Published: 8:30am, 11 Oct 2025Updated: 8:34am, 11 Oct 2025

This is the sixth and final part of the exclusive Capital Connectors series in which influential Chinese and global bankers reveal the opportunities and challenges for Hong Kong in its evolution as an international financial hub.

Advertisement

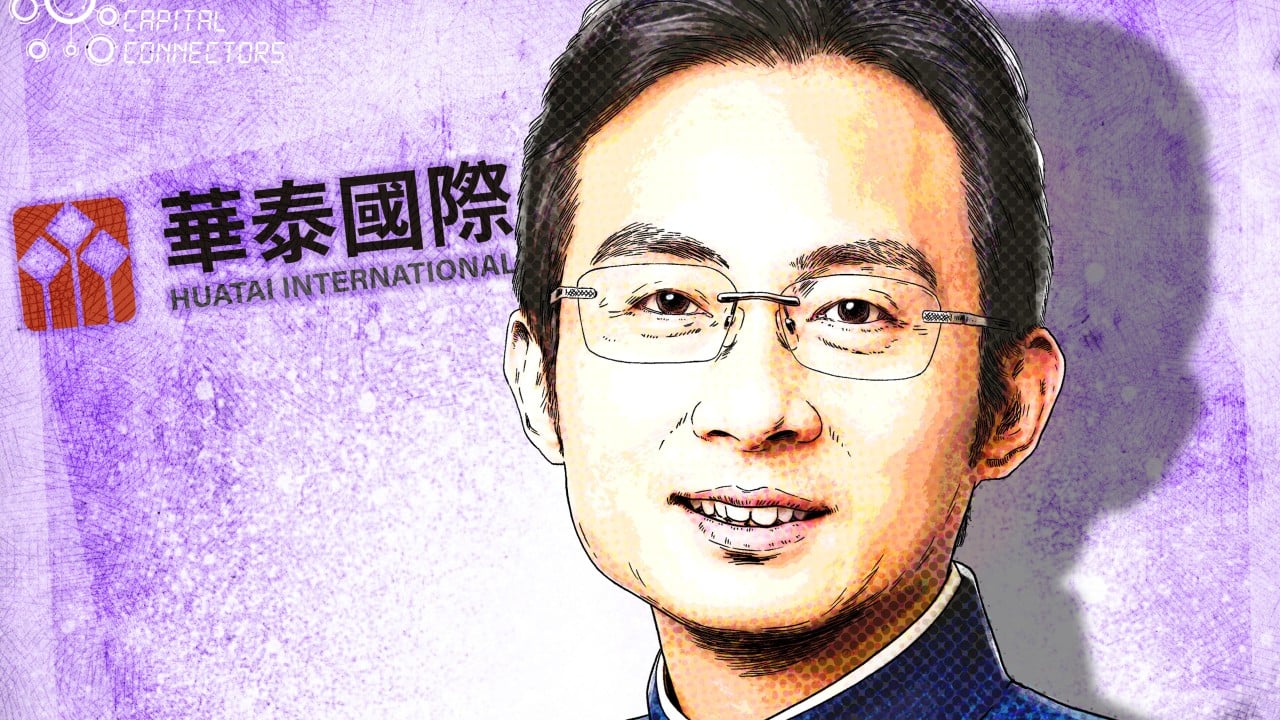

If history serves as a guide, Hong Kong’s continued reign as a premier international financial centre depends on a time-tested formula: adapting to meet evolving needs, particularly in response to the development of China’s economy, according to Wang Lei, CEO of Huatai Financial Holdings.

From introducing red chips and H-shares to the creation of Chapter 18A and Chapter 18C listing rules and confidential filings, Hong Kong’s financial innovation over the decades not only served foreign capital, but more importantly, met the evolving needs of mainland China’s opening-up and reforms.

Now, as China pivots towards tech self-sufficiency and advanced manufacturing development, Hong Kong faces a new task, according to Wang.

“Hong Kong’s success as an international financial hub always lies in how it meets the motherland’s financing demands,” he said. “Like in the past, this will remain a tremendous opportunity for Hong Kong in this new era.”

Wang, who is also a member of the Hong Kong Chief Executive’s Council of Advisers, said the city needed to design “financial frameworks focusing on specialised technology sectors to support [capital needs from] global companies”.