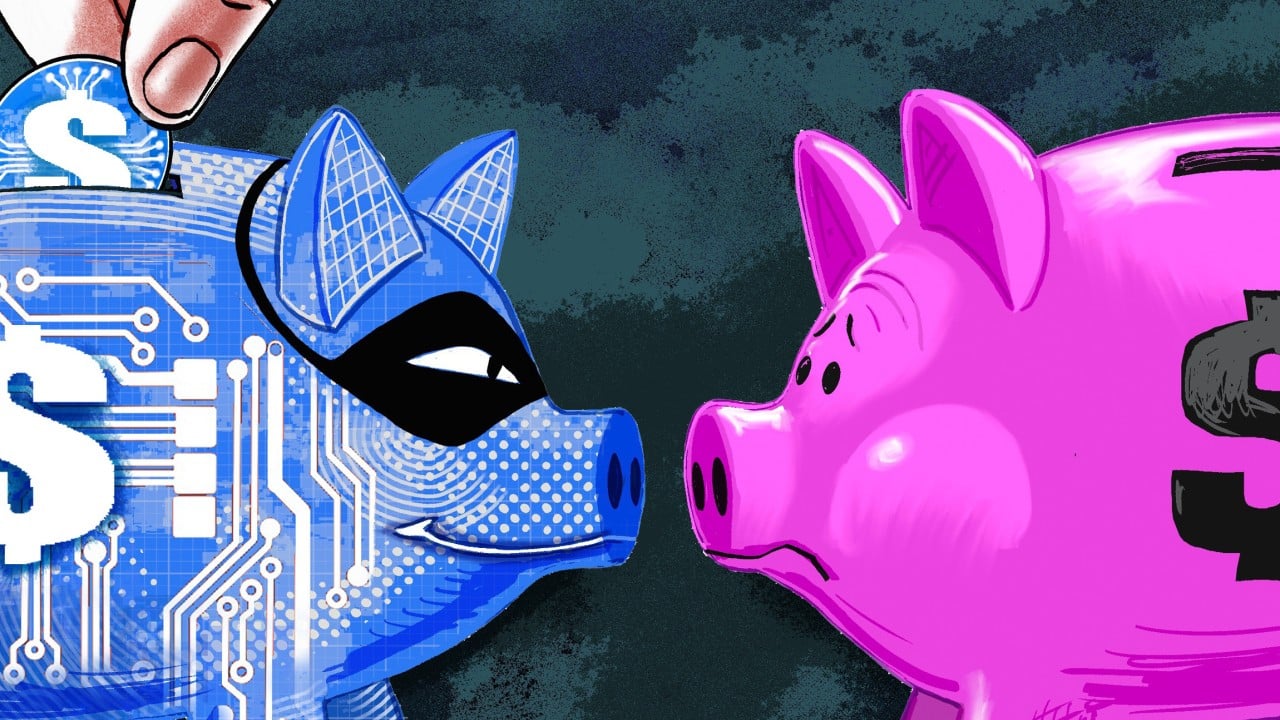

The fascination with cryptocurrencies shows no sign of fading. With the passage of the Guiding and Establishing National Innovation for US Stablecoins (Genius) Act in July, US lawmakers added to the sense that crypto is here to stay. But an uncomfortable issue remains unresolved: are cryptocurrencies a genuine innovation capable of serving the common good, or a speculative threat to financial and social stability?

Not all cryptocurrencies are alike. Unbacked ones, such as bitcoin or Ethereum, have no underlying assets. Backed cryptocurrencies, including stablecoins, attempt to anchor their value through holdings of real-world assets, such as dollars. Nonetheless, the same two questions apply: are they viable? And, if so, do they benefit society?

While humility requires that we not claim certainty about the answer to the first question, the second one must be met with a resounding no. Crypto innovation has some valuable features but the proliferation of private digital assets has also widened the gap between private and social interests.

Advertisement

Bitcoin is the archetype of an unbacked cryptocurrency with no intrinsic value. Its valuation represents what economists call a pure bubble. But not all bubbles burst immediately. Gold has been trading for millennia at prices far above its “fundamental” value. Could bitcoin become the new gold? Possibly. At most, we can be confident very few of the hundreds of thousands of cryptocurrencies that have emerged will survive.

The social damage stemming from unbacked crypto is clearer. One cost is a diversion of seigniorage. In traditional systems, the gains from issuing money flow to the community via the state; with crypto, that privilege is privatised or wasted. Another problem is crime. Bitcoin and similar assets are notorious for facilitating tax evasion, money laundering and illicit finance.

Advertisement

Then there are the implications for macroeconomic policymaking. Central banks can stabilise economies and prevent financial contagion only if they control liquidity during crises. And unbacked cryptocurrencies lack any form of investor protection.