Dangerous squabbles in remote Himalayan borderlands between China and India may, at least for now, have been soothed by a recent meeting between the two nations’ top diplomats.

But the Indian Ocean looms as the next potential flashpoint, security analysts say, as New Delhi flashes increasingly anxious eyes at Beijing’s ports and ship deployments across a vast expanse of water in India’s backyard – but crucial to China’s supply of oil.

In July, on the sidelines of an Asean (Association of Southeast Asian Nations) meeting in Laos, S. Jaishankar and Wang Yi, the respective foreign ministers of India and China, agreed to thrash out differences that have resulted in mobilisation of troops along their shared Himalayan border.

The diplomats agreed “to work with purpose and urgency to achieve complete disengagement at the earliest”, according to a statement by India’s Ministry of External Affairs.

The meeting – which followed a visit by Indian Prime Minister Narendra Modi to Russia – left hints that their common friend Moscow may have played a role in nudging the two Asian giants towards calming tensions along a border, which flared into war in 1962 and have since seen sometimes deadly skirmishes between rival militaries, the worst in 2020 leaving 20 Indian and four Chinese troops dead.

Russia probably “urged both countries to put aside [their] differences”, said Christopher Blackburn, a British political and security analyst. “It looks like they have listened.”

With the mountain border spat simmering down, analysts say control and influence in the Indian Ocean presents a new and formidable challenge.

China, which relies on free passage of the ocean for 80 per cent of its crude oil imports, has steadily accumulated strategic ports and related infrastructure in a zone which stretches from the Arabian Sea to the Strait of Malacca, sharply aware of its vulnerability to blockades in vast, open waters in the event of a major conflict.

Yet its investment has raised alarm bells in Delhi which views the Indian Ocean as its home turf yet is playing catch up with its own investments.

“The sea route from the Middle East to the coastal cities of China is running through the Malacca Strait, which is a location that the US and India can blockade,” said Satoru Nagao, a non-resident fellow at the Hudson Institute focusing on US-Japan-India security cooperation.

The scenario is dubbed by analysts as the “Malacca Dilemma”, in which naval forces of rival powers such as the United States or India could disrupt Beijing’s vital supply route.

The Indian Ocean region has thus far been relatively unscathed by the disruptions roiling global shipping routes thanks to the Israel-Gaza and Russia-Ukraine wars.

Indian policymakers are looking to China’s frequent run-ins with Southeast Asian neighbours in the South China Sea as a guide to how China’s strategic imprints can over time become painful pinch points between nations.

From port projects in Sri Lanka and Sudan, Kenya and Pakistan, China has built a network of assets referred to as a “string of pearls” that is perceived by Delhi and others to have encircled India.

Beijing’s Belt and Road Initiative – which has enrolled Bangladesh, the Maldives, Nepal, Pakistan and Sri Lanka – has further fuelled concerns in India, which lags behind in economic might, diplomatic currency with fractious neighbours, as well as in the capacity to deliver its own state-backed mega-projects, including ports in the remote Andaman and Nicobar Islands and Sittwe in Myanmar.

Wider competition is setting the tone of relations between the world’s two most populous nations.

While the Indian economy is largely pegged to the service sector, Modi’s government has been vying for a slice of China’s global manufacturing pie by doling out incentives and slashing India’s notorious red tape to access a large, cheap labour pool.

Meanwhile, Modi and China’s leader Xi Jinping have rarely met face to face since the Himalayan stand-off.

“Relations with China are not doing very well,” said Jaishankar, referring to the still unresolved border issues between the two countries, at a news conference in Tokyo on the sidelines of a Quad meeting this week.

“For India the primary question in the Indian Ocean region is security,” said Aditya Gowdara Shivamurthy, associate fellow with the Delhi-based Observer Research Foundation. “For China, it is crucial to win in the Indian Ocean because it cements its position as the Asian power.”

‘Suspect behaviour’

At the same time as financing and building ports, China’s naval presence is growing. The presence of its ships in the Indian Ocean has stirred suspicion from Delhi that so-called “research vessels” deployed by Beijing are in fact spy ships.

Earlier this year, two Chinese research vessels were spotted near India’s coast. In March, one was spotted near the Bay of Bengal region, which followed the docking of another vessel at a Maldivian Port.

