A recent surge of Chinese commercial aviation companies, either formulating or reviving listing plans, highlights the sector’s strong appetite for funding, according to analysts, as Beijing steps up support for innovation-driven businesses seeking to raise capital.

Advertisement

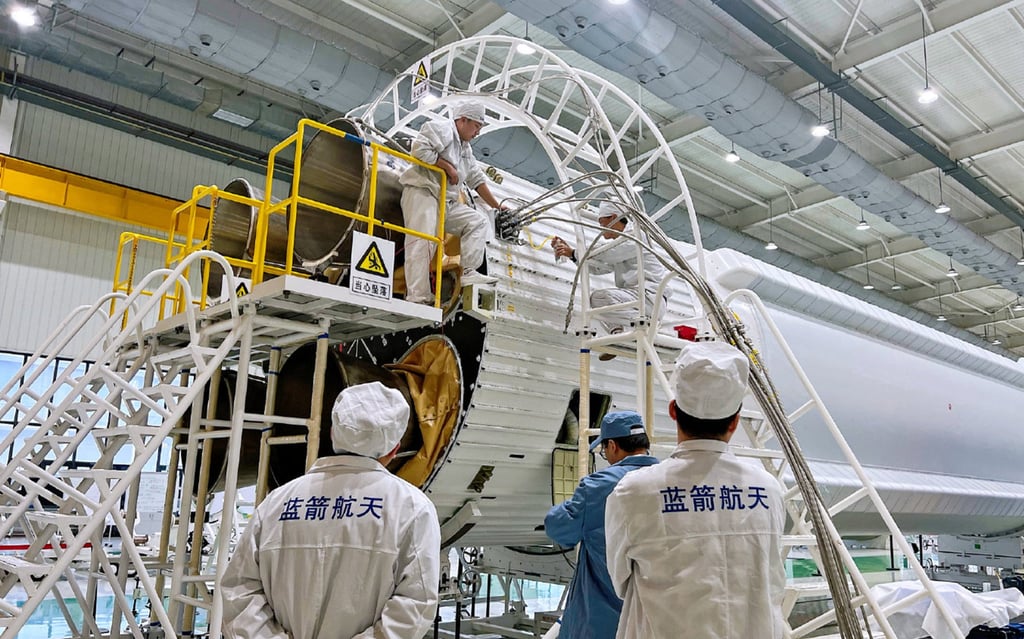

LandSpace Technology – which launched in 2023 the world’s first methane-fuelled rocket into orbit, ahead of US competitors SpaceX and Blue Origin – entered a coaching agreement with China International Capital Corporation on July 25, targeting an onshore listing on Shanghai’s Nasdaq-style tech board Star Market.

Just a day before, Jiangsu Yixin Aerospace Technology, a microsatellite communication systems maker, signed with Minsheng Securities, according to filings published on the CSRC website.

The pre-listing coaching process – overseen by the China Securities Regulatory Commission (CSRC), the primary regulatory body for the securities market – is a prerequisite for companies aiming to list on the country’s A-share market.

Conducted by investment banks, the training covers initial public offering (IPO) regulations, legal compliance and business due diligence.

Those moves indicated the companies’ intent to raise capital, but the timing and formal submission of IPO applications would ultimately depend on the regulatory climate, said Shen Meng, a director at Beijing-based investment firm Chanson & Co.