Major US stock indexes ended sharply lower on Monday as US recession worries shook global markets and drove investors out of risky assets, while Apple shares dropped as Berkshire Hathaway cut its stake in the company.

The recession concerns followed weak economic data last week, including Friday’s soft US payrolls report.

Indexes pared losses in late morning after data showed US services sector activity in July rebounded from a four-year low amid a rise in orders and employment.

Shares of Apple fell after Berkshire Hathaway halved its stake in the iPhone maker. Billionaire investor Warren Buffett also let cash at Berkshire soar to US$277 billion.

Nvidia, Microsoft and Alphabet also slid, while the Cboe Volatility index, Wall Street’s “fear gauge”, rose sharply.

Chicago Fed President Austan Goolsbee downplayed recession fears, but said Fed officials need to be aware of changes in the environment to avoid being too restrictive with interest rates.

“Today we’re seeing a sell-off as an extension of that anxiety that was felt last week,” said Neville Javeri, portfolio manager and head of the Empiric LT Equity team at Allspring in Washington.

It “started off with the jobs data last week, and it clearly led to the belief that the Fed needs to start being more proactive around where those unemployment numbers are going”, he said.

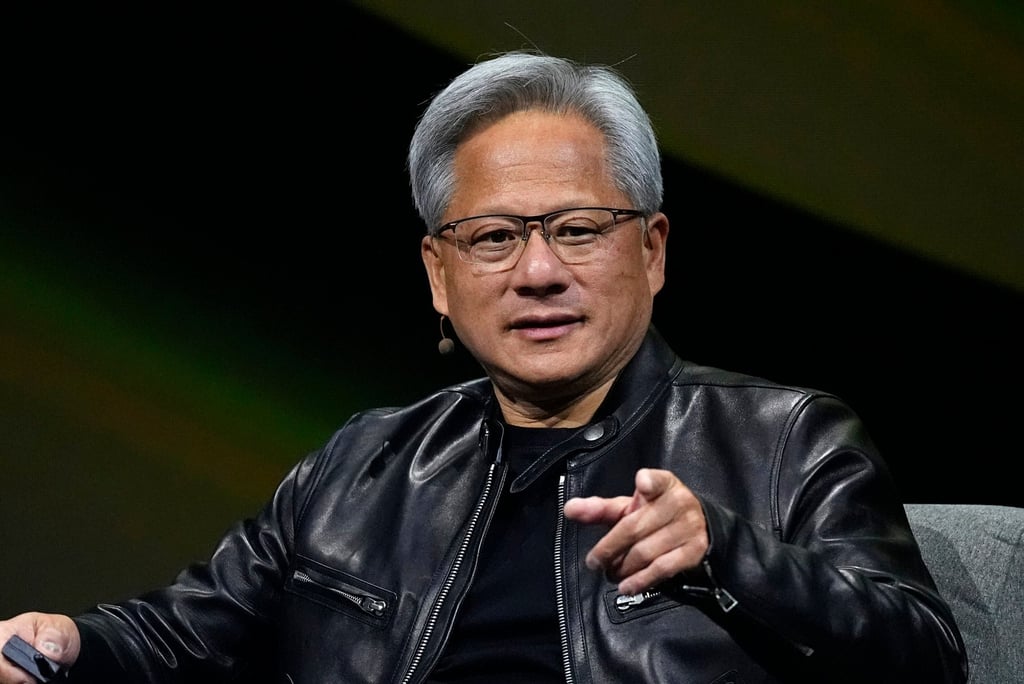

Jensen Huang shed a record amount of Nvidia shares from his portfolio last month, bringing his total stock sales to nearly US$500 million this summer and putting the CEO of the chip titan ahead of the brutal global stock sell-off.

According to filings with the Securities and Exchange Commission, Taiwan-born Huang sold US$322.7 million worth of his company’s shares in July and has sold nearly US$500 million in stock this summer.

The sales are part of a pre-determined trading plan Huang filed in March, and the transactions were well-timed.

The CEO got ahead of the broader selloff in tech, which gathered momentum last Thursday after a slew of weak economic data and missed tech earnings.

Nvidia stock, in particular, has been under pressure even before the latest bout of market volatility, as investors begin to question the impact of heavy artificial intelligence spending on corporate earnings.

The stock dropped another 7 per cent on Monday, bringing the total decline over the last month to around 20 per cent.

According to preliminary data on Monday, the S&P 500 lost 159.20 points, or 2.98 per cent, to end at 5,187.36 points, while the Nasdaq Composite lost 567.78 points, or 3.38 per cent, to 16,208.38. The Dow Jones Industrial Average fell 1,030.47 points, or 2.59 per cent, to 38,706.79.

The weak jobs report and shrinking manufacturing activity in the world’s largest economy added to worries following recent disappointing forecasts from the big US technology companies. The Nasdaq Composite on Friday confirmed it was in correction territory.

The so-called Magnificent Seven group of stocks has been the main driver for the indexes hitting record highs this year.

Traders also attributed some weakness in stocks to unwinding of sharp positions of carry trades, where investors borrow money from economies with low interest rates such as Japan or Switzerland to fund their bets in high-yielding assets elsewhere.

US Treasury yields tumbled to their lowest level in a year and a closely watched gap between two- and 10-year Treasury notes turned positive for the first time since July 2022, usually indicating the economy is heading into a downturn.

Traders now see a 92.5 per cent probability that the US central bank will cut benchmark rates by 50 basis points in September, compared with an 11 per cent chance seen last week, according to CME’s FedWatch Tool.

Pringles maker Kellanova soared after a Reuters report said confectionery giant Mars was exploring a potential buyout of the company.

Additional reporting by Business Insider