Beijing says its vessels are simply carrying out ocean-bed surveys for scientific reasons. But Indian officials allege such vessels have a habit of “going dark” or turning off the vessels’ automatic identification system transponders.

Shivamurthy says these ships are believed to be manned by the People’s Liberation Army “and we don’t know much about their use”.

A January report by the Washington-based Center for Strategic and International Studies alleged that 80 per cent of Chinese civilian research vessels had “demonstrated suspect behaviour or possess organisational links”, suggesting that their work was connected to military objectives.

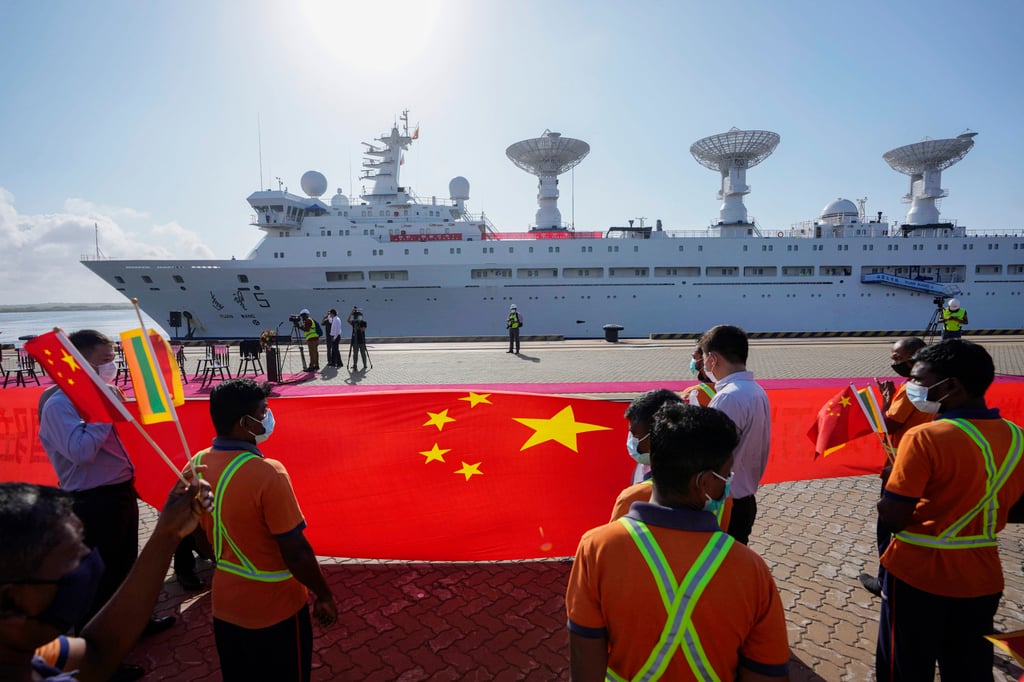

Suspicions intensified last October when Beijing docked a vessel – Shi Yan 6 – at Sri Lanka’s main port of Colombo.

It was virtually a replay of another Chinese research vessel, Yuan Wang 5, which docked at Hambantota Port in August 2022. The port is under a 99-year lease to the Chinese-state owned company that built it after Colombo failed to service a US$1.4 billion loan to pay for the project.

“India protested but could not succeed in getting the Yuan Wang 5 out of Hambantota,” said Srikanth Kondapalli, the dean of the School of International Studies and a professor of China studies at Jawaharlal Nehru University (JNU) in India.

“This incident indicated that China has more rights and say on Hambantota than the Sri Lankans themselves,” he added, noting that there was an opportunity for Beijing to move “military-related assets” to such ports in the future.

In January, Sri Lanka declared a moratorium on foreign research ships entering its waters for a year, in a move observers say was linked to pressure from Delhi.

But last month Sri Lankan Foreign Minister Ali Sabry told Japanese state media NHK that it would resume permitting calls from foreign research vessels at its ports from next year as the government “cannot only block China”.

Japan – along with India and France – is a co-chair of Sri Lanka’s Official Creditors’ Committee that in June firmed up a debt treatment deal with Sri Lanka.

China’s expanding activities in the Indian Ocean region are viewed as a “big threat” by India, according to Nagao from the Hudson Institute.

