Sales of distressed real estate in Hong Kong jumped in the first half of the year, accounting for about three quarters of the volume, with the coming months likely to see an unusually high number of such transactions, according to CBRE.

Distressed sales typically account for less than 10 per cent of transactions in the city, but with interest rates climbing to a 23-year high in a span of 16 months since March 2022, investors have found it increasingly difficult to service debt, the property consultancy said.

In the first six months of the year, overall deals amounted to HK$23.1 billion (US$2.95 billion), the second-lowest half-year total since the second quarter of 2008, CBRE said. Fire sales accounted for HK$16.8 billion or 73 per cent of the total investment in the period.

“In the second half, there will be something like 50 per cent of [distressed sales] because interest rates are still at a high level and a rate cut is unlikely to happen earlier than September,” said Reeves Yan, executive director and head of capital markets at CBRE Hong Kong.

Many existing owners are facing tremendous pressure from the high interest costs of around 6 per cent, while the return on property assets is about 3.5 per cent, he added.

In May, a 5,171 sq ft mansion, 10B at Black’s Link on The Peak, linked to Hui Ka-yan, the founder of the liquidated China Evergrande Group, was sold by creditors to a privately owned company for HK$448 million. The amount was 44 per cent less than the HK$800 million that appraisers had estimated the property to be worth.

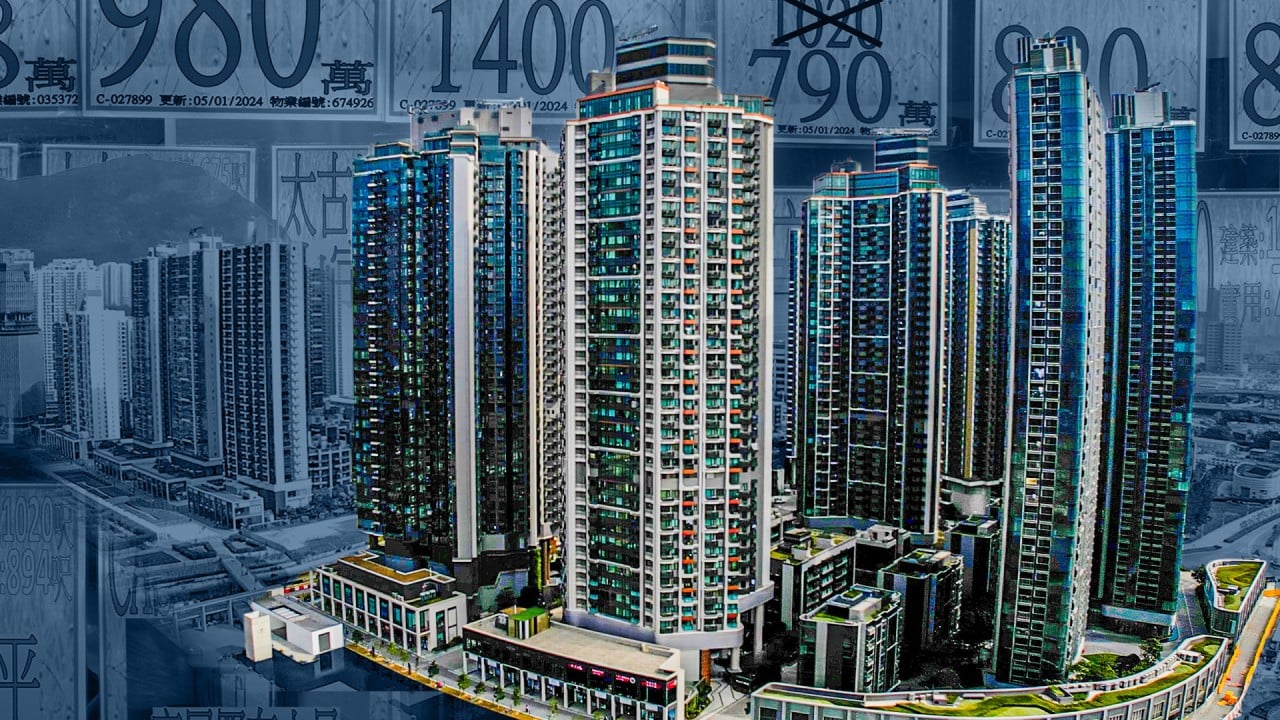

One HarbourGate East Tower in Hung Hom, one of the many assets seized last year from Chinese tycoon Chen Hongtian, has been put on sale for a second time amid weak office market sentiment.

Receivers put the tower back on the market for a new round of bidding, according to a statement last week by Savills, the sole agent for the sale.

The prime harbourfront property was valued at around HK$7 billion in 2022, Savills said when it was first put on the market in May 2023. The property was bought for HK$4.5 billion in 2016.

Other market observers noted that with interest rates remaining higher for longer, more distressed transactions were likely and banks would be pressed to start seizing assets to satisfy debt obligations.