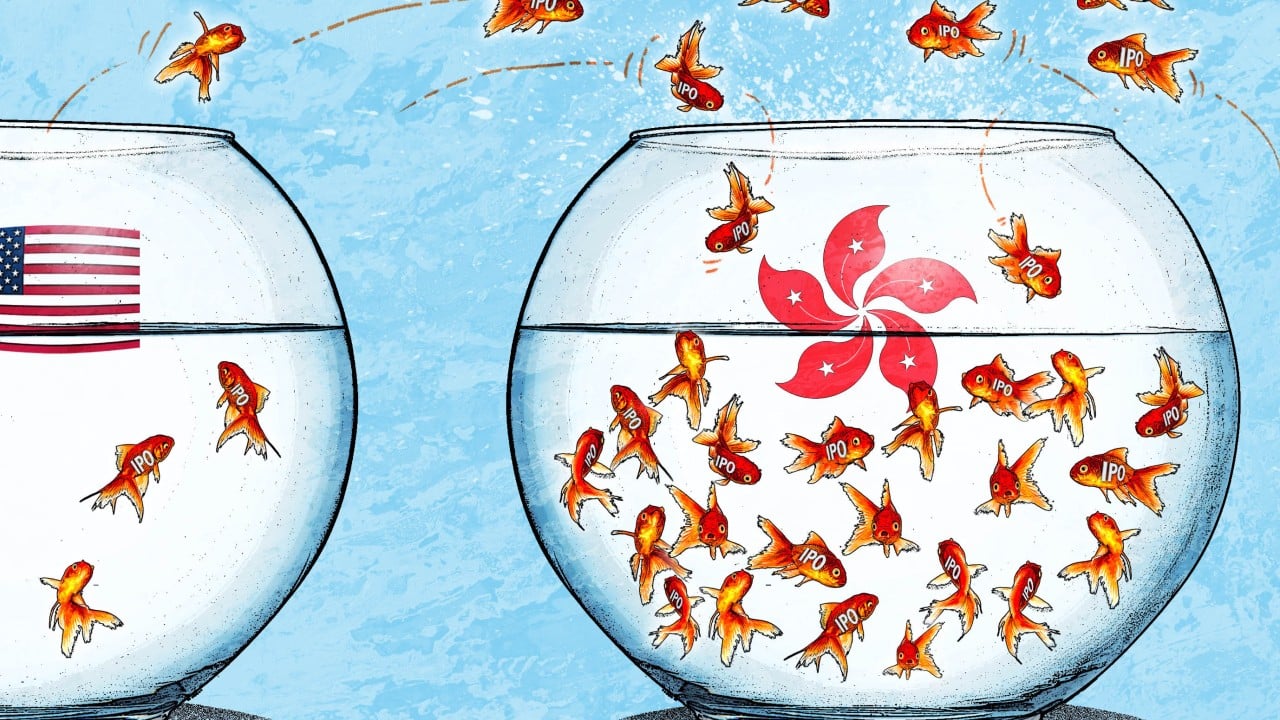

In the first of a two-part series about Hong Kong’s market for initial public offerings, Zhang Shidong and Ao Yulu report that more Chinese companies opted to list in Hong Kong in the first eight months of 2025 than in New York.

Advertisement

Hong Kong has overtaken the US as the new listing venue for mainland Chinese companies, marking a major milestone for the world’s fourth-largest capital market after a decade of betting on its growth in its much larger and stronger hinterland.

As many as 46 China-domiciled companies raised a combined HK$118.2 billion (US$16.5 billion) via initial public offerings (IPOs) on the Hong Kong stock exchange so far this year, compared with 16 listings by Chinese companies in the US over the same period, which raked in a mere US$740.9 million, according to data compiled by Bloomberg.

There is a good reason for flocking to Hong Kong. New shares have jumped by 19.4 per cent on average in their trading debuts in the city this year, with some particularly hot stocks like the metabolic medicine producer Innogen Pharmaceutical Group jumping almost fourfold last week.

By comparison, new listings in the US have risen by an average of 3.6 per cent over the same period, according to calculations by the Post. After the typical excitement of the first days of trading, those shares have since returned an average of 5.5 per cent.

“Hong Kong’s capital market has been more active this year and shows signs of continued recovery”, said Kenny Ng, a strategist at China Everbright Securities International. “The growing rivalry between China and the US has added uncertainty to capital markets, which is why more companies are choosing to list in Hong Kong. There is still the lingering risk of delisting for Chinese stocks in the US, [so] mainland firms tend to prefer the Hong Kong market in the face of such unclear regulatory prospects.”

Advertisement