No base for conflict

Despite China’s accumulation of infrastructure assets in the Indian Ocean region, analysts say most are for commercial and not military purposes. Moreover, without a naval base, Chinese vessels will be dangerously exposed in the event of a violent flashpoint.

“The Chinese navy and the Indian navy can never be in a situation of confrontation unless China has a base in the Indian Ocean,” Shivamurthy said. “China might have economic and military leverage but India has geopolitical leverage.”

The Pentagon’s 2023 China Military Power Report published in October says China’s navy has about 370 warships, which is expected to grow to 435 ships by 2030.

The US fleet is smaller, with about 280 vessels and expected to reach only 300 in the early 2030s. In comparison, India possesses around 130 warships that is expected to grow to 160 by 2030.

“India has the advantage of geography because China is a far-off country,” said Manoj Joshi, a security expert at the Observer Research Foundation, adding without naval bases in the Indian Ocean any ambitions by China will be limited.

“But China sees itself as competing with the US rather than India.”

India could easily defend itself even with a smaller naval fleet size, he said, adding that the chances of a conflict was likely to arise only if Delhi decided to take a strong stance against Beijing in the event of a future conflict, such as siding with Taiwan.

Beijing sees the island as part of China and has never ruled out the use of force to take it back. Most countries, including the US, do not see Taiwan as an independent state, but are opposed to a change of status quo by force.

In the event of a full-scale war over Taiwan, Chinese oil tankers traversing the Indian Ocean could be sunk or captured, draining their capacity to engage in a sustained conflict, analysts say.

The Pentagon report listed 11 potential Chinese bases in the Indian Ocean, including in Sri Lanka, Pakistan and Tanzania. These locations align with Beijing’s diplomatic and commercial initiatives under its belt and road programme but have not materialised into military assets.

The report noted that China has “little power projection capability” in the Indian Ocean.

Experts also note that China does not have “tactical air support” for any naval deployments into the Indian Ocean.

“The Chinese may bring the aircraft carriers into the Indian Ocean, but they are sitting ducks,” Kondapalli said.

Meanwhile, Nagao argues that the Indian navy alone will not be able to deal with China.

“However, China is alone, and India is not … the number of political partners has been a decisive factor in geopolitical struggles,” he added.

Delhi and friends

As Delhi is spooked by China’s growing footprint, India may need to tug harder on its partnerships with other countries including co-members of the “Quad” group – the US, Japan and Australia.

“The challenge is bound to get more pronounced,” said Harsh Pant, a professor of international relations at King’s College London, noting the risk of further Chinese expansion especially if the US-China rivalry again comes to boiling point in coming months.

Donald Trump, the front runner in the US presidential election, adopted a hardline stance towards China in his previous term, lumping blanket tariffs on Chinese goods and talking tough on their rivalry. President Joe Biden has extended the trade war, determined to tuck back in the rise of Chinese tech.

“If US-China rivalry escalates, China is going to push for these [port] projects across the world. India will also have to recalibrate its responses accordingly,” Pant said.

Delhi’s option to stave off any metastasising presence in its neighbourhood will be to leverage its partnerships with the European Union, Japan and the US and build more strategic assets across nations craving investment but lacking in cash.

“China has more money but we [India] bring different capabilities. We bring partners like the EU, US and Japan,” Pant said, adding that it was vital for India to build outposts.

In October, India will hold naval exercises in the Bay of Bengal region with its Quad group members, manoeuvres which cannot fail to catch Beijing’s attention.

At the same time, to avoid onerous state spending and the risk of bungled delivery, the South Asian country may also support private enterprises to build new infrastructure in countries with major needs from Sri Lanka and Bangladesh to the Maldives.

Last December, India’s Adani group, controlled by one of Asia’s richest people Gautam Adani, launched a project to develop the Colombo West International Terminal project in Sri Lanka’s capital, backed by more than US$500 million in funding from a US government agency.

From energy generation to telecommunications, a slew of other private firms are eyeing projects across the region, industry officials say, a potential to outbox Chinese investment in a crucial region.

Last year, Adani’s companies faced a major stock rout following accusations from short-seller Hindenburg Research, which alleged widespread fraud and stock market manipulation by the conglomerate. But the group has bounced back on infrastructure bets, with shares of Adani ports jumping to record highs in June.

