminal Court on Wednesday convicted two executives at an oil exploration company of fraud, who had been accused of embezzling over US$1.8 billion from Malaysia’s state investment fund 1MDB.

The verdict was the latest episode in the 1MDB scandal, a complex tale of international corruption that has buffeted a slew of financial institutions and individuals across the globe since allegations of wrongdoing first surfaced in 2015.

Prosecutors alleged that Swiss-British national Patrick Mahony and Swiss-Saudi Tarek Obaid had helped to set up a joint venture with 1MDB by creating the impression that their company, PetroSaudi, was backed by the Saudi government.

This was not, in fact, the case, but the accused managed to persuade 1MDB’s board into signing up to the scheme in 2009 before going on to defraud the fund, prosecutors said.

According to the indictment, the two executives defrauded the wealth fund of US$1.8 billion to enrich themselves, with Obaid getting at least US$805 million and Mahony at least US$37 million.

Obaid was sentenced to seven years in prison by the court, while Mahony received a sentence of six years.

Lawyers for the two men, who had denied wrongdoing, could not immediately be reached for comment.

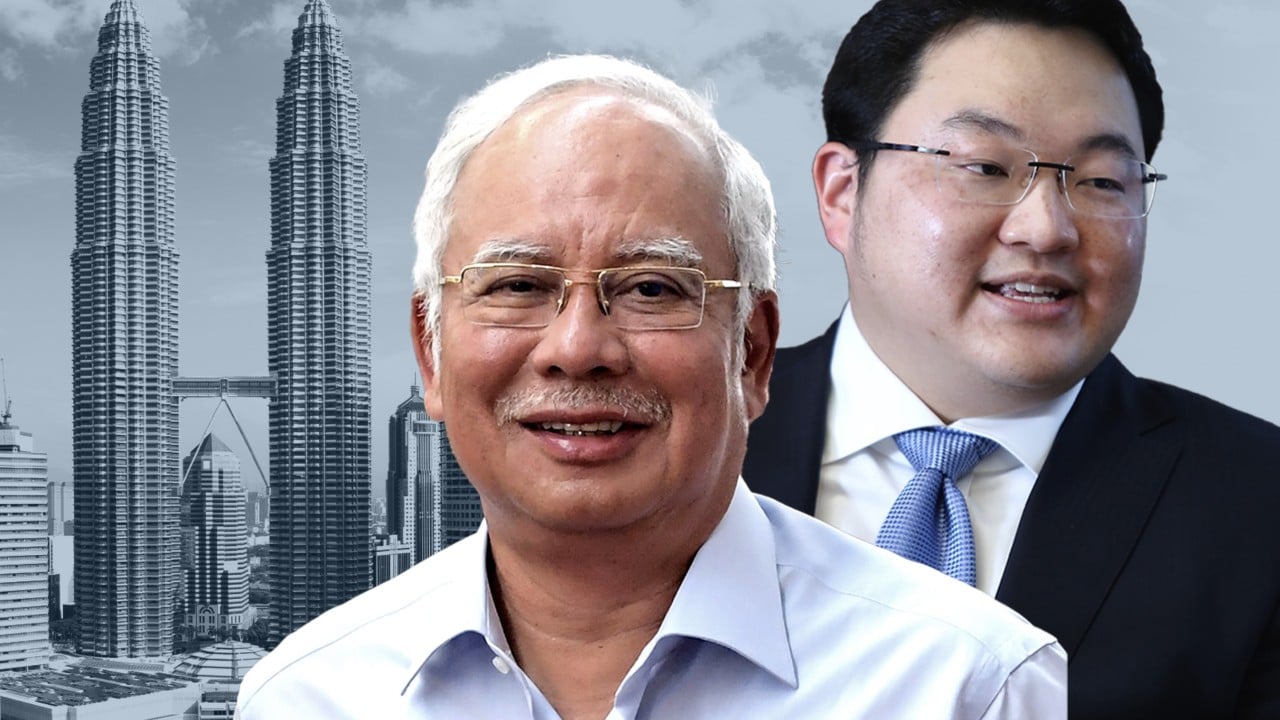

