The US’ China containment strategy and its shift towards re-industrialisation are shrinking the market for competitive industries in high-income economies. Ultimately, these economies could face increasing competition with a technologically independent China, as well as higher prices for raw materials.

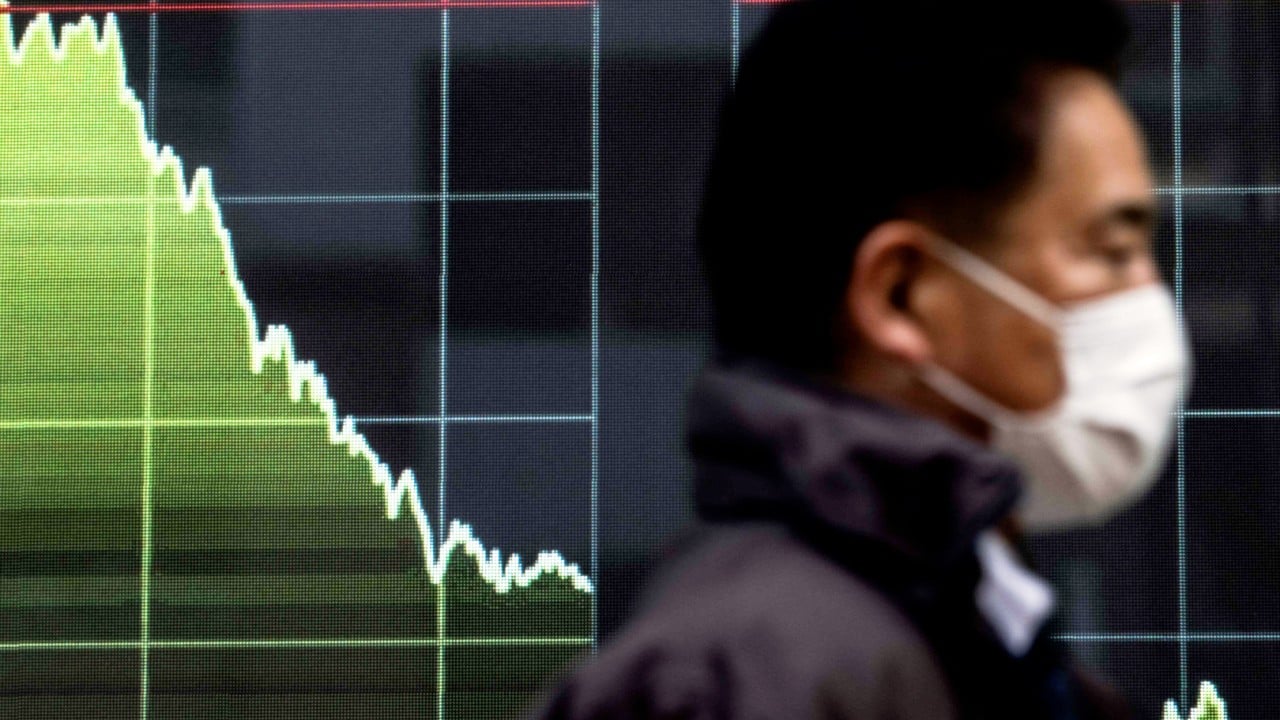

The squeeze on multiple fronts may push them into middle-income status. Currencies such as the yen, the euro, the won and even the New Taiwan dollar have been on trajectories similar to that of a secular bear market.

High-income economies, such as Germany, Japan and South Korea, carved out their competitive niches in the US-centric global economy after World War II. They achieved an edge with pricing power in specific areas such as technology, manufacturing or branding.

Pricing power in the right sectors is the key to reaching high-income status. After China launched the reform and opening up policy four decades ago and entered the global economy, the advantages that high-income economies had gained were amplified. Costs were lowered by some of them shifting production to China.

This equilibrium has been under stress with China’s rapid technological development and improved manufacturing sophistication. The price war in China’s car market is a good example. The market is the biggest in the world and has been dominated by multinational companies for decades. They produced cars in China at low cost and sold them at high prices. The rise of Chinese car manufacturers has changed that dynamic. Global carmakers now face a prolonged crisis.

The US’ containment strategy towards China is another blow to these advanced economies. The US wants to dent or reverse China’s tech rise. One method of doing this is cutting off China from the hi-tech supply chain.

Restrictions on China’s access to the equipment needed for making chips are perhaps the best illustration. They shrink the market for these high-income powers. As China develops its own supply chain, it will compete in overseas markets, further denting their revenues.

US sanctions haven’t worked out well so far. China’s technological advancements show no sign of slowing down. However, the next US administration, whether it is run by the country’s vice-president Kamala Harris or former president Donald Trump, is likely to expand tech sanctions on China.

US chip equipment manufacturers have been able to sell more products that existing sanctions don’t apply to yet, more than likely compensating for any lost sales. But if the US expands the sanctions list sharply next year, revenues could significantly decline.

In response, China is likely to pour more resources into technologies that the US denies it access to. If that strategy is successful, it could mean the permanent loss of the Chinese market and, over time, competition in other markets. When it comes to production, China has lower costs and a larger scale. Middle powers such as Germany and Japan will be at a considerable disadvantage.

The US has been aiming to re-industrialise for years and there seems to be a sense of urgency among US policy elites. Manufacturing subsidies in the Inflation Reduction Act are a case in point.

The next administration is likely to step up measures to support national industries. Subsidies could be expanded, with a continued role for the free market of course. Tariffs could be increased for other countries aside from China. Procurement by the US government and its contractors could become conditional on production localisation.

One of the quickest ways for the US to re-industrialise is by relocating production away from its allies to within its own borders. However, relying on local capacity has not worked and is unlikely to work in the future.

The loss of access to China’s market, increased Chinese competition and decreased exports to the US could hollow out the economies of middle powers. They could also be pressured into buying energy and minerals from the US. Their terms of trade are on a slippery downward slope.

The strength of currencies in high-income economies depends on their terms of trade. When they lose industries with pricing power, they are arguably no different from middle-income economies. In the current geopolitical environment, their currencies are facing a downward trend. What is happening to the yen will expand to other middle power currencies.

The US dollar is overvalued, as shown by the US’ large current account and fiscal deficits. As the currencies of middle powers decline, the dollar will become more overvalued.

The dollar is held up by money inflow. The dollar’s dominance in the global currency market makes this possible.

East Asia accounts for much of global savings. Some US politicians have discussed the possibility of a war over Taiwan. One effect of this has been scaring rich people in the region to move money out. That potentially leads to more purchases of dollar assets.

The US needs a realistic value for the dollar to make its re-industrialisation viable in the long run. That will require China revaluing its currency. However, China cannot be coerced into doing so, as Japan was in the 1985 Plaza Accords. The US would have to make a deal with China to achieve that. China would certainly demand many concessions in return. When the US is willing to properly deal with China, the dollar’s value will normalise.

Dr Andy Xie is a Shanghai-based independent economist specialising in China and Asia, and writes, speaks and consults on global economics and financial markets