There have also been reports the billionaire shares close ties to Modi, implying his business plans align with Modi’s economic growth strategy for India.

China too has marked its presence with projects such as the China-Maldives Friendship Bridge in the Maldives, the first cross-sea bridge built on the Indian Ocean.

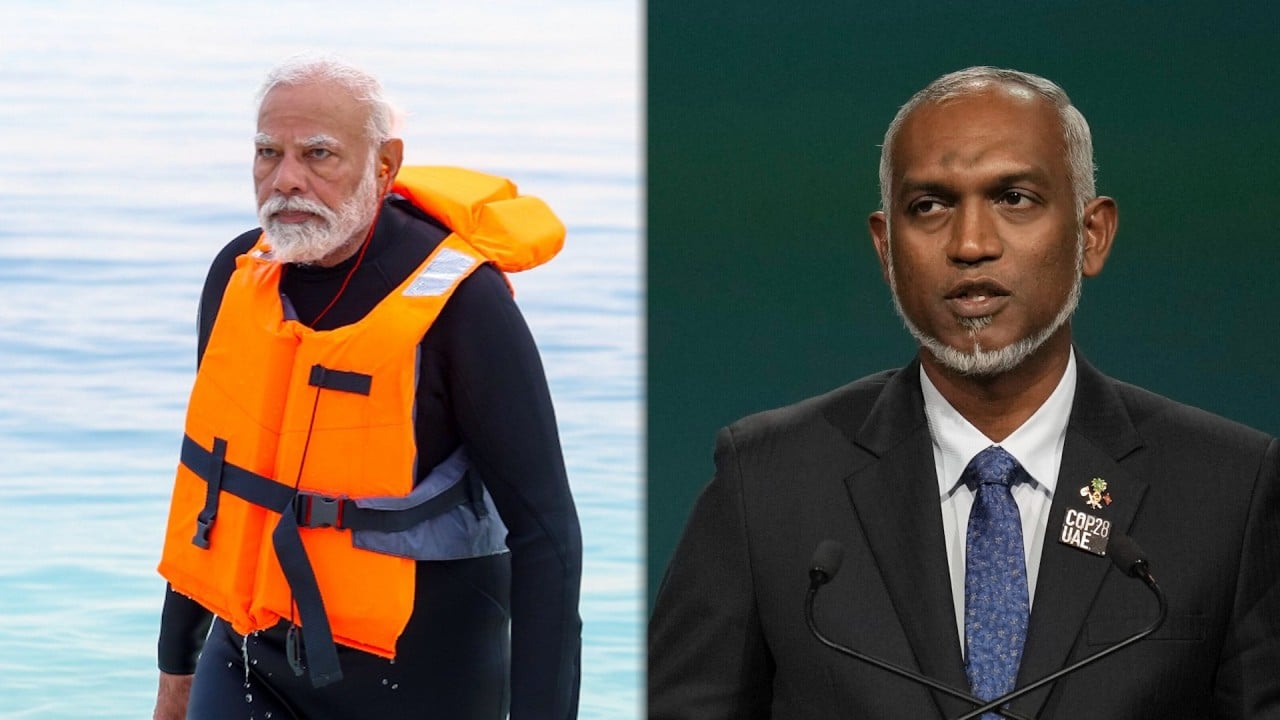

Ties between India and the Maldives came under strain after President Mohamed Muizzu was elected on an anti-India campaign late last year. But since then the island country has sought to mend fences with rounds of diplomatic visits and invites by Indian policymakers.

“China’s economic footprint will continue to expand in the global South and Central Asia as the US and perhaps Europe become increasingly hostile,” said Einar Tangen, a senior fellow at the Taihe Institute think tank in Beijing.

Now there are guide ropes for de-escalation in the Himalayas, experts say China, the world’s second-ranked economy, may next have to take the lead in defusing tensions or suspicions over its plans in the Indian Ocean region.

“If China can show a willingness to engage with its neighbours and lower its aggression and expansive policies, then … I don’t see a potential conflict in the Indian Ocean. But the onus is on China to stop being so aggressive,” Blackburn said.

“Can it deliver on its promises to India? We shall see.”