[The content of this article has been produced by our advertising partner.]

As Hong Kong advances toward regulated digital money, a new era of digital payments is taking shape. With the Hong Kong Monetary Authority (HKMA) preparing for licensed, fully asset-backed HKD stablecoins as early as 2026, the city is moving beyond the volatility of “crypto” and into a future of where money moves instantly, securely and at lower cost.

Stablecoins Are Not Crypto — They Are Digital Cash

Advertisement

For many people, “cryptocurrency” brings to mind speculation. But Hong Kong’s regulated stablecoins are different. They function like a digital upgrade to the Hong Kong Dollar— safe, backed by high quality reserves, and able to move 24/7 across the internet. This framework ensures stability, transparency, and consumer-protection standards.

Practical Benefits for Consumers and Merchants

Advertisement

These upcoming HKD stablecoins and tokenized deposits will unlock real value for everyday users. Consumers can expect faster refunds, quicker cross border payments, and more transparent foreign exchange rates. Instead of waiting days for a refund, digital HKD can return to your wallet instantly.

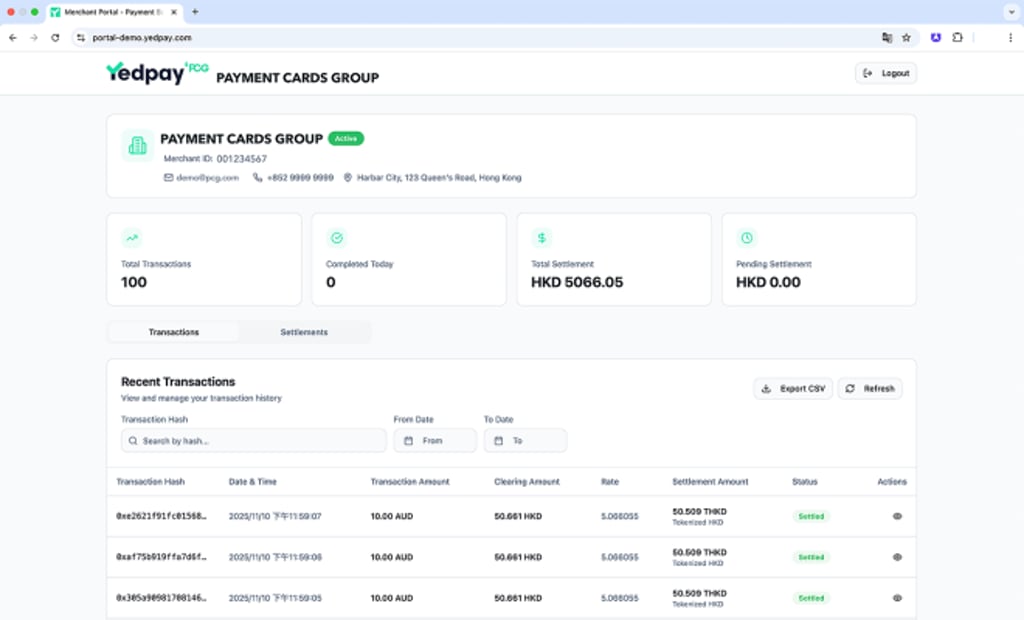

Merchants stand to benefit even more. Traditional payment settlement often involves delays and high costs. Stablecoin based settlement improves cash flow, supports instant reconciliation, and reduces friction from FX conversions — especially for cross border or ecommerce transactions. This enables businesses to operate with greater visibility and certainty over their daily cash position.

Advertisement

Seamless Upgrade to Card Payments — No Change to User Experience

The innovation lies in the backend. Consumers will continue to pay with their cards as usual, while settlement shifts to faster digital rails. Payment Cards Group (PCG) has been one of the first movers in proving this model. “We believe the future of payments is not about replacing the old, but about integrating innovative technology to enhance what already works.,” said Beatrice Tai, Co-founder & COO of PCG. “Card payments can seamlessly run on these new stablecoin rails, combining the security and convenience of the card network with the efficiency of digital currency.”

Advertisement

Cyberport Sharing and Pilot Success

PCG is positioning itself as a first mover in this transformation. PCG recently completed its Cyberport backed pilot under the “Blockchain & Digital Asset Pilot Subsidy Scheme (BCDA),” demonstrating how regulated stablecoins can enhance Hong Kong’s payment infrastructure. The project is supported by the sponsor JETCO — Hong Kong’s shared ATM network and a key payments infrastructure operator.

Advertisement

PCG also shared insights from this pilot on 10 December at Cyberport, offering the public and media a first look at how stablecoin settlement can modernize Hong Kong’s payment ecosystem.

A New Chapter for Hong Kong

Advertisement

Hong Kong’s roadmap for regulated digital money represents more than technological progress — it is a step toward a more efficient, secure, and inclusive financial future. With industry players like PCG leading real world testing, stablecoin settlement is poised to become a core part of how money moves in Hong Kong in the years ahead.

Advertisement