When Hong Kong office worker W.K. Chang began putting on weight as a teenager, her doctor said it was due to hormonal imbalances that slowed her metabolism. She reached a peak weight of 100kg about a year ago, but has since lost 25kg.

Advertisement

The secret to losing a quarter of her weight? Chang, who asked not to be identified by her full name, was one of the city’s first 200 chronic obesity patients to receive access to a new weight-loss drug, originally developed for diabetes. At a cost of HK$2,700 (US$344) each month, it was not cheap.

“I’m lucky since my family pays for my drug bills, but my friends who want it can’t afford it,” she said. “My doctor said I can reduce the dosage and the costs provided I keep up with my low-sugar diet and do cardiovascular exercises to maintain my weight.”

Chang’s friends and others with similar health problems may soon have better and more affordable access to the drugs that treat both diabetes and obesity, analysts said.

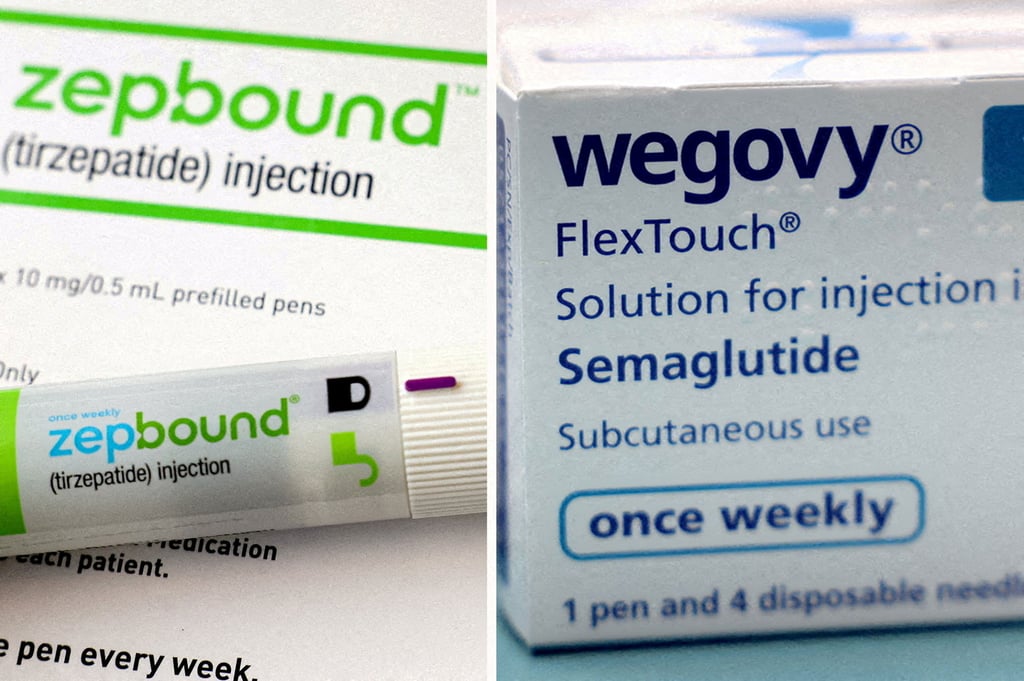

That is because the patent on semaglutide – the drug that mimics the naturally-produced hormone glucagon-like peptide-1 (GLP-1) that regulates blood sugar, appetite and digestion – expires in China next year. In other markets, the patent will expire in 2031 or 2032. Semaglutide is sold by Novo Nordisk as Ozempic.

Analysts said cheaper generic versions of the drug could then be launched by rivals, bringing down prices. Up to 20 generic drug players in China will vie for market share and exert downward pressure on prices, according to a report published in May by Boston-based L.E.K. Consulting.

Advertisement