Hua Hong Semiconductor, China’s second-largest contract chip manufacturer, plans to acquire equity interests in sister foundry Shanghai Huali Microelectronics for an undisclosed sum to consolidate resources and meet growing for demand for so-called legacy chips.

Advertisement

On Monday, Hua Hong suspended trading of its shares on the Nasdaq-style Star Market of the Shanghai Stock Exchange for up to 10 days, as the proposed transaction announced on Sunday was subject to a review by the company’s board and the general meeting of the firm, as well as approval from regulatory authorities.

During that suspension, Hua Hong’s Hong Kong-listed shares will continue trading, according to its Monday filing. The stock closed down 6.20 per cent to HK$48.12 on the same day.

The Chinese pure-play chip foundry, which is ranked behind domestic market leader Semiconductor Manufacturing International Corp (SMIC), said its proposed deal would be financed with a combination of cash payment, share issuance and raising of matching funds.

While technological hurdles and US sanctions have kept China behind in advanced chipmaking, domestic production and international demand for legacy chips have maintained momentum.

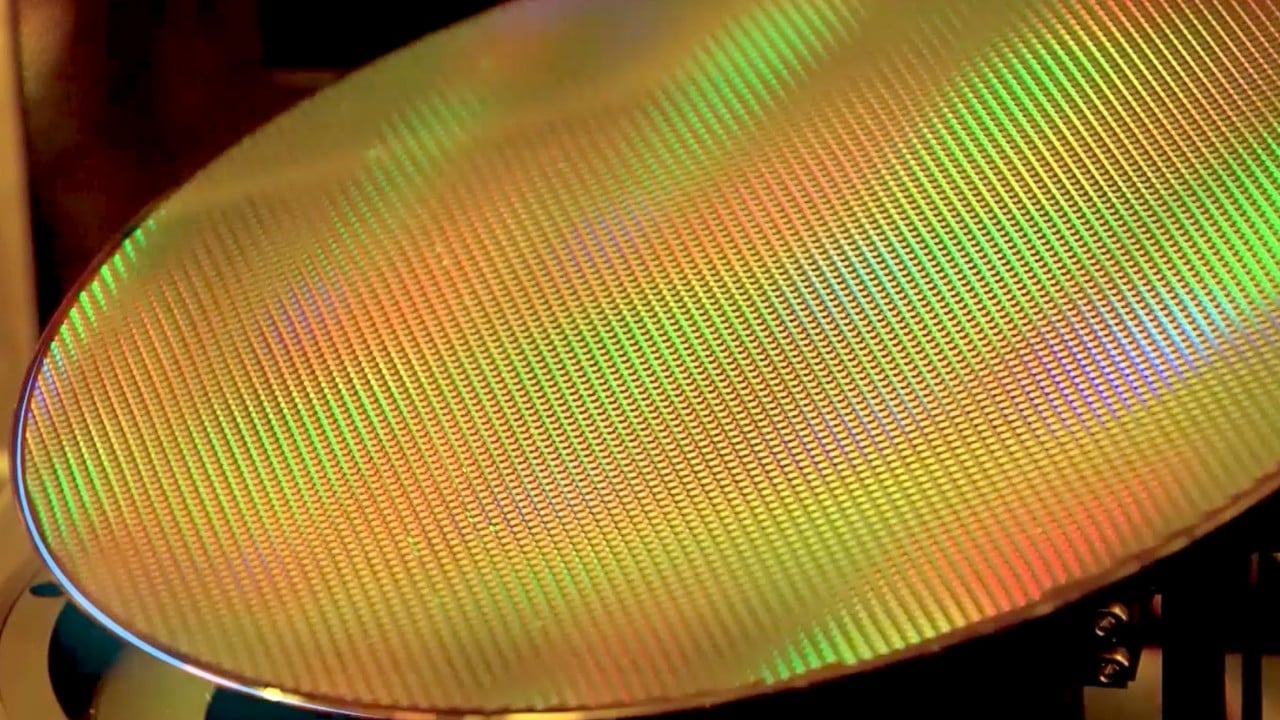

Legacy chips – made using 28-nanometre or larger wafer etching processes – are regarded as holding strategic value because of their versatility. These chips are widely used in cars, home appliances, consumer electronics, broadband network equipment, factory automation systems, medical devices and military systems.

Advertisement