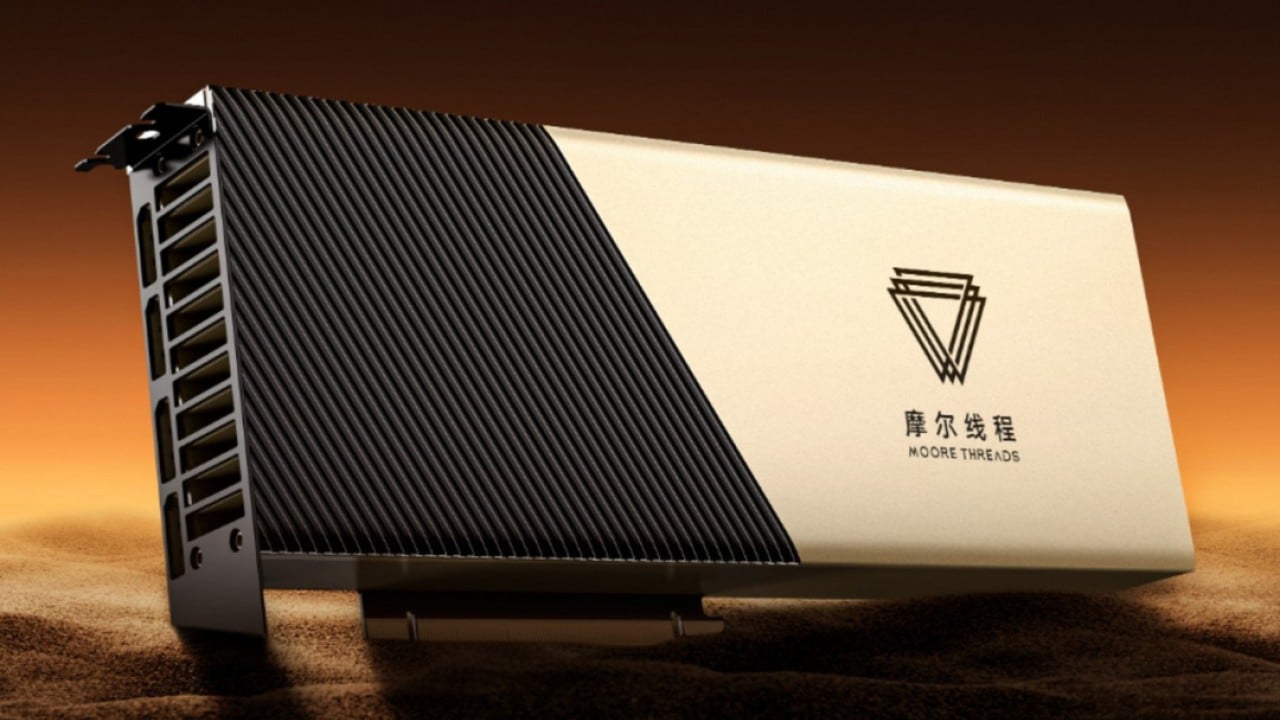

Chinese onshore investor frenzy for artificial intelligence chips has intensified, with the initial public offering (IPO) of Beijing-based graphics processing unit (GPU) maker Moore Threads drawing more than 4,000 times subscription from retail investors this week.

The red-hot demand for Moore Threads highlights China’s determination to build home-grown alternatives to Nvidia’s chips, and is expected to accelerate listing plans for other domestic GPU developers, from MetaX to Biren Technology.

Cambricon Technologies, a Shanghai-listed AI chipmaker, has also become one of the most sought-after stocks in the city, with its share price doubling in 2025.

Advertisement

Backed by tech giants including Tencent Holdings and ByteDance, Moore Threads opened lottery-style subscriptions on Monday at an IPO price of 114.28 yuan.

Online orders from retail investors exceeded the number of shares on offer by more than 4,000 times, resulting in a final allotment rate of just 0.036 per cent, according to a company filing on Wednesday.

Advertisement

On Shanghai’s Nasdaq-style Star Market, qualified institutional investors receive proportionate allocations, while retail investors subscribe through a system akin to a lucky draw.

Moore Threads raised about 8 billion yuan, valuing the company at 53.7 billion yuan. Its debut date has yet to be finalised.