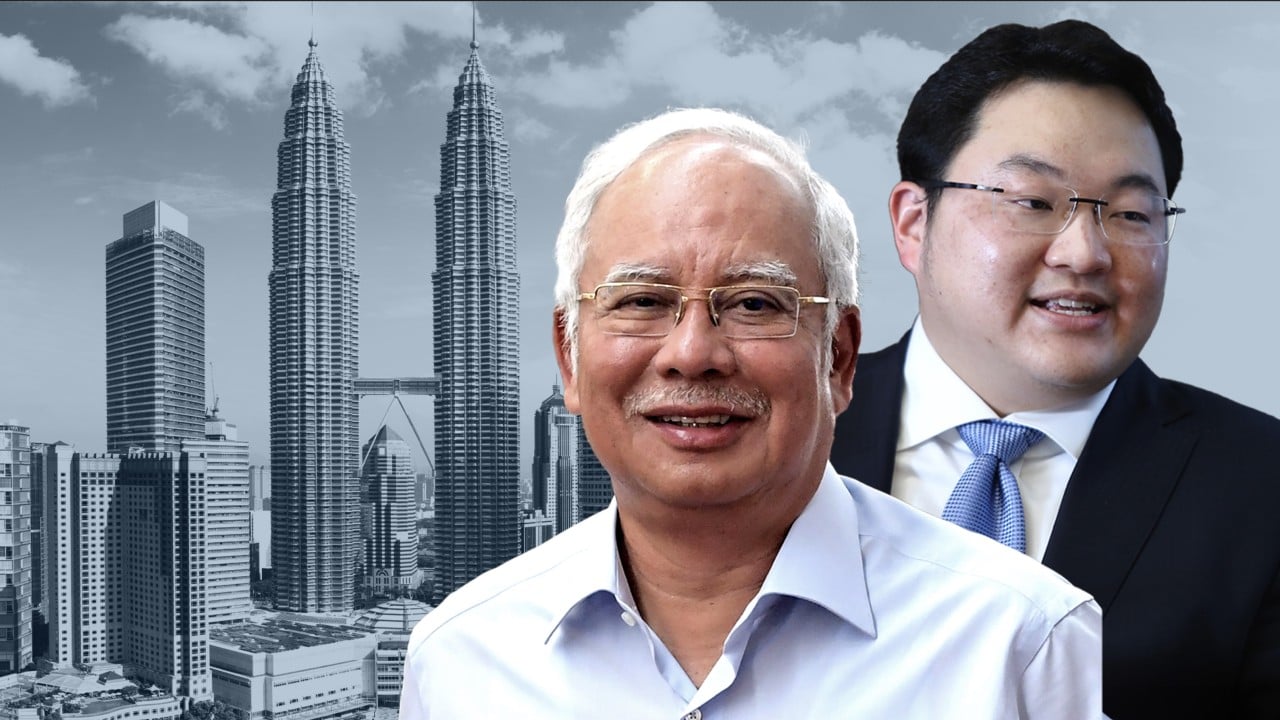

Prosecutors said the two men created the fraudulent scheme with fugitive Malaysian financier Jho Low, an adviser to former Malaysian prime minister Najib Razak, who is already in prison over his role in the multibillion-dollar scandal.

Initially extracting US$1 billion from 1MDB so it could buy a stake in their venture, the accused took a further US$830 million from the fund between 2010 and 2011 as part of an Islamic loan that followed on from their tie-up, prosecutors said.

Between September 2009 and at least July 2015 the accused arranged for bank accounts to be opened in Switzerland to help launder the millions, prosecutors said.

They used the money to buy real estate in Switzerland and London, jewellery and private equity, as well as to develop the PetroSaudi business from which they received a sizeable income, and to maintain “a lavish lifestyle”, prosecutors said.

1MDB earlier this year filed a lawsuit against Mahony seeking the return of the US$1.83 billion.

Malaysian and US investigators estimate a total of US$4.5 billion was siphoned away from 1MDB following its inception in 2009, implicating figures ranging from Razak, Goldman Sachs staff and high-level officials elsewhere.