To safeguard national security, Beijing will impose export controls on rare antimony metals, ores and oxides, as well as equipment for processing superhard materials.

In an online statement on Thursday, the Ministry of Commerce and the General Administration of Customs said the move, effective September 15, will help China defend its interests and also fulfil its non-proliferation obligations.

“It is a common international practice to implement export controls on items related to antimony and superhard materials,” said a spokesperson for the commerce ministry, adding that the ban does not target any specific country or region, and that exports would be permitted if they comply with regulations.

“We oppose any country or region using controlled items from China to engage in activities that harm China’s national sovereignty, security, and development interests,” the spokesperson said.

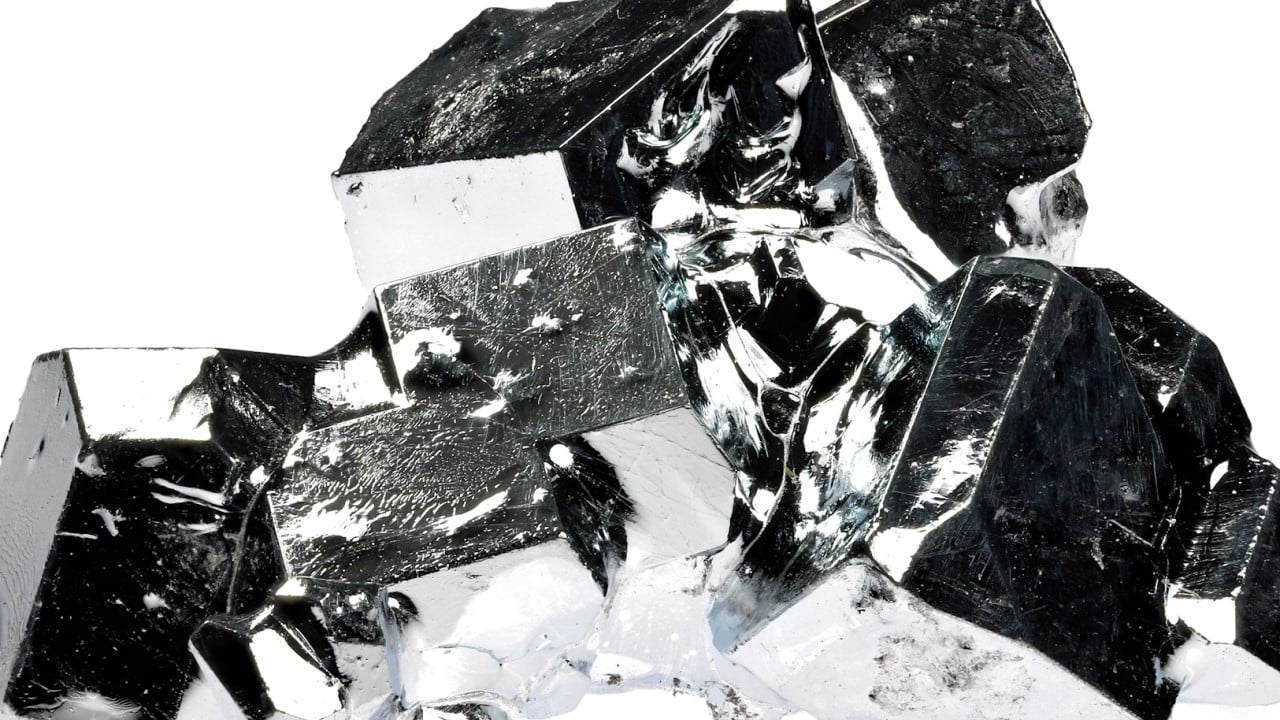

Common applications of antimony metal include its use as a hardener in lead for storage batteries, in alloys with lead and tin to improve properties for solders and bullets, as well as in semiconductor devices.

Antimony trioxide – the most important of the antimony compounds – is primarily used in flame-retardant formulations.

And the use of antimony trioxide as a clarifying agent in photovoltaic glass has been on the rise in the past years.

The US considers antimony a mineral critical to economic and national security – a distinction also held by rare earth elements such as cobalt and uranium, according to the US International Trade Commission.

In the US, the leading uses of antimony include antimonial lead and ammunition, as well as flame retardants, according to US Geological Survey in 2024.

Also included in the new restrictions are certain types of equipment for synthesizing superhard materials. That equipment includes cubic press machines, which can be used to make lab-grown diamonds.

Shi Yinhong, a professor of international relations at Beijing’s Renmin University, saw the move as a means to prevent any Chinese companies from trying to profit from global military conflicts through trade.

He said that some companies, “whether state-owned or private, which often conceal some of their sensitive activities, help in whatever way the belligerents of military conflict wherever in the world”.

Such economic activities can put the Chinese government in a “difficult or embarrassing” position, according to Shi.

He added that pressures to restrain those companies come from both China and the West.

China accounted for 63 per cent of all antimony metal and oxide imports by the US from 2019-22, the survey said, adding that China’s antimony mine production has fallen significantly over the past several years.

Still, China’s antimony ore production stood at 40,000 metric tonnes last year, accounting for nearly half of the world’s total.

Alicia Garcia-Herrero, chief economist for the Asia-Pacific region at French investment bank Natixis, called the move a “retaliation signal” by Beijing.

She said Beijing wants to show that “not only the US has export controls on dual technology”, and also that “China has military technology that they can weaponise”.

More